Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I need Answer

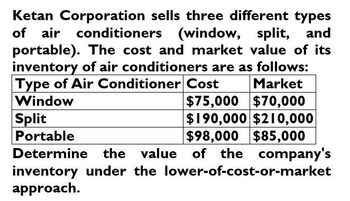

Transcribed Image Text:Ketan Corporation sells three different types

of air conditioners (window, split, and

portable). The cost and market value of its

inventory of air conditioners are as follows:

Type of Air Conditioner Cost

Window

Split

Portable

Market

$75,000 $70,000

$190,000 $210,000

$98,000 $85,000

Determine the value of the company's

inventory under the lower-of-cost-or-market

approach.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ouzts Corporation is considering Altemnative A and Alternative B. Costs associated with the alternatives are listed below: Alternative Alternative Materials costs Processing costs Equipment rental Occupancy costs $ 42,000 $ 38,600 $ 13,400 $ 15,100 $ 56,200 $ 38,600 $ 13,400 $ 22,600 What is the financial advantage (disadvantage) of Alternative B over Alternative A? Multiple Cholce $109100 $21.700) $130.800 其其 69°F Mostly pe here to search DELLarrow_forwardCompany E has two divisions, Division A and Division B. Division A is currently buying Component X from an external seller for $13. Division B produces Component X and has excess capacity. Using the following data, what would the transfer price per unit if Division A purchased Component X from Division B at the market-based transfer price? • Variable cost per unit $6 • Fixed cost per unit 1.65 • Division B sales price of Component X 14.50arrow_forwardMarigold Company gathered the following data about the three products that it produces: Product PresentSales Value Estimated AdditionalProcessing Costs Estimated Salesif Processed Further A $10400 $7200 $18600 B 12400 4200 15600 C 9400 2200 13600 Which of the products should not be processed further? a. Product C b. Products A and C c. Product B d. Product Aarrow_forward

- Cox Electric makes electronic components and has estimated the following for a new design of one of its products. Fixed cost = $23,750 • Material cost per unit = $0.17 • Labor cost per unit = $0.11 • Revenue per unit = $0.66 Note that fixed cost is incurred regardless of the amount produced. Per-unit material and labor cost together make up the variable cost per unit. Assuming that Cox Electric sells all that it produces, profit is calculated by subtracting the fixed cost and total variable cost from total revenue. Construct an appropriate spreadsheet model to find the profit based on a given production level and use the spreadsheet model to answer these questions. (a) Construct a one-way data table with production volume as the column input and profit as the output. Breakeven occurs when profit goes from a negative to a positive value; that is, breakeven is when total revenue = the total cost, yielding a profit of zero. Vary production volume from 0 to 100,000 in increments of 10,000.…arrow_forwardRings company has three product lines A, B and C. The following financial information is available:arrow_forwardCompany E has two divisions, Division A and Division B. Division A is currently buying Component X from an external seller for $12. Division B produces Component X and has excess capacity. Using the following data, what would the transfer price per unit if Division A purchased Component X from Division B at the cost-based transfer price? Variable cost per unit $7.48 • Fixed cost per unit 1.97 • Division B sales price of Component X 14.50arrow_forward

- Oriole Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Oriole has the following arrangement with Blue Spruce Inc. Blue Spruce purchases equipment from Oriole for a price of $910, 100 and contracts with Oriole to install the equipment Oriole charges the same price for the equipment irrespective of whether it does the installation or not. The cost of the equipment is $643, 000. Blue Spruce is obligated to pay Oriole the $ 910,100 upon the delivery of the equipment. Oriole delivers the equipment on June 1, 2025, and completes the installation of the equipment on September 30, 2025. The equipment has a useful…arrow_forwardTwo alternatives, code-named X and Y, are under consideration at Guyer Corporation. Costs associated with the alternatives are listed below. Alternative Alternative Y Materials costs Processing costs Equipment rental Occupancy costs $ 49,000 $ 53,800 $ 20,200 $ 19,200 $ 71,000 $ 53,800 $ 20,200 $ 28,600 What is the financial advantage (disadvantage) of Alternative Y over Alternative X? Multiple Cholce S(157.900) $142.200 S173.600 S31.400) 68°F Mostly cloudy ype here to search DELLarrow_forwardCarla Vista Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Carla Vista has the following arrangement with Pharoah Inc. Pharoah purchases equipment from Carla Vista for a price of $1,008,900 and contracts with Carla Vista to install the equipment. Carla Vista charges the same price for the equipment irrespective of whether it does the installation or not. The cost of the equipment is $654,000. . Pharoah is obligated to pay Carla Vista the $1,008,900 upon the delivery of the equipment. Carla Vista delivers the equipment on June 1, 2025, and completes the installation of the equipment on September 30, 2025. The…arrow_forward

- Carla Vista Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Carla Vista has the following arrangement with Pharoah Inc. Pharoah purchases equipment from Carla Vista for a price of $1,008,900 and contracts with Carla Vista to install the equipment. Carla Vista charges the same price for the equipment irrespective of whether it does the installation or not. The cost of the equipment is $654,000. Pharoah is obligated to pay Carla Vista the $1,008,900 upon the delivery of the equipment. Carla Vista delivers the equipment on June 1, 2025, and completes the installation of the equipment on September 30, 2025. The…arrow_forwardCarla Vista Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications, Carla Vista has the following arrangement with Pharoah Inc. Pharoah purchases equipment from Carla Vista for a price of $1,008,900 and contracts with Carla Vista to install the equipment. Carla Vista charges the same price for the equipment irrespective of whether it does the installation or not. The cost of the equipment is $654,000. Pharoah is obligated to pay Carla Vista the $1.008,900 upon the delivery of the equipment. Carla Vista delivers the equipment on June 1, 2025, and completes the installation of the equipment on September 30, 2025. The…arrow_forwardCox Electric makes electronic components and has estimated the following for a new design of one of its products. . Fixed cost $27,000 Material cost per unit - $0.17 Labor cost per unit $0.11 Revenue per unit = $0.68 Note that fixed cost is incurred regardless of the amount produced. Per-unit material and labor cost together make up the variable cost per unit. Assuming that Cox Electric sells all that it produces, profit is calculated by subtracting the fixed cost and total variable cost from total revenue. Construct an appropriate spreadsheet model to find the profit based on a given production level and use the spreadsheet model to answer these questions, (a) Construct a one-way data table with production volume as the column input and profit as the output. Breakeven occurs when profit goes from a negative to a positive value; that is, breakeven is when total revenue the total cost, yielding a profit of zero. Vary production volume from 0 to 100,000 in increments of 10,000. In which…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning