FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please answer fast i give you upvote.

Transcribed Image Text:1

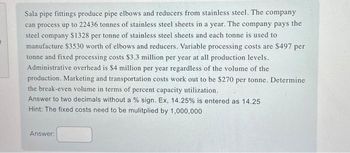

Sala pipe fittings produce pipe elbows and reducers from stainless steel. The company

can process up to 22436 tonnes of stainless steel sheets in a year. The company pays the

steel company $1328 per tonne of stainless steel sheets and each tonne is used to

manufacture $3530 worth of elbows and reducers. Variable processing costs are $497 per

tonne and fixed processing costs $3.3 million per year at all production levels.

Administrative overhead is $4 million per year regardless of the volume of the

production. Marketing and transportation costs work out to be $270 per tonne. Determine

the break-even volume in terms of percent capacity utilization.

Answer to two decimals without a % sign. Ex, 14.25% is entered as 14.25

Hint: The fixed costs need to be mulitplied by 1,000,000

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- I have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forwardfour email will be recorded when you submit this form Required Question A "balanced transaction" (DR=CR) is a guarantee that a transaction has been recorded 100% correctly. * O True False Back Next Page 6 of 25 Clea This formarrow_forwardHomework x a ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser%=D0&launchUrl%=https%253A%252F%252Ffaytechcc.blackboard.c A User Management,... I https://outlook.offi. e FES Protection Plan System 7 - North C.. ework Exercises A Saved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate On April 1, Moloney Meat Distributors sold merchandise on account to Fronke's Franks for $3,630 on Invoice 1001, terms 1/10, n/30. The cost of merchandise sold was $2.260. Payment was received in full from Fronke's Franks, less discount, on April 10. Required: Record the transactions for Moloney Meat Distributors on April 1and April 10. The company uses the perpetual inventory system. (Round final answers to the nearest whole dollar value.)arrow_forward

- Not a previously submitted question. Thank youarrow_forwardGibson Corporation’s balance sheet indicates that the company has $580,000 invested in operating assets. During the year, Gibson earned operating income of $67,280 on $1,160,000 of sales. Required Compute Gibson’s profit margin for the year. Compute Gibson’s turnover for the year. Compute Gibson’s return on investment for the year. Recompute Gibson’s ROI under each of the following independent assumptions:(1) Sales increase from $1,160,000 to $1,392,000, thereby resulting in an increase in operating income from $67,280 to $76,560.(2) Sales remain constant, but Gibson reduces expenses, resulting in an increase in operating income from $67,280 to $69,600.(3) Gibson is able to reduce its invested capital from $580,000 to $464,000 without affecting operating income.arrow_forwardNot a previously submitted question. Thank youarrow_forward

- Create a SQL table using your name with the following features: the columns of your table must include, at least the data types (in this order) and one more of your choice NOTE: You need to specify a 2 column (i.e 2 attribute 1. varchar (n), // where n covers the string length you want to enter 2. Int, 3. decimal, (precision = 8, scale = 3 4. date. 5. ??? your choice here ??? Table constraints: 1. It has a two column primary key 2. a check constraint on 2 columns, on the decimal and the date field 3. Use '2024-02-18' date as the default on the date field 5. write down your relational schema 5. Create the table, insert at least 4 rows, and do a Select * to show them example don't just copy these, change the constraint namesarrow_forward42 O Browser geNOWv2 | Online teachin X + n/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false DSU AcadCalendar C crunchy roll crunchy roll A Home - Hudl Spotify EReadir U D2L O DSU Support PDSU WebMail O DSU Account Monaco & Associates Use the following five transactions for Monaco & Associates, Inc. to answer the question(s). October 1 Bills are sent to clients for services provided in September in the amount of $800. Dravo Co. delivers office furniture ($1,060) and office supplies ($160) to Monaco 6 leaving an invoice for $1,220. 15 Payment is made to Dravo Co. for the furniture and office supplies delivered on October 9. 23 A bill for $430 for electricity for the month of September is received and will be paid on its due date in November. 31 Salaries of $850 are paid to employees. Based only on these transactions, what is the total amount of expenses that should appear on the income statement for the month of October? Oa. $1,280 Ob. $430…arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education