Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

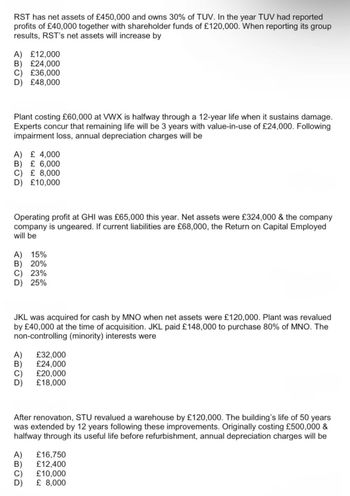

Transcribed Image Text:RST has net assets of £450,000 and owns 30% of TUV. In the year TUV had reported

profits of £40,000 together with shareholder funds of £120,000. When reporting its group

results, RST's net assets will increase by

A) £12,000

B) £24,000

C) £36,000

D) £48,000

Plant costing £60,000 at VWX is halfway through a 12-year life when it sustains damage.

Experts concur that remaining life will be 3 years with value-in-use of £24,000. Following

impairment loss, annual depreciation charges will be

A) £4,000

B) £6,000

C) £8,000

D) £10,000

Operating profit at GHI was £65,000 this year. Net assets were £324,000 & the company

company is ungeared. If current liabilities are £68,000, the Return on Capital Employed

will be

A) 15%

B) 20%

C) 23%

D) 25%

JKL was acquired for cash by MNO when net assets were £120,000. Plant was revalued

by £40,000 at the time of acquisition. JKL paid £148,000 to purchase 80% of MNO. The

non-controlling (minority) interests were

A) £32,000

B) £24,000

시티이미

C) £20,000

£18,000

D)

After renovation, STU revalued a warehouse by £120,000. The building's life of 50 years

was extended by 12 years following these improvements. Originally costing £500,000 &

halfway through its useful life before refurbishment, annual depreciation charges will be

A)

ABCD

£16,750

B) £12,400

£10,000

C)

£ 8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The firm is contemplating the following (base case): Vehicle acquisition cost $ 48,000 Years of useful life (economic life) 1 Tax rate 25% Required rate of return on equity 11% Required return on debt 6% Debt ratio 40% Annual revenues $ 175,000 Operating expenses (excluding depreciation) $ 115,000 1.Depreciate straight-line over the year of useful life, down to $0 over one year. The maximum dividend is paid at year end. Ignore any working capital effects. Capital charge will be based on the assets at the beginning of each year. What is the WACC?arrow_forwardMNO'S ROCE was 15%. If company gearing was 20%, and net assets were £150,000, calculate shareholder funds. A) 105,000 B) 120,000 125,000 ABCD 135,000 PQR's plant, costing £80,000, was damaged in its 6th year of business use. Plant life is 10 years. Engineers reckon residual plant life to be 3 years with value-in-use of £30,000. The plant could be scrapped now for £10,000. Calculate the asset impairment. 시리이이 25,000 20,000 15,000 10,000 HIJ acquired all shares and half of the loan stock in KLM whose net assets were revalued by £120,000 from £340,000 at the time. Goodwill arising was £24,000, and leverage in KLM was 25%. Calculate the investment in KLM in HIJ's books. A) 298,000 316,000 392,000 436,000 YZA's quick asset ratio is half the current ratio. Current assets excluding inventory were £60,000. Calculate the inventory amount in current assets. A) 시이이이 25,000 30,000 45,000 60,000arrow_forwardThe firm is contemplating the following (base case): Vehicle acquisition cost $ 48,000 Years of useful life (economic life) 1 Tax rate 25% Required rate of return on equity 11% Required return on debt 6% Debt ratio 40% Annual revenues $ 175,000 Operating expenses (excluding depreciation) $ 115,000 1.Depreciate straight-line over the year of useful life, down to $0 over one year. The maximum dividend is paid at year end. Ignore any working capital effects. Capital charge will be based on the assets at the beginning of each year. What's the times-interest-earned?arrow_forward

- Grace Corp. invested $12,500 in a project. At the end of 14 years, the company sold the project for $65,275. What annual rate of return did the firm earn on this projectarrow_forwardMarcos has current annual sales of $52600 net fixed assets of $38900, and total asset s of 56300. Tje firm is currently operating at a 79percent capacity. What is the capital intensity ratio at full capacity?arrow_forwardThe firm is contemplating the following: Crane acquisition cost $ 1,000,000 Years of useful life (economic life) 5 Tax rate 0% Required rate of return on equity 10% Annual revenues $ 2,000,000 OCF analysis Economic Profit analysisarrow_forward

- The firm is contemplating the following (base case): Vehicle acquisition cost $ 48,000 Years of useful life (economic life) 1 Tax rate 25% Required rate of return on equity 11% Required return on debt 6% Debt ratio 40% Annual revenues $ 175,000 Operating expenses (excluding depreciation) $ 115,000 1.Depreciate straight-line over the year of useful life, down to $0 over one year. The maximum dividend is paid at year end. Ignore any working capital effects. Capital charge will be based on the assets at the beginning of each year. What's the P&L?arrow_forwardBridgewater Associates invests $88 billion in each of Lucid Group, Inc. (LCID) and Tesla, Inc. (TSLA). Bridgewater has a “2 and 15” fee structure and its management fees and incentive fees are calculated independently at the end of each year. After one year, the investment in LCID is valued at $110 billion and the investment in TSLA is valued at $120 billion. The annual return to an investor in Bridgewater Associates is closest to A. 30.88%. B. 27.65%. C. 23.47%. D. 18.75%.arrow_forwardCompany A is preparing a deal to acquire company B. One analyst estimated that the merger would produce 85 million dollars of annual cost savings, from operations, general and administrative expenses and marketing. These annual cost savings are expected to begin two years from now, and grow at 2.5% a year. In addition the analyst is assuming an after-tax integration cost of 0.1 billion, and taxes of 20%. Assume that the integration cost of 0.1 billion happens one year after the merger is completed (year 1). The analyst is using a cost of capital of 10% to value the synergies. Company B’s equity is trading at 2.3 B dollars (market value of equity). Company A is planning to pay a 32% premium for company B. a) Compute the value of the synergy as estimated by the analyst. b) does the estimate of synergies justify the premium? Could you show me how to work this out in an excel sheet?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education