FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

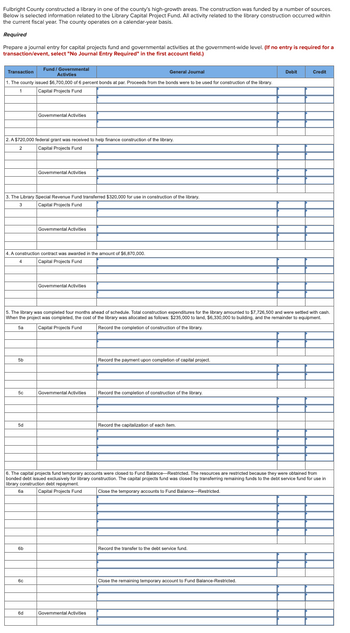

Transcribed Image Text:Fulbright County constructed a library in one of the county's high-growth areas. The construction was funded by a number of sources.

Below is selected information related to the Library Capital Project Fund. All activity related to the library construction occurred within

the current fiscal year. The county operates on a calendar-year basis.

Required

Prepare a journal entry for capital projects fund and governmental activities at the government-wide level. (If no entry is required for a

transaction/event, select "No Journal Entry Required" in the first account field.)

Fund/ Governmental

Activities

General Journal

1. The county issued $6,700,000 of 6 percent bonds at par. Proceeds from the bonds were to be used for construction of the library.

1

Capital Projects Fund

Transaction.

2. A $720,000 federal grant was received to help finance construction of the library.

2

Capital Projects Fund

3. The Library Special Revenue Fund transferred $320,000 for use in construction of the library.

Capital Projects Fund

3

4

4. A construction contract was awarded in the amount of $6,870,000.

Capital Projects Fund

5b

5c

5d

Governmental Activities

ба

Governmental Activities

5. The library was completed four months ahead of schedule. Total construction expenditures for the library amounted to $7,726,500 and were settled with cash.

When the project was completed, the cost of the library was allocated as follows: $235,000 to land, $6,330,000 to building, and the remainder to equipment.

5a Capital Projects Fund

Record the completion of construction of the library.

6b

6c

Governmental Activities

6d

Governmental Activities

Governmental Activities

Record the payment upon completion of capital project.

6. The capital projects fund temporary accounts were closed to Fund Balance-Restricted. The resources are restricted because they were obtained from

bonded debt issued exclusively for library construction. The capital projects fund was closed by transferring remaining funds to the debt service fund for use in

library construction debt repayment.

Capital Projects Fund

Close the temporary accounts to Fund Balance-Restricted.

Governmental Activities

Record the completion of construction of the library

Record the capitalization of each item.

Debit

Record the transfer to the debt service fund.

Credit

Close the remaining temporary account to Fund Balance-Restricted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardBay City uses the purchases method to account for supplies. At the beginning of the year the city had no supplies on hand. During the year the city purchased $600,000 of supplies for use by activities accounted for in the general fund. The city used $400,000 of those supplies during the year. Assuming that the city maintains its books and records in a manner that facilitates the preparation of its fund financial statements, at fiscal year-end the appropriate account balances related to supplies expenditures and supplies inventory would be A.) Expenditures $600,000; Supplies inventory $200,000. B.) Expenditures $600,000; Supplies inventory $0. C.) Expenditures $400,000; Supplies inventory $200,000. D.) Expenditures $400,000; Supplies inventory $0.arrow_forwardOnly typed solutionarrow_forward

- Please answer complete and properlyarrow_forwardPlease provided details solution and Do not Give image formatarrow_forwardTheodore County uses a General Fund, a Special Revenue Fund, and an Enterprise Fund. The Special Revenue Fund is financed by a grant from the state to provide care for the elderly. The Enterprise Fund provides bus service both to the public and to government agencies. Prepare entries to record these transactions. Identify the funds involved in each case. a. The Enterprise Fund bills the Special Revenue Fund $15,000 for bus service provided to the elderly. b. The General Fund receives an electricity bill for $20,000 and prepares a voucher to pay the bill. The General Fund then bills the Special Revenue Fund for $3,000, representing the portion of the electricity bill applicable to the senior citizens building. C. The Enterprise Fund is short of cash to pay its bills. The General Fund lends the Enterprise Fund $50,000 in cash, which will be repaid before the end of the year. d. The General Fund pays cash of $100,000 to the Enterprise Fund as a subsidy to help meet the operating costs of…arrow_forward

- The City of Grinders Switch maintains its books in a manner that facilitates the preparation of fund accounting statements and uses worksheet adjustments to prepare government-wide statements. 1. General fixed assets as of the beginning of the year, which had not been recorded, were as follows: Land Buildings Improvements Other Than Buildings Equipment Accumulated Depreciation, Capital Assets $ 7,700,000 33,398,400 14,839,400 11,569,000 25,333,000 2. During the year, expenditures for capital outlays amounted to $7,510,000. Of that amount, $4,806,400 was for buildings; the remainder was for improvements other than buildings. 3. The capital outlay expenditures outlined in (2) were completed at the end of the year (and will begin to be depreciated next year). For purposes of financial statement presentation, all capital assets are depreciated using the straight-line method, with no estimated salvage value. Estimated lives are as follows: buildings, 40 years; improvements other than…arrow_forwardTopic Please research an annual comprehensive financial report of any local municipality of your choice that had a general government capital construction project that was financed. Discuss the project and type of financing that the local government used, and opine on the other various financing options that the government could have used. In your opinion, did the local government use the most effective financing option? Why or why not? Note: Please provide a link to the referenced material used. This can be attached as a website link or a document (PDF/Word). Make sure to reference your source (using APA 7th edition).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education