FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

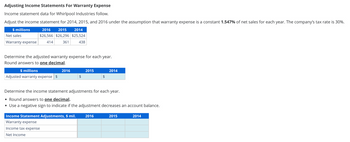

Transcribed Image Text:Adjusting Income Statements For Warranty Expense

Income statement data for Whirlpool Industries follow.

Adjust the income statement for 2014, 2015, and 2016 under the assumption that warranty expense is a constant 1.547% of net sales for each year. The company's tax rate is 30%.

$ millions

Net sales

Warranty expense

2016

2015

2014

414

$26,566 $26,296 $25,524

438

361

Determine the adjusted warranty expense for each year.

Round answers to one decimal.

$ millions

2016

2015

2014

Adjusted warranty expense $

$

$

Determine the income statement adjustments for each year.

• Round answers to one decimal.

• Use a negative sign to indicate if the adjustment decreases an account balance.

Income Statement Adjustments, $ mil.

2016

2015

Warranty expense

Income tax expense

Net Income

2014

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- pre.3arrow_forwardMirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. 0-30 days 31-90 days Over 90 days past due past due past due Accounts receivable amount $55,000 $33,000 $17,000 Percent uncollectible 8% 15% 30% Total per category ? Total uncollectible ? To manage earnings more efficiently, Mirror Mart decided to change past-due categories as follows. 0-60 days 61-120 days Over 120 days past due past due past due Accounts receivable Amount $84,000 $11,000 $7,000 Percent uncollectible 8% 15% 30% Total per category ? ? ? Total uncollectible ? Complete the following. A. Complete each table by filling in the blanks. 0-30 days 31-90 days Over 90 days past due past due past due Accounts receivable amount $55,000 $33,000 $17,000 Percent uncollectible 8% 15% 30% Total per category Total uncollectiblearrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $400,000; Allowance for Doubtful Accounts has a debit balance of $3,500; and sales for the year total $1,800,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $15,800. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.arrow_forward

- Your answer is correct. Calculate Maple Leaf's receivables turnover and collection period for 2019 and 2018. (Round receivables turnover to 2 decimal places, e.g. 52.75 and collection period to 1 decimal place, e.g. 52.7. Use 365 days for calculation.) Receivables turnover Collection period 2019 33.75 times 2018 34.81 times 10.81 days 10.48 days (b) Has the company's liquid improved weakened? weakened Company's liquidity has Attempts: 1 of 1 usedarrow_forwardAdjusting Allowance for Doubtful Accounts and Bad Debt Expense Merck & Company reported the following in its financial statements. $ millions Accounts receivable, net Allowance for doubtful accounts 2016 2017 2018 2019 $8,773 $8,591 $8,839 $8,473 244 199 149 108 Adjust the balance sheet and income statement to reflect a 1.97874% of Allowance for doubtful accounts to Gross accounts receivables for each year. Assume a tax rate of 20%. • Round answers to one decimal. • Use a negative sign to indicate if the adjustment decreases an account balance. 2016 2017 2018 2019 Adjusted allowance for doubtful accts. $ $ $ $ Income Statement Adjustments Bad debts expense Income tax expense at 20% Net Income Balance Sheet Adjustments Allowance for doubtful accounts Accounts receivable, net Deferred tax liabilities Retained Earningsarrow_forwardSales Cost of goods sold Accounts receivable Numerator: 2021 $ 446,762 225,881 21,623 Numerator: Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. Numerator: 1 1 1 1 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Net Sales favorable or unfavorable? 2020 $ 290,105 146,803 16,913 Trend Percent for Net Sales: 2019 $ 232,084 119,092 15,828 2021: 2020: 2019: 2018: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Cost of Goods Sold: 1 Denominator: 7 1 1 1 1 1 I 1 Denominator: Trend Percent for Accounts Receivable: Denominator: 1 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Accounts Receivable favorable or unfavorable? 2018 $ 167,570 84,885 9,820 = = = = = = = = = = 2017 $ 128,900 64,450 8,804 = Trend percent Trend percent Trend percent % % % % % % % % % % % % %…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education