Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

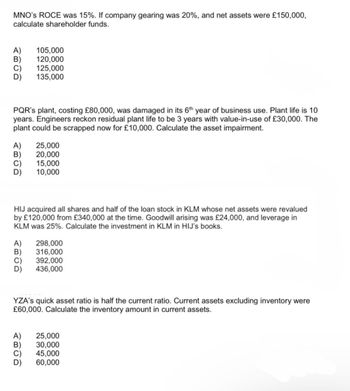

Transcribed Image Text:MNO'S ROCE was 15%. If company gearing was 20%, and net assets were £150,000,

calculate shareholder funds.

A) 105,000

B) 120,000

125,000

ABCD

135,000

PQR's plant, costing £80,000, was damaged in its 6th year of business use. Plant life is 10

years. Engineers reckon residual plant life to be 3 years with value-in-use of £30,000. The

plant could be scrapped now for £10,000. Calculate the asset impairment.

시리이이

25,000

20,000

15,000

10,000

HIJ acquired all shares and half of the loan stock in KLM whose net assets were revalued

by £120,000 from £340,000 at the time. Goodwill arising was £24,000, and leverage in

KLM was 25%. Calculate the investment in KLM in HIJ's books.

A) 298,000

316,000

392,000

436,000

YZA's quick asset ratio is half the current ratio. Current assets excluding inventory were

£60,000. Calculate the inventory amount in current assets.

A)

시이이이

25,000

30,000

45,000

60,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- am.111.arrow_forwardThe firm is contemplating the following (base case): Vehicle acquisition cost $ 48,000 Years of useful life (economic life) 1 Tax rate 25% Required rate of return on equity 11% Required return on debt 6% Debt ratio 40% Annual revenues $ 175,000 Operating expenses (excluding depreciation) $ 115,000 1.Depreciate straight-line over the year of useful life, down to $0 over one year. The maximum dividend is paid at year end. Ignore any working capital effects. Capital charge will be based on the assets at the beginning of each year. What's the times-interest-earned?arrow_forwardGrace Corp. invested $12,500 in a project. At the end of 14 years, the company sold the project for $65,275. What annual rate of return did the firm earn on this projectarrow_forward

- Vikrambahiarrow_forwardThe firm is contemplating the following: Crane acquisition cost $ 1,000,000 Years of useful life (economic life) 5 Tax rate 0% Required rate of return on equity 10% Annual revenues $ 2,000,000 OCF analysis Economic Profit analysisarrow_forwardThe firm is contemplating the following (base case): Vehicle acquisition cost $ 48,000 Years of useful life (economic life) 1 Tax rate 25% Required rate of return on equity 11% Required return on debt 6% Debt ratio 40% Annual revenues $ 175,000 Operating expenses (excluding depreciation) $ 115,000 1.Depreciate straight-line over the year of useful life, down to $0 over one year. The maximum dividend is paid at year end. Ignore any working capital effects. Capital charge will be based on the assets at the beginning of each year. What's the P&L?arrow_forward

- A Company has just invested in a new Machining Center that cost $150,000. The company believes that it will be able to use this new piece of equipment for the next 10 years. At the end of this 10 year period, the company thinks that they can sell this equipment for $20,000. The company's MARR value is 10% ycy. (P/F %.n) (A/F %,n) (F/A %,n) (A/P %,n) (P/A %, 10 0.3855 0.06275 15.9374 0.16275 6.1446 Question: Calculate the Annual Capital Recovery & Return Value (CR) for this new equipment. Please Fill the dollar amount in the answer window. (For example if your answer was $30,000; enter 30,000. If your answer was $-15,000; then enter -15,000) -23,157.5arrow_forwardHanshabenarrow_forwardGodoarrow_forward

- A CNC mill was purchased 4 years ago for $50,000. The current market value is $26,000, which will decline as follows over the next 5 years: $20,000, $16,250, $ 14,000, $12,000, and $8500. The O&M costs are estimated to be $6000 this year. These costs are expected to increase by $2000 per year starting year 2. MARR = 10% The marginal cost for defender in year 2 Group of answer choices $13,750 $ is 14,600 $ 13,875 $15,400 $12,400arrow_forward2. An entrepreneur will open a wet seasoning business. The required investment is Rp 77,500,000.00 at the beginning of the year. Operating costs include raw materials, space rental, operators and other costs amounting to IDR 47,000,000.00 in the first year and are expected to continue to increase. An increase of 5% from the previous year. The operating life is estimated to be the same as the economic life of the machines, which is an average of 7 years with a salvage value of IDR 1% of the investment cost. It is known that the levelithe current rate is 15%. The net income earned is IDR 70,000,000.00/year. Determine the feasibility of the business with the analysis: a. Cash flow table b. NPV c. IRR d. Net B/C ratio e. Conclusion?arrow_forward1.Suppose a construction company has an inventory of 1 million board ft of lumber purchased as $400,000. If lumber prices rise by 50% and the company is asked to bid a new project, the replacement cost is?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education