FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

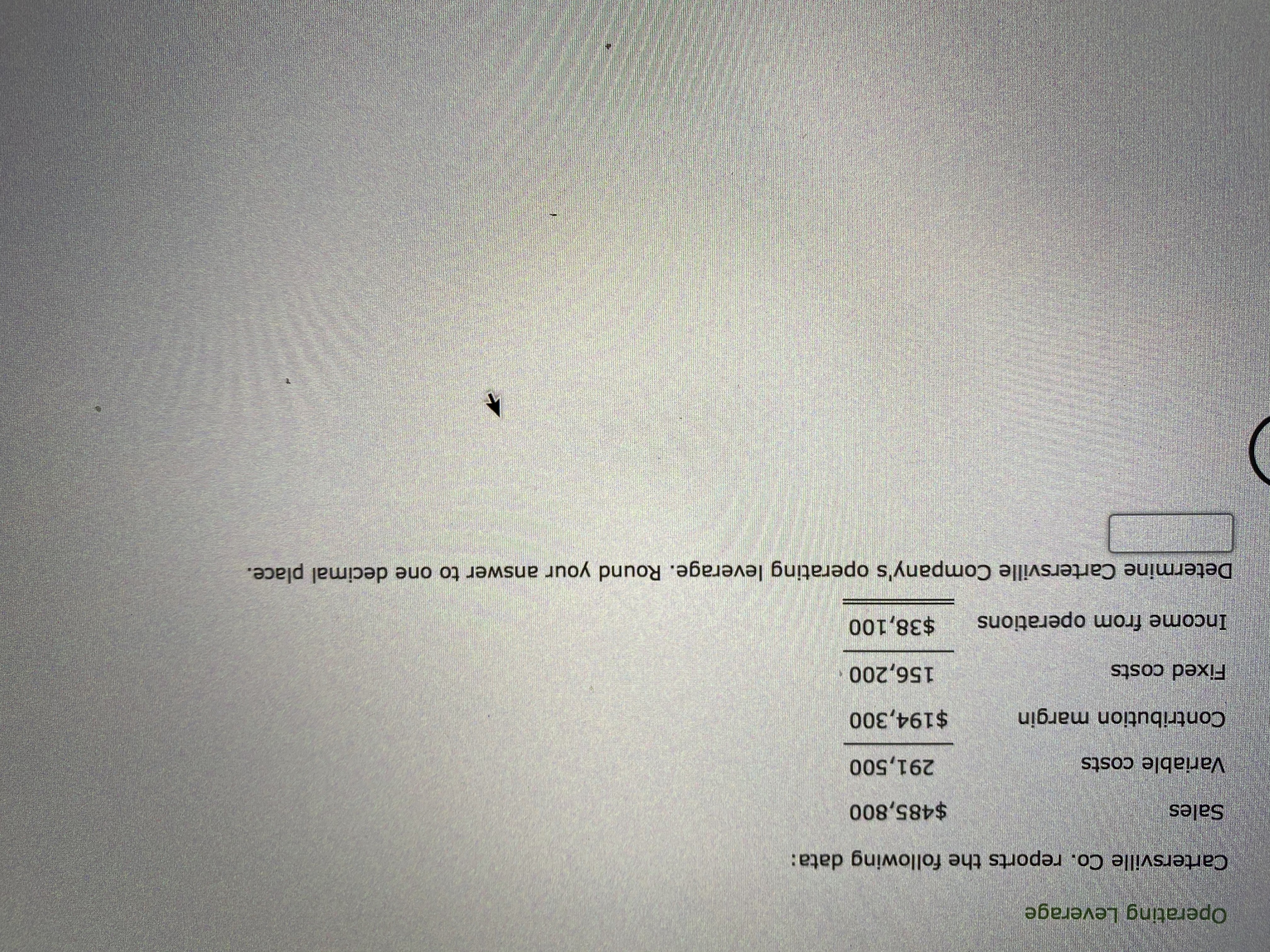

Transcribed Image Text:Operating Leverage

Cartersville Co. reports the following data:

Sales

$485,800

Variable costs

291,500

Contribution margin

$194,300

Fixed costs

156,200

Income from operations

$38,100

Determine Cartersville Company's operating leverage. Round your answer to one decimal place.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume the following financial data pertains to a certain single-product lodging business:Room Sales - $400,000Total Variable - $260,000Costs Contribution Margin - $140,000Total Fixed Costs - $ 76,000IBIT - $ 64,000Based on the financial data provided, the contribution margin percentage is __________ percent.arrow_forwardA firm’s contribution margin ratio is 18.4%. If the degree of operating leverage is 15.6 at the $223.1k sales level. Given this information, calculate the firm’s net operating income.arrow_forwardThe following income statement is provided for Vargas, Inc. What is this company's magnitude of operating leverage? Assume that net income is equal to operating income.arrow_forward

- Operating Leverage Cartersville Co. reports the following data: Sales $455,200 Variable costs (250,400) Contribution margin $204,800 Fixed costs (146,300) Operating income $58,500 Determine Cartersville Co.’s operating leverage. Round your answer to one decimal place.arrow_forwardMorse Company reports total contribution margin of $63,210 and pretax net income of $12,900 for the current month. The degree of operating leverage is:arrow_forwardBR Company has a contribution margin of 20%. Sales are $403,000, net operating income is $80,600, and average operating assets are $128,000. What is the company's return on investment (ROI)? Multiple Choice 63.0% 0.3% 20.0% 3.2%arrow_forward

- Sun Corporation's contribution format income statement for July appears below: Sales $ 425,500 Variable expenses 234,025 Contribution margin 191,475 Fixed expenses 59,360 Net operating income $ 132,115 The degree of operating leverage is closest to:arrow_forwardOperating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc. Sales $275,600 $882,000 Variable costs 110,600 529,200 Contribution margin $165,000 $352,800 Fixed costs 110,000 205,800 Income from operations $55,000 $147,000 a. Compute the operating leverage for Beck Inc. and Bryant Inc. If required, round to one decimal place. Вeck Inc. Bryant Inc. 2.4 b. How much would income from operations increase for each company if the sales of each increased by 20%? If required, round answers to nearest whole number. Dollars Percentage Вeck Inc. $ 33,000 60 V % Bryant Inc. 70,560 57 X % c. The difference in the increases of income from operations is due to the difference in the operating leverages. Beck Inc.'s higher v operating leverage means that its fixed costs are a larger percentage of contribution margin than are Bryant Inc.'s.arrow_forwardBeck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc. Sales $374,700 $1,056,000 Variable costs 150,300 633,600 Contribution margin $224,400 $422,400 Fixed costs 158,400 246,400 Income from operations $66,000 $176,000 a. Compute the operating leverage for Beck Inc. and Bryant Inc. If required, round to one decimal place. Beck Inc. Bryant Inc. b. How much would income from operations increase for each company if the sales of each increased by 20%? If required, round answers to nearest whole number. Dollars Percentage Beck Inc. $ % Bryant Inc. $ %arrow_forward

- A1 please help.....arrow_forwardConsider the following summary modified income statement for Tech Inc.: Sales $593,000 Variable Operating Costs 252,000 Contribution Margin $341,000 Fixed Operating Costs 121,000 Operating Income $220,000 Interest Expense 26,000 Net Income $194,000 Calculate Tech's degree of operating leverage. A В C E 1 2 Degree of Operating Leverage = 4 5 7 8 9 10 3. 6.arrow_forwardKnowledge Check East Division of Blue Spruce Anchors provided the following information: Contribution margin Controllable margin Average operating assets Minimum rate of return Return on investment $890,000 $395,900 $2,140,000 Compute the return on investment and the residual income. (Round return on investment answer to two decimal places (e.g., 15.25%).) Residual income 9 % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education