FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

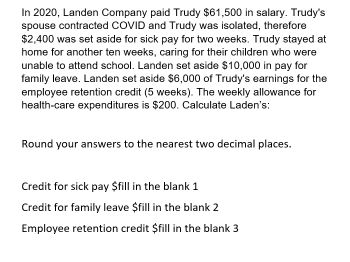

Transcribed Image Text:In 2020, Landen Company paid Trudy $61,500 in salary. Trudy's

spouse contracted COVID and Trudy was isolated, therefore

$2,400 was set aside for sick pay for two weeks. Trudy stayed at

home for another ten weeks, caring for their children who were

unable to attend school. Landen set aside $10,000 in pay for

family leave. Landen set aside $6,000 of Trudy's earnings for the

employee retention credit (5 weeks). The weekly allowance for

health-care expenditures is $200. Calculate Laden's:

Round your answers to the nearest two decimal places.

Credit for sick pay $fill in the blank 1

Credit for family leave $fill in the blank 2

Employee retention credit $fill in the blank 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Emily Turnbull, president of Aerobic Equipment Corporation, is concerned about her employees’ well-being. The company offers its employees free medical, dental, and life insurance coverage. It also matches employee contributions to a voluntary retirement plan up to 5% of their salaries. Assume that no employee’s cumulative wages exceed the relevant wage bases. Payroll information for the biweekly payroll period ending January 24 is listed below. Wages and salaries $2,300,000 Employee contribution to voluntary retirement plan 115,000 Medical insurance premiums paid by employer 46,000 Dental insurance premiums paid by employer 16,100 Life insurance premiums paid by employer 8,050 Federal and state income tax withheld 494,500 FICA tax rate 7.65% Federal and state unemployment tax rate 6.20% Required: 1., 2. & 3. Record the necessary journal entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)…arrow_forwardPrince Distribution Incorporated has an unfunded postretirement benefit plan. Medical care and life insurance benefits are provided to employees who render 10 years service and attain age 55 while in service. At the end of 2024, Jim Lukawitz is 31. He was hired by Prince at age 25 (6 years ago) and is expected to retire at age 62. The expected postretirement benefit obligation for Lukawitz at the end of 2024 is $50,000 and $54,000 at the end of 2025. Calculate the accumulated postretirement benefit obligation at the end of 2024 and 2025 and the service cost for 2024 and 2025, as pertaining to Lukawitz. Note: Enter your answers in whole dollar amount. Round your final answers to the nearest whole dollar. APBO Service 2024 ____ _____ 2025 ____ _____arrow_forwardJanice earns $85,000 working as an administrative assistant in a public company based in New York. The company provides a matching contribution in the 401(k) plan of 50% up to a maximum contribution of 4% of compensation. Her 401(k) plan account had $20,000 in it at the beginning of the year. She contributed $5,000 to the plan this year and the employer made the matching contribution before year end. The ending balance of the account is $30,000. What is her return on her investments this year for the 401(k) account? A. 8.8%. B. 9.9%. C. 12.5%. D. 25%.arrow_forward

- The plant union is negotiating with the Eacty Company, which is on the verge of bankruptcy. Eagle has offered to pay for the employees' hospitalization insurance in exchange for a wage reduction. Each employee currently pays premiums of $4,000 a year for their insurance. Which of the following is correct: a.If an employee's wages are reduced by $5,000 and the employee is in the 24% marginal tax bracket, the employee would benefit from the offer. b.If an employee's wages are reduced by $6,000 and the employee is in the 35% marginal tax bracket, the employee would benefit from the offer. c.If an employee's wages are reduced by $4,000 and the employee is in the 12% marginal tax bracket, the employee would benefit from the offer. d."If an employee's wages are reduced by $5,000 and the employee is in the 24% marginal tax bracket, the employee would benefit from the offer", "If an employee's wages are reduced by $4,000 and the employee is in the 12% marginal tax bracket, the employee would…arrow_forward(COVID provisions) Lamden Company paid its employee Trudy, wages of $61,500 in 2020. Of this amount, $2,400 was allocated to sick pay for two weeks due to Trudy’s spouse contracting COVID and Trudy being quarantined. Trudy spent another 10 weeks at home caring for their children that were unable to attend school. Lamden allocated $10,000 in wages to family leave. Lamden allocated $6,000 of Trudy’s wages to the employee retention credit (5 weeks). The allocation of health care costs is $200 per week. Compute Lamden’s: Round your answers to two decimal places. Credit for sick pay Credit for family leave Employee retention creditarrow_forwardAbhaliyaarrow_forward

- Edwards Company just hired another employee - Jane. The Edwards Company provides supplemental retirement benefits to its employees realizing the insufficiency of the Social Security benefits for a comfortable retirement life. Edwards has asked you to perform the necessary computations pertaining to the retirement benefits for Jane. Jane's current salary is $40,000. Jane will be entitled to this supplementary retirement benefits after 20 years of work- the start of the 21st year. The retirement plan will last for 25 years. Per company practices. Jane will be granted with a year-end salary increase of 2% per year effective Jan. 1st of each year that she works. The amount of annual retirement benefit is going to be 45% of Jane's salary right before the start of the retirement and will be paid at the start of each year, Any invested funds for pension will earn 4% compounded annually. Click here to use Excel. Compute Jane's annual retirement benefit Example of Answer: 4000.20 Two decimal…arrow_forwardHow to calculate the following: (COVID provisions) Lamden Company paid its employee Trudy, wages of $61,500 in 2020. Of this amount, $2,400 was allocated to sick pay for two weeks due to Trudy’s spouse contracting COVID and Trudy being quarantined. Trudy spent another 10 weeks at home caring for their children that were unable to attend school. Lamden allocated $10,000 in wages to family leave. Lamden allocated $6,000 of Trudy’s wages to the employee retention credit (5 weeks). The allocation of health care costs is $200 per week. Compute Lamden’s: Credit for sick pay Credit for family leave Employee retention creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education