FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:S

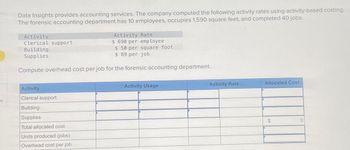

Data Insights provides accounting services. The company computed the following activity rates using activity-based costing.

The forensic accounting department has 10 employees, occupies 1,590 square feet, and completed 40 jobs.

Activity

Clerical support

Activity Rate

Building

Supplies

$ 690 per employee

$50 per square foot

$ 89 per job

Compute overhead cost per job for the forensic accounting department.

Activity

Clerical support

Building

Supplies

Total allocated cost

Units produced (jobs)

Overhead cost per job

Activity Usage

Activity Rate

Allocated Cost

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Computing Total Job Costs and Unit Product Costs Using a Plantwide Predetermined Overhead Rate Mickley Company’s plantwide predetermined overhead rate is $14.00 per direct labor-hour and its direct labor wage rate is $ 17.00 per hour. The following information pertains to Job A-500: Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 40 units, what is the unit product cost for this job?arrow_forwardCarver Test Systems manufactures automated testing equipment. The company uses a job-order costing system and applies overhead on the basis of machine-hours. At the beginning of the year, estimated manufacturing overhead was P1,960,000 and the estimated machine-hours was 98,000. Data regarding several jobs at Carver are presented below. Beginning Direct Direct MachineJob Number Balance Materials Labor HoursXJ-107 ................... P118,600 P4,000 P8,400 150ST-211 ................... P121,450 P2,500 P12,160 300XD-108.................. P21,800 P86,400 P36,650 3,100SL-205 ................... P34,350 P71,800 P32,175 2,700RX-115 .................. P0 P18,990 P21,845 1,400By the end of the first month (January), all jobs but RX-115 were completed, and all completed jobs had been delivered to customers except for SL-205. How much is the Cost of Goods Sold per job?arrow_forwardDrilling Company uses activity-based costing and provides this information: Driver Rate Manufacturing Activity Materials handling Machinery Assembly Inspection Cost Driver Drilling has just completed 74 units of a component for a customer. Each unit required 94 parts and 2.70 machine hours. The prime cost is $1,240 per finished unit. All other manufacturing costs are classified as manufacturing overhead. Required 1 Number of parts Number of machine hours Number of parts Number of finished units Required: 1. Compute the total manufacturing costs and the unit costs of the 74 units just completed using ABC costing. 2. In addition to the manufacturing costs, the firm has determined that the total cost of upstream activities, including research and development and product design, is $174 per unit. The total cost of downstream activities, such as distribution, marketing, and customer service, is $294 per unit. Compute the full product cost per unit, including upstream, manufacturing, and…arrow_forward

- Mickley Company’s plantwide predetermined overhead rate is $20.00 per direct labor-hour and its direct labor wage rate is $12.00 per hour. The following information pertains to Job A-500: Direct materials $ 290 Direct labor $ 180 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 50 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.)arrow_forwardA company makes two products 1 and 2. The finishing activity pool has estimated manufacuring costs of $81,411 and the cost drivers for Product 1 is 400 and 262 for Product 2. The assembling activity pool has estimated costs of $62,196 and the cost drivers for Product 1 is 200 and 300 for Product 2. Direct labor hours for Product 1 is 452and 114 for Product 2. What is the total manufacturing overhead cost to be assigned to Product 1 using a single overhead rate as under tradional cost accounting?arrow_forwardRex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $157,850 4,100 $ Machine Hours 324,622 14,114 2$ Inspections 119,000 3,400arrow_forward

- Job 910 was recently completed. The following data have been recorded on its job cost sheet: Direct materials. Direct labor-hours Direct labor wage rate Machine-hours The Corporation applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $19 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 910 would be: Multiple Choice $7,236 $3,793 $3,720 $6,396 Prev $ 2,461 2 of 7 74 labor-hours $ 18 per labor-hour 137 machine-hours Nextarrow_forwardWhite Company has two departments, Cutting and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department bases its rate on direct labor-hours. At the beginning of the year, the company made the following estimates: Department Cutting Finishing Direct labor-hours 7,800 76,000 Machine-hours 52,700 3,200 Total fixed manufacturing overhead cost $ 390,000 $ 425,000 Variable manufacturing overhead per machine-hour $ 3.00 0 Variable manufacturing overhead per direct labor-hour 0 $3.75 Required (see below for hints, if needed): 1. Compute the predetermined overhead rate for each department. 2. The job cost sheet for Job 203, which was started and completed during the year, showed the following: Department Cutting Finishing Direct labor-hours 3 16 Machine-hours 89 6 Direct materials $ 730 $ 380 Direct labor…arrow_forwardLanden Corporation uses job-order costing. At the beginning of the year, it made the following estimates: Direct labor-hours required to support estimated production 140,000 Machine-hours required to support estimated production 70,000 Fixed manufacturing overhead cost $ 784,000 Variable manufacturing overhead cost per direct labor-hour $ 2.00 Variable manufacturing overhead cost per machine-hour $ 4.00 During the year, Job 550 was started and completed. The following information pertains to this job: Direct materials $ 175 Direct labor cost $ 225 Direct labor-hours 15 Machine-hours 5 Required: Assume Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: Compute the plantwide predetermined overhead rate. Compute the total manufacturing cost of Job 550. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job…arrow_forward

- Hardevarrow_forwardCraft Company reports the following partial activity-based costing information for its Deluxe model. Complete the table by entering amounts for the missing items. Note: Round "Overhead per unit" to 2 decimal places. Activity Assembly Factory services Setup Total allocated cost Units produced Overhead cost per unit Activity Usage 3,000 direct labor hours 2,800 square feet setups $ $ Activity Rate 10 per direct labor hour per square foot 180 per setup Allocated Cost 28,000 4,500 2,500arrow_forwardData concerning three of Kilmon Corporation’s activity cost pools appear below: Activity Cost Pools Estimated Overhead Cost Expected Activity Assembling products $ 86,070 4,530 assembly hours Designing products $ 605,412 3,012 product design hours Setting up batches $ 48,140 830 batch set-ups Required: Compute the activity rates for each of the three cost pools.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education