FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

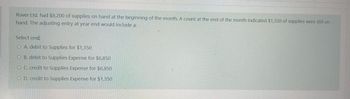

Transcribed Image Text:Rover Ltd. had $8,200 of supplies on hand at the beginning of the month. A count at the end of the month indicated $1,350 of supplies were still on

hand. The adjusting entry at year end would include a:

Select one:

O A. debit to Supplies for $1,350

OB. debit to Supplies Expense for $6,850

OC. credit to Supplies Expense for $6,850

OD. credit to Supplies Expense for $1,350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At December 31, Gill Co. reported accounts receivable of $236,000 and an allowance for uncollectible accounts of $1,450 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 2% of accounts receivable. The amount of the adjustment for uncollectible accounts would be: Multiple Choice $1,450 $4.980 $3,270. $4,720arrow_forwardAt December 31, Gill Co. reported accounts receivable of $281,000 and an allowance for uncollectible accounts of $1,600 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 3% of accounts receivable. The amount of the adjustment for uncollectible accounts would be: Multiple Choice $8,340. $1,600. $8,430. $6,830.arrow_forwardAt the end of the year, Dahl Enterprises estimates the uncollectible accounts expense to be 0.8 percent of net sales of $7,575,000. The current credit balance of Allowance for Uncollectible Accounts is $12,900. Prepare the entry to record the uncollectible accounts expense. What is the balance of Allowance for Uncollectible Accounts after this adjustment? You must show your computations.arrow_forward

- Ernie Upshaw is the supervising manager of Sleep Tight Bedding. At the end of the year, the company’s accounting manager provides Ernie with the following information, before any adjustment.Accounts receivable $500,000Estimated percent uncollectible 9%Allowance for uncollectible accounts $20,000 (debit)Operating income $320,000In the previous year, Sleep Tight Bedding reported operating income (after adjustment) of $275,000. Ernie knows that it’s important to report an upward trend in earnings. This is important not only for Ernie’s compensation and employment, but also for the company’s stock price. If investors see a decline in earnings, the stock price could drop significantly, and Ernie owns a large amount of the company’s stock. This has caused Ernie many sleepless nights.Required:1. Record the adjustment for uncollectible accounts using the accounting manager’s estimate of 9% of accounts receivable.2. After the adjustment is recorded in requirement 1, what is the revised amount…arrow_forwardCalculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $120 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $26.59 October 16 Credit $10.00 October 25 Purchase $121.60 average daily balance = $arrow_forwardCalculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $130 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $27.59 October 16 Credit $20.00 October 25 Purchase $124.60 average daily balance = $arrow_forward

- At the end of the current year, the accounts receivable account has a debit balance of $1,117,000 and sales for the year total $12,670,000. a. The allowance account before adjustment has a credit balance of $15,100. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a credit balance of $15,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $48,300. c. The allowance account before adjustment has a debit balance of $6,400. Bad debt expense is estimated at 1/4 of 1% of sales. d. The allowance account before adjustment has a debit balance of $6,400. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $53,100. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. b. $ C. $ d. $arrow_forwardAt the end of the year, a company reports a balance in its Allowance for Uncollectible Accounts of $2,000 (credit) before any year-end adjustment. The company estimates future uncollectible accounts to be 2% of credit sales for the year. Credit sales for the year total $282,000. Record the adjustment for the allowance for uncollectible accounts using the percentage-of-credit-sales method on a balance sheet.arrow_forwardExplain in details please fast ASAP The Sports Store has a beginning receivables balance on January 1 of $2,640. Sales for January through April are $3,440, $3,590, $2,690, and $4,720, respectively. The accounts receivable period is 45 days. How much did the store collect in the month of April? Assume a year has 360 days.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education