FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:werow abboro IIA a 31. Decreased the petty cash fund by $100.

usted balance:

D

dger

balance:

om cash sales was $18,780.

Instructions

Journalize the transactions.

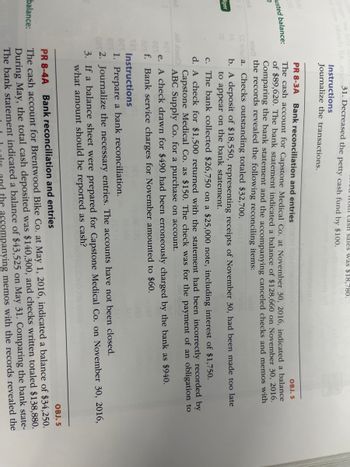

PR 8-3A Bank reconciliation and entries THOM

OBJ. 5

The cash account for Capstone Medical Co. at November 30, 2016, indicated a balance

of $89,620. The bank statement indicated a balance of $128,660 on November 30, 2016.

Comparing the bank statement and the accompanying canceled checks and memos with

the records revealed the following reconciling items:

SS nuta. Checks outstanding totaled $32,700.

b. A deposit of $18,550, representing receipts of November 30, had been made too late

to appear on the bank statement.

c. The bank collected $26,750 on a $25,000 note, including interest of $1,750.

d.

A check for $1,500 returned with the statement had been incorrectly recorded by

Capstone Medical Co. as $150. The check was for the payment of an obligation to

ABC Supply Co. for a purchase on account.

oll bed

e. A check drawn for $490 had been erroneously charged by the bank as $940.

f. Bank service charges for November amounted to $60.

Instructions

1. Prepare a bank reconciliation.

2. Journalize the necessary entries. The accounts have not been closed.

3. If a balance sheet were prepared for Capstone Medical Co. on November 30, 2016,

what amount should be reported as cash?

PR 8-4A Bank reconciliation and entries

OBJ. 5

The cash account for Brentwood Bike Co. at May 1, 2016, indicated a balance of $34,250.

During May, the total cash deposited was $140,300, and checks written totaled $138,880.

The bank statement indicated a balance of $43,525 on May 31. Comparing the bank state-

the accompanying memos with the records revealed the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5. Bank Reconciliation Johnson Corporation's bank statement for October reports an ending balance of $22,381, whereas Johnson's cash account shows a balance of $22,025 on October 31. The following additional information is available: 6. A $855 deposit made on October 31 was not recorded by the bank until November. 7. At the end of October, outstanding checks total $1,222. 8. The bank statement shows bank service charges of $125 not yet recorded by the company. 9. The company erroneously recorded as $973 a check that it had actually written for $379. It was correctly processed by the bank. 10. A $480 check from a customer, deposited by the company on October 29, was returned with the bank statement for lack of funds. Required: 1. Prepare the October bank reconciliation for Johnson Corporation.arrow_forwardPlease do not give solution in image format thankuarrow_forwardThe bank statement for Jeffrey Co. indicates a balance of $8,785 on October 31. After the journals for October had been posted, the cash account had a balance of $8,998. a. Cash sales of $945 had been erroneously recorded in the cash receipts journal as $495. b. Deposits in transit not recorded by bank, $778. c. Bank debit memo for service charges, $40. d. Bank credit memo for note collected by bank, $23,985 plus $885 interest. e. Bank debit memo for $756 NSF (not sufficient funds) check from Calin Sams, a customer. f. Checks outstanding, $1,860. Record the appropriate journal entries that would be necessary for Jeffrey Co. Record the entry that increases cash first. If an amount box does not require an entry, leave it blank.arrow_forward

- Do not give answer in imagearrow_forwardBank Reconciliation and Entries The cash account for Deaver Consulting at October 31, 20Y6, indicated a balance of $7,735. The bank statement indicated a balance of $9,930 on October 31, 20Y6. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: Checks outstanding totaled $3,570. A deposit of $3,720, representing receipts from October 31, had been made too late to appear on the bank statement. The bank had collected $1,940 on a note left for collection. The face of the note was $1,840. A check for $550 returned with the statement had been incorrectly recorded by Deaver Consulting as $500. The check was for the payment of an obligation to Oxford Office Supplies Co. for the purchase of office supplies on account. A check drawn for $530 had been incorrectly charged by the bank as $30. Bank service charges for October amounted to $45. Instructions: 1. Prepare a bank reconciliation. Deaver…arrow_forward549 Bank Reconciliation - Quiz The cash account for CAP Co. at October 31, 2016, indicated a balance of $12,525. The bank statement indicated a balance of $16,050 on October 31, 2016. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: Checks outstanding totaled $3000. A deposit of $2,000, representing receipts of June 30, had been made too late to appear on the bank statement. The bank had collected $2,600 on a note left for collection. The face of the note was $2,500. A check for $100 returned with the statement had been incorrectly recorded by CAP Co. as $10. The check was for the purchase of supplies. A check received for $100 had been erroneously recorded by the bank as $150. Bank service charges for June amounted to $35.arrow_forward

- Nonearrow_forwardPlease dont give solutions in an imagearrow_forwardEntries for bank reconciliation The following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 2016: 1. Cash balance according to the company's records at August 31, 518,130. 2. Cash balance according to the bank statement at August 31, $19,240. 3. Checks outstanding, $3,600. 4. Deposit in transit not recorded by bank, $2,960. 5. A check for $270 in payment of an account was erroneously recorded in the check register as $720. 6. Bank debit memo for service charges, $60. Journaline the entries that should be made by the company that (a) increase cash and (b) decrease cash. If an amount box does not require an entry, leave blank a: 2016 August 31 Cash b. August 31 Accounts Payable ✓arrow_forward

- please provide correct solution of this questionarrow_forwardActivities: Prepare a bank reconciliation statement. Write your answer on a separate sheet of paper. IV. Activity 1 The bank statement of the Fast Company shows a balance of P10,000 on 31 January 2015 whereas the company's ledger shows a balance of P8,525. The following reasons have been identified for this discrepancy. 1. An amount of P822 sent to the bank for a deposit on January 31, 2015, does not appear in the bank statement. 2. The following checks issued during January have not yet been cleared by the bank. a. Check No: 201, Issue date: 15 January 2015, Amount; P200. b. Check No: 212, Issue date: 19 January 2015, Amount; P20. c. Check No: 216, Issue date: 25 January 2015, Amount; P610. 3. A note receivable amounting to P1,588 has been collected by the bank for the company. 4. The bank statement shows that interest amounting to P50 has been earned on average account balance during January. 5. The bank has charged P10 for the collection of a note. 6. A check of P100 deposited by…arrow_forwardBank Reconciliation The following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 20Y6: Cash balance according to the company's records at August 31, $25,520. Cash balance according to the bank statement at August 31, $26,850. Checks outstanding, $5,180. Deposit in transit, not recorded by bank, $4,160. A check for $480 in payment of an account was erroneously recorded in the check register as $840. Bank debit memo for service charges, $50. a. Prepare a bank reconciliation, using the format shown in Exhibit 13. Creative Design Co.Bank ReconciliationAugust 31, 20Y6 Cash balance according to bank statement $fill in the blank - Select - - Select - Adjusted balance $fill in the blank Cash balance according to company's records $fill in the blank - Select - - Select - Adjusted balance $fill in the blank b. If the balance sheet were…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education