FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

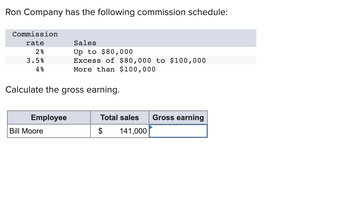

Transcribed Image Text:**Ron Company Commission Schedule:**

Ron Company uses the following commission schedule:

- **2%** on sales **up to $80,000**

- **3.5%** on sales in **excess of $80,000 up to $100,000**

- **4%** on sales **more than $100,000**

**Task: Calculate the gross earning.**

Here is an example scenario:

| Employee | Total Sales | Gross Earning |

|-----------|-------------|---------------|

| Bill Moore | $141,000 | |

To calculate the gross earning for Bill Moore:

1. **Sales up to $80,000:**

- Commission = 2% of $80,000 = $1,600

2. **Sales from $80,000 to $100,000 (i.e., $20,000):**

- Commission = 3.5% of $20,000 = $700

3. **Sales in excess of $100,000 (i.e., $41,000):**

- Commission = 4% of $41,000 = $1,640

4. **Total Gross Earning:**

- $1,600 + $700 + $1,640 = $3,940

So, Bill Moore's gross earning would be **$3,940**.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Problem 5 George Washington Company buys one kind of merchandise at $12 per unit and sells it at $25 per unit. The company's sales representatives receive a 20% commission on each sale. The March Income Statement shows the following information: Sales Cost of goods sold Gross profit George Washington Company Income Statement For Month Ended March 31 Expenses: Sales commissions Advertising Store rent Administrative salaries Depreciation Other Total expenses Net Income $500,000 240,000 $100,000 50,000 5,000 10,000 6,000 12,000 $260,000 $183,000 $ 77.000 The company's management believes that the March results will be repeated during April, May, and June without any changes in strategy. However, some changes are being considered. Management believes that unit sales will increase at a rate of 8% each month during the next quarter (including April) if the item's selling price is reduced to $22.50 per unit and if advertising expenses are increased by 40% and remain at that level for all…arrow_forwardProblem 1. Better Man Company reported the following information on its income statement for the first quarter of the year. January Php 375,000 32,000 12,000 March Eebruary Php 750,000 Sales Sales Returns & Allowances Sales Discounts Net Sales Php 25,000 15,000 9,000 736,000 255,000 Cost of Sales Gross Profit 620,000 185,000 310,000 Required: Calculate the missing information.arrow_forwardTB MC Qu. 7-87 Gullnson Corporation has two dlvislons: Divlslon ... Gulinson Corporation has two divisions: Division A and Division B. Data from the most recent month appear below. Total Division Division Company $591,000 $222,000 $369, 000 275,580 A B Sales Variable expenses Contribution margin Traceable fixed expenses 113, 220 162, 360 315,420 195,000 108,780 66,000 206,640 129,000 Segment margin 120,420 $ 42,780 $ 77,640 Common fixed expenses 65,010 Net operating income $ 55,410 The break-even in sales dollars for Division A is closest to: (Round your Intermedlate calculatlons to 2 decimal places.) Multiple Cholce $134,694 $184,531 $487179 1:06 73°F Mostly sunny 10/20/ here to search DELLarrow_forward

- AIR Co. manufactures one main product and two by-products, A and B. Data for April follows: Main Product By-product A В Total $6,000 $1,100 $75,000 $3,500 $900 $84,500 $13,500 Sales Cost of further | $11,500 processing Marketing Admin & $6,000 $750 $550 $7,300 Expenses |Joint Cost Product based on sales allowed for A and B is 15% and 12% respectively. Compute for the total production cost of the main product. $37,500arrow_forwardXYZ Enterprises Corporation's single product appear below: Selling Price Per Unit Rs. 150 Variable Expense Per Unit 90 Fixed Expenses for the month 424,840 Total Sales in amount to attain the company's monthly target profit of Rs. 50,000 is closest to:arrow_forwardDelisa Corporation has two divisions: Division L and Division Q. Data from the most recent month appear below: Total Company Division L Division Q Sales $587,000 $172,000 $415,000 Variable expenses 376,090 98,040 278,050 Contribution margin 210,910 73,960 136,950 Traceable fixed expenses 105,290 30,870 74,420 Segment margin 105,620 $ 43,090 $ 62,530 Common fixed expenses 68,550 Net operating income $ 37,070 The break-even in sales dollars for Division Q is closest to:arrow_forward

- Ron Company has the following commission schedule: Commission rate Sales 2 % Up to $80,000 3.5 % Excess of $80,000 to $100,000 4 % More than $100,000 Calculate the gross earning. Employee Total Sales Gross Earnings Lauren Cleaves $ 143,000arrow_forwardOwearrow_forwardTrillium, Inc. reports the following information for April: Alpha Beta Units sold 3,000 units 750 units Sales price per unit $250 $700 Variable manufacturing cost per unit 175 500 Sales commission per unit: Alpha: 4% of sales price 10 Beta: 6% of sales price 42 What is the contribution margin ratio of Beta? (Round your answer to two decimal places.) OA. 30% OB. 28.57% ○ C. 6% OD. 22.57%arrow_forward

- The KC Services Company has the following data: Sales revenue $645 Managers salary $60 other sales $77 Depreciation $61 labor $80 Rent $82 Marketing costs $45 other costs $64 plant maintenance $35 Supervisory equal 27 of the labor Administrative costs $81 Calculate the gross margin Note Please give your answers with 2 numbers after the decimal point.arrow_forwardD.Insert a column called percentage contribution in an appropriate area of the spreadsheet, to display the total contribution to overall sales by each salesperson. The answer is to be formatted as percentage. e.Company policy dictates that all sales volumes exceeding nine million ($8,000, 000.00) but not exceeding ten million ($10, 000, 000.00) should receive an incentive of US $700.00, otherwise they should receive US $200.00. In an appropriate area of the spreadsheet create a heading called Special Incentive 1 and make the necessary calculations using the necessary function f.Company policy also dictates that all sales volumes exceeding ten million ($10,000, 000.00) but less than or equal to twelve million ($12, 000, 000.00) should receive a trip to any Air Jamaica destination, otherwise they should not receive a trip. In an appropriate area of the spreadsheet create a heading called Special Incentive 2 and make the necessary calculations using the necessary functionarrow_forwardDelos, Inc. reports the following information for April: Sigma 2,000 units $300 150 Units sold Sales price per unit Variable manufacturing cost per unit Sales commission per unit: Sigma: 8% of sales price Gamma: 10% of sales price What is the contribution margin of Sigma? OA. $300,000 OB. $252,000 OC. $72,000 OD. $552,000 24 Gamma 700 units $600 480 60arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education