FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

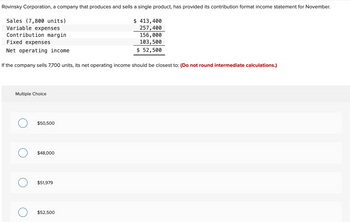

Transcribed Image Text:Rovinsky Corporation, a company that produces and sells a single product, has provided its contribution format income statement for November.

Sales (7,800 units)

Variable expenses

$ 413,400

257,400

156,000

103,500

Contribution margin

$ 52,500

Fixed expenses

Net operating income

If the company sells 7,700 units, its net operating income should be closest to: (Do not round intermediate calculations.)

Multiple Choice

$50,500

$48,000

O $51,979

$52,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- income statement total per unit Units 44,000 1 Sales $220,000 $5.00 Cost of Sales(variable expenses) 88,000 2.00 Gross Margin 132,000 3.00 Operating Costs(fixed expneses) 125,500 2.85 Net Profit 6,500 15 Now do this activity a second time with a higher selling price. Calculate break-even at a $7.00 selling price. Using the information from the above income statement, calculate the break-even per unit, the gross margin percent, and the break-even total sales. Calculate break-even based on units. Fixed Costs/ (Sales price per unit – Variable costs per unit) = Break Even in Units Calculate break-even based on Total Sales. Gross Margin/ Sales = Gross…arrow_forwardSales (22,200 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 199,800 119,880 79,920 46, 620 $ 33,300 Per Unit $9.00 5.40 $ 3.60 Required: (Consider each of the four requirements independently): 1. Assume the sales volume increases by 3,330 units: a. What is the revised net operating income? b. What is the percent increase in unit sales? c. Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? 2. What is the revised net operating income if the selling price decreases by $1.10 per unit and the number of units sold increases by 23%? 3. What is the revised net operating income if the selling price increases by $1.10 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 5%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 7%?…arrow_forwardIn the cost-volume- profit graph (above), what is represented by the point marked "A"? Question 1 options: Breakeven point Fixed expenses Operating income area Operating loss areaarrow_forward

- Target Profit Trailblazer Company sells a product for $95 per unit. The variable cost is $55 per unit, and fixed costs are $312,000. Determine (a) the break-even point in sales units and (b) the break-even point in sales units if the company desires a target profit of $65,520. a. Break-even point in sales units units b. Break-even point in sales units if the company desires a target profit of $65,520 unitsarrow_forwardUnit sales (a) Selling price per unit Variable cost per unit Traceable fixed expense TB MC Qu. 12A-46 Woodridge Corporation manufactures numerous... Woodridge Corporation manufactures numerous products, one of which is called Alpha-32. The company has provided the following data about this product Multiple Choice $1,375,220 77,000 76.00 61.00 $1,323,000 $52.220 Help $ $ Management is considering increasing the price of Alpha-32 by 5%, from $76.00 to $79.80. The company's marketing managers estimate that this price hike would decrease unit sales by 5%, from 77,000 units to 73,150 units Assuming that the total traceable fixed expense does not change, what net operating income will product Alpha-32 earn at a price of $79.80 if this sales forecast is correct? Save & Exitarrow_forwardContribution Margin Ratio, Variable Cost Ratio, Break-Even Sales Revenue The controller of Ashton Company prepared the following projected income statement: Sales $88,000 Total variable cost 23,760 Contribution margin $64,240 Total fixed cost 43,800 Operating income $20,440 Required: 1. Calculate the contribution margin ratio. Note: Enter as a percent, rounded to the nearest whole number. fill in the blank 1 % 2. Calculate the variable cost ratio. Note: Enter as a percent, rounded to the nearest whole number.fill in the blank 2 % 3. Calculate the break-even sales revenue for Ashton. Note: Round your answer to the nearest dollar. $fill in the blank 3 4. How could Ashton increase projected operating income without increasing the total sales revenue? Decrease the contribution margin ratioarrow_forward

- Please do not give solution in image format thankuarrow_forwardMultiproduct breakeven analysis and target profit, taxes Pursuit Company produces two products: Bric and Brac. The following table summarizes the products' details and planned unit sales for the upcoming period: Bric BrAc Sellingpriceperunt...........$S25$30 Variablecostperunit ... $14$17 Planned unit sales volume . . . . . . 800, 000 400,000 Pursuit Company has total fixed costs of $10 million and faces a tax rate of 30%. Required (a)What is Pursuit Company's expected profit at the planned level of sales? (b)Assuming a constant sales mix, what are the unit sales of Bric and Brac required for Pursuit Company to break even? (c) Assuming a constant sales mix, what are the unit sales of Bric and Brac required for Pursuit Company to earn an after-tax income of $910, 000 ?arrow_forwardA. Determine the missing amounts S.No Unit Selling Price Unit Variable Cost Contribution Margin per unit Contribution Margin Ratio 1 2 3 550 1500 (e) 370 (c) (f) (a) 600 900 (b) (d) 30 B. For Al Farabi Company, variable costs are 75% of sales, and fixed costs are $210,000.Management’snet income goal is $70,000. Compute the required sales needed to achieve management’s target net income of $70,000. (Use the mathematical equation approach.) C. Company A’s costs are mostly variable, whereas Company B’s costs are mostly fixed. When sales increase, which company will tend to realize the greatest increase in profits? Explain.arrow_forward

- asap pleasearrow_forwardSegment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) $ 255,000 178,500 76,500 107,000 (30,500) (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segment be eliminated?arrow_forwardplease answer last three questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education