EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

What is the correct answer of this financial accounting question following requirements?

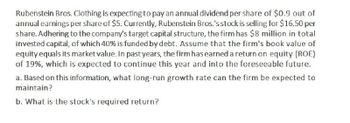

Transcribed Image Text:Rubenstein Bros. Clothing is expecting to pay an annual dividend per share of $0.9 out of

annual earnings per share of $5. Currently, Rubenstein Bros.'s stock is selling for $16.50 per

share. Adhering to the company's target capital structure, the firm has $8 million in total

invested capital, of which 40% is funded by debt. Assume that the firm's book value of

equity equals its market value. In past years, the firm has earned a return on equity (ROE)

of 19%, which is expected to continue this year and into the foreseeable future.

a. Based on this information, what long-run growth rate can the firm be expected to

maintain?

b. What is the stock's required return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that XYZ, Inc. is a single asset firm that is expected to generate $5 million in net cash flows per year indefinitely. The firm's tax rate is 35%. After satisfying all mandatory obligations, all remaining FCF is distributed to common stockholders in the form of cash dividends. The appropriate cost of equity capital, to ABC, is 14%. The firm's target capital structure includes a mix of debt and common equity and interest paid on debt amounts of $500,000 and this amount is tax deductable. What is the present value of the common equity to the shareholders of XYX corporation? $20,892,857 $2,925,000 $3,925,000 $4,925,000arrow_forwardHook Industries's capital structure consists solely of debt and common equity. It can issue debt at rd = 11%, and its common stock currently pays a $2.75 dividend per share (DO $2.75). The stock's price is currently $ 28.00, its dividend is expected to grow at a constant rate of 8% per year, its tax rate is 25%, and its WACC is 13.85%. What percentage of the company's capital structure consists of debt? Do not round intermediate calculations. Round your answer to two decimal places. % oloarrow_forwardHook Industries's capital structure consists solely of debt and common equity. It can issue debt at r_{d} = 10% and its common stock currently pays a $3.00 dividend per share ( D_{0} = $3.00). The stock's price is currently \$ 20.75 , its dividend is expected to grow at a constant rate of 5% per year, its tax rate is 25%, and its WACC is 12.75%. What percentage of the company's capital structure consists of debt? Do not round intermediate calculations. Round your answer to two decimal places. %?arrow_forward

- ABC Inc. is expected to pay a $2.50 dividend at year end (D1 = $2.50), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for $52.50 a share. The before-tax cost of debt is 7.50% and the tax rate is 40%. The target capital structure consist of debt and 55% common equity. What is the companys WACC if all the equity used is from retained earnings?arrow_forwardHook Industries's capital structure consists solely of debt and common equity. It can issue debt at rd = 8%, and its common stock currently pays a $2.00 dividend per share (Do = $2.00). The stock's price is currently $28.50, its dividend is expected to grow at a constant rate of 9% per year, its tax rate is 25 %, and its WACC is 15.35%. What percentage of the company's capital structure consists of debt?arrow_forwardHook Industries's capital structure consists solely of debt and common equity. It can issue debt at rd = 10%, and its common stock currently pays a $3.25 dividend per share (D0 = $3.25). The stock's price is currently $24.00, its dividend is expected to grow at a constant rate of 7% per year, its tax rate is 25%, and its WACC is 12.60%. What percentage of the company's capital structure consists of debt? Do not round intermediate calculations. Round your answer to two decimal places. Please, if possible use Excel formulas, cell references, & horizontal timelines to show all work.arrow_forward

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forwardSarensen Systems Inc. is expected to pay a dividend of $2.50 at year end (D), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for $ 37.50 a share. The before -tax cost of debt is 7.50 %, and the tax rate is 40% . The target capital structure consists of 45% debt and 55% common equity.What is the company's WACC if all the equity used is from retained earnings?arrow_forward

- Hook Industries's capital structure consists solely of debt and common equity. It can issue debt at rd = 10%, and its common stock currently pays a $3.50 dividend per share (D0 = $3.50). The stock's price is currently $35.00, its dividend is expected to grow at a constant rate of 4% per year, its tax rate is 25%, and its WACC is 12.05%. What percentage of the company's capital structure consists of debt? Do not round intermediate calculations.arrow_forwardYou are considering a stock investment in one of two firms (NoEquity, Inc., and NoDebt, Inc.), both of which operate in the same industry and have identical EBITDA of $39.4 million and operating income of $15.5 million. NoEquity, Inc., finances its $70 million in assets with $69 million in debt (on which it pays 10 percent interest annually) and $1 million in equity. NoDebt, Inc., finances its $70 million in assets with no debt and $70 million in equity. Both firms pay a tax rate of 21 percent on their taxable income. Calculate the net income and return on assets-funders' investments-for the two firms. (Enter your dollar answers in millions of dollars. Round "Net income" answers to 3 decimal places and "Return on assets" answers to 2 decimal places.) Answer is not complete. NoEquity Net income $ 0.000 million Return on assets % NoDebt million %arrow_forwardYou are considering a stock investment in one of two firms (NoEquity, Inc., and NoDebt, Inc.), both of which operate in the same industry and have identical EBITDA of $39.3 million and operating income of $16.5 million. NoEquity, Inc., finances its $75 million in assets with $74 million in debt (on which it pays 10 percent interest annually) and $1 million in equity. NoDebt, Inc., finances its $75 million in assets with no debt and $75 million in equity. Both firms pay a tax rate of 21 percent on their taxable income. Calculate the net income and return on assets-funders' investments-for the two firms. (Enter your dollar answers in millions of dollars. Round "Net income" answers to 3 decimal places and "Return on assets" answers to 2 decimal places.) Net income Return on assets NoEquity million % NoDebt million %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT