FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

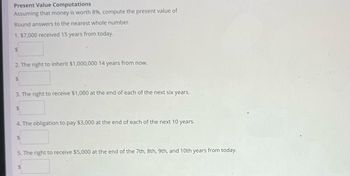

Transcribed Image Text:Present Value Computations

Assuming that money is worth 8%, compute the present value of

Round answers to the nearest whole number.

1. $7,000 received 15 years from today.

$

2. The right to inherit $1,000,000 14 years from now.

$

3. The right to receive $1,000 at the end of each of the next six years.

$

4. The obligation to pay $3,000 at the end of each of the next 10 years.

$

5. The right to receive $5,000 at the end of the 7th, 8th, 9th, and 10th years from today.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gus deposited $6,000 on February 4, 2021. How much does Gus have on September 4, 2028, if the rate is 4% compounded semiannually?arrow_forward6. Masuku agrees to pay R250 at the beginning of each year for 15 years. If money is worth 43% p.a. Find the value of the remaining payments just before he makes the sixth payment. A. R2 067.20 B. R2 067 C. D. E. R2 067.11 2 067.20 R2 067 Iarrow_forwardMr. Glen Secundo won a lottery paying P1,400,000 at the beginning of each year for 15 years. Find the amount must set aside today to satisfy this annuity at 13% compounded annually.arrow_forward

- Jane Wilson won a lottery. The British Columbia Lottery Commission offers her three payout options to receive her prize: Option 1 Receive CAD 140,000 at the end of 10 years. Option 2 Receive CAD 12,000 at the end of each of the next ten years. Option 3 Receive CAD 5,000 at the end of each of the next ten years plus CAD 10,000 at the end of each of the ten subsequent years. The interest rate is 5.0%, compounded annually. REQUIRED: 1. Which option should Jane select?arrow_forwardVv. Mary will receive $12,000 per year for the next 10 years as royalty for her work on a finance book. What is the present value of her royalty income if the opportunity cost is 12 percent? Assume that payments come at the end of each year. O $235,855 O $75,939 O $210,585 O $67,803arrow_forwardPaul intends to retire in 15 years and would like to receive $1,500 every month for 20 years, starting at the end of the first month in which he retires. How much must he have at the beginning of retirement if interest is 5% compounded annually? Select one: a. $191,834.03 b. $229,415.16 c. $228,235.00 d. $227,287.97 e. $230,349.83arrow_forward

- Your employer contributes $500 per month, at the beginning of each month, to a retirement fund on your behalf. The contributions earn interest at a rate of 6% per year, compounded monthly. At the end of twenty years, what will be the balance of the fund? Group of answer choices $69,790 $232,175 $70,139 $220,713 $231,020arrow_forwardSusan won the lottery today which will pay an annual perpetuity of X, with the first payment occurring five years from today. The perpetuity has a present value of 100,000 based on an annual effective interest rate of 1% for the first ten years and 5% for all years thereafter. Calculate X. A. 4,100 B. 4,224 C. 4,357 D. 4,401 E. 5,696arrow_forwardMr. Bill purchased a new house for 110,000. He paid 20,000 down and agreed to pay the rest over the next 30 years in 30 equal end of the year payments plus 12 percent compound interest on the unpaid balance. What will these equal payments be?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education