[The following information applies to the questions displayed below.]

A recent annual report for Commonwealth Delivery included the following note:

NOTE 1: DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PROPERTY AND EQUIPMENT. Expenditures for major additions, improvements and flight equipment modifications are capitalized when such costs are determined to extend the useful life of the asset or are part of the cost of acquiring the asset. Expenditures for equipment overhaul costs of engines or airframes prior to their operational use are capitalized as part of the cost of such assets as they are costs required to ready the asset for its intended use. Maintenance and repairs costs are charged to expense as incurred . . .

Assume that Commonwealth Delivery made extensive repairs on an existing building and added a new wing. The building is a garage and repair facility for delivery trucks that serve the Denver area. The existing building originally cost $784,000, and by the end of last year, it was half

a. Ordinary repairs and maintenance expenditures for the year, $15,000 cash.

b. Extensive and major repairs to the roof of the building, $125,000 cash. These repairs were completed at the end of the current year

c. The new wing was completed on December 31 of the current year at a cash cost of $242,000.

Required:

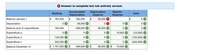

1. Applying the policies of Commonwealth Delivery, complete the following, indicating the effects for the preceding expenditures. Indicate the effects positive value for increase, negative value for decrease.

I don't know why i got it wrong..

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Fulbright County constructed a library in one of the county's high-growth areas. The construction was funded by a number of sources. Below is selected information related to the Library Capital Project Fund. All activity related to the library construction occurred within the current fiscal year. The county operates on a calendar-year basis. Required Prepare a journal entry for capital projects fund and governmental activities at the government-wide level. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Fund/ Governmental Activities General Journal 1. The county issued $6,700,000 of 6 percent bonds at par. Proceeds from the bonds were to be used for construction of the library. 1 Capital Projects Fund Transaction. 2. A $720,000 federal grant was received to help finance construction of the library. 2 Capital Projects Fund 3. The Library Special Revenue Fund transferred $320,000 for use in construction of the library.…arrow_forwardSeveral expenditures are listed below. Indicate whether or not each expenditure would be included in the cost of acquisition for each item below. The answer box provides two options, Yes (if the expenditure would be included ) or No, (if the expenditure would not be included.) Cost testing materials and labor in testing a purchased machine Yes before use Compensation for injury to No construction worker Cost of overhaul to a used Yes machine purchased before initial use Cost of tearing down a building Yes on newly acquired land Repairs to a new machine Yes damaged while moving it into > > > > >arrow_forwardDrabinski Ltd. decided on 1 July 20X3 to dispose of an asset group consisting of land, a building, and equipment. An active plan of disposal is being carried out, and sale is highly probable within the following year. The assets’ carrying values and estimated recoverable amounts at 1 July 20X3 are as follows: Cost Carrying Value Estimated Recoverable Amount Land $ 470,000 $ 470,000 $ 498,000 Building 3,400,000 1,640,000 970,000 Equipment 1,040,000 470,000 357,000 $ 4,910,000 $ 2,580,000 $ 1,825,000 On 31 December 20X3, the net recoverable amount of the group is reliably estimated to be $1,859,000. On 1 April 20X4, the asset group is sold for $1,919,000, net of costs to sell. Prepare journal entries that are appropriate to record the information above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Do not give answer in imagearrow_forward

- In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Assume that Westgate Construction's contract with Santa Clara County does not qualify for revenue recognition over time. Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. 2-a. In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc." for construction costs incurred). 2024 $ 2,739,000 5,561,000 2,300,000 2,100,000 Cost incurred during the year Estimated costs to complete as of year-end 2025 $ 3,735,000 1,826,000 4,174,000 3,900,000 2024 $ 2,430,000 5,630,000 2-b. In the journal below, complete the necessary journal entries for the year…arrow_forwardThe City of Algonquin maintains its books to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: Deferred inflows of resources—property taxes of $73,500 at the end of the previous fiscal year were recognized as property tax revenue in the current year's Statement of Revenues, Expenditures, and Changes in Fund Balance. The City levied property taxes for the current fiscal year in the amount of $13,789,400. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $309,200 is thought to be uncollectible, $365,000 would likely be collected during the 60-day period after the end of the fiscal year, and $52,800 would be collected after that time. The City had recognized the maximum of property taxes allowable under modified accrual accounting. In addition to the expenditures…arrow_forwardOn November 1, the city of Reaganton sold a police vehicle for $10,000 cash that was originally purchased for $100,000. The vehicle had been depreciated at the government-wide level and accumulated depreciation at the date of sale was 92,000. Record this sale (1) from the perspective of the governmental activities at the government-wide level, and (2) from the perspective of the General Fund.arrow_forward

- The City of Grinders Switch maintains its books in a manner that facilitates the preparation of fund accounting statements and uses worksheet adjustments to prepare government-wide statements. 1. General fixed assets as of the beginning of the year, which had not been recorded, were as follows: Land Buildings Improvements Other Than Buildings Equipment Accumulated Depreciation, Capital Assets $ 7,700,000 33,398,400 14,839,400 11,569,000 25,333,000 2. During the year, expenditures for capital outlays amounted to $7,510,000. Of that amount, $4,806,400 was for buildings; the remainder was for improvements other than buildings. 3. The capital outlay expenditures outlined in (2) were completed at the end of the year (and will begin to be depreciated next year). For purposes of financial statement presentation, all capital assets are depreciated using the straight-line method, with no estimated salvage value. Estimated lives are as follows: buildings, 40 years; improvements other than…arrow_forwardSe.114.arrow_forwardsvitaarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education