FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

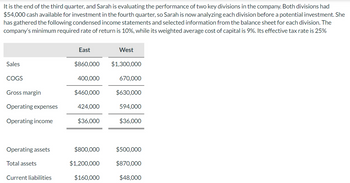

Transcribed Image Text:It is the end of the third quarter, and Sarah is evaluating the performance of two key divisions in the company. Both divisions had

$54,000 cash available for investment in the fourth quarter, so Sarah is now analyzing each division before a potential investment. She

has gathered the following condensed income statements and selected information from the balance sheet for each division. The

company's minimum required rate of return is 10%, while its weighted average cost of capital is 9%. Its effective tax rate is 25%

Sales

COGS

Gross margin

Operating expenses

Operating income

Operating assets

Total assets

Current liabilities

East

$860,000

400,000

$460,000

424,000

$36,000

$800,000

$1,200,000

$160,000

West

$1,300,000

670,000

$630,000

594,000

$36,000

$500,000

$870,000

$48,000

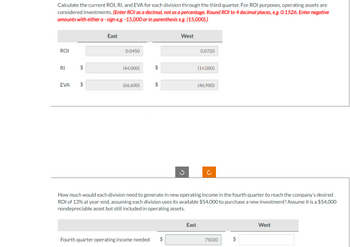

Transcribed Image Text:Calculate the current ROI, RI, and EVA for each division through the third quarter. For ROI purposes, operating assets are

considered investments. (Enter ROI as a decimal, not as a percentage. Round ROI to 4 decimal places, e.g. 0.1526. Enter negative

amounts with either a-sign e.g.-15,000 or in parenthesis eg. (15,000).)

West

ROI

RI

$

EVA $

East

0.0450

(44,000)

(66,600)

$

G

Fourth quarter operating income needed $

0.0720

(14,000)

(46,980)

How much would each division need to generate in new operating income in the fourth quarter to reach the company's desired

ROI of 13% at year-end, assuming each division uses its available $54,000 to purchase a new investment? Assume it is a $54,000

nondepreciable asset but still included in operating assets.

East

75020

$

West

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Data for Hermann Corporation are shown below: Percent of Per Unit Sales Selling price Variable expenses $ 60 100% 39 65 Contribution margin $ 21 35% Fixed expenses are $72,000 per month and the company is selling 4,200 units per month. Required: 1-a. How much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,600, the monthly sales volume increases by 100 units, and the total monthly sales increase by $6,000? 1-b. Should the advertising budget be increased? Complete this question by entering your answers in the tabs below. Req 1A Req 1B How much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,600, the monthly sales volume increases by 100 units, and the total monthly sales increase by $6,000? (Do not round intermediate calculations.) Net operating income decreases byarrow_forwardAssume the Hiking Shoes division of the Simply Shoes Company had the following results last year (in thousands). Management's target rate of return is 30% and the weighted average cost of capital is 15%. Its effective tax rate is 30%. Sales Operating income Total assets Current liabilities What is the division's Return on Investment (ROI)? A. 68.57% B. 171.43% C. 40% O D. 22.57% $6,000,000 2,400,000 3,500,000 790,000 COarrow_forwardUsing the following data, estimate the new Return on Investment if there is a 10% increase in sales - with average operating assets as the base. Sales $2,000,000 Variable costs 1,100,000 Contribution margin 45% 900.000 Controllable fıxed costs 300.000 Controllable margin $600,000 Average operating assets $5,000,000 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forward

- 42. The manager of Stock Division projects the following for next year: Sales $185,000 Operating income Operating assets The manager can invest in an additional project that would require $40,000 investment in additional assets and would generate $6,000 of additional income. The company's minimum rate $60,000 $375,000 of return is 14%. What is the residual income for Stock Division without the additional investment? * $6,000 $7,500 $40,000 $6,200 $6,600arrow_forward:04 Variable expenses for Alpha Corporation are 40% of sales. What are sales at the break-even point, assuming that fixed expenses total $150,000 per year: Multiple Choice O $250,000 $600,000 $375,000 $150,000arrow_forward36arrow_forward

- #1 The company had an overall return on investment (ROI) of 15% last year (considering all divisions). The Office Products Division has an opportunity to add a new product line that would require an additional investment in operating assets of $1,000,000. The cost and revenue characteristics of the new product line per year would be: This Year New Line Next Year New product line Info Company Oveall Info: Sales $10,000,000.00 $ 2,000,000.00 $12,000,000.00 Sales $2,000,000.00 ROI 15% Variable expenses $6,000,000.00 $7,200,000.00 Variable expenses 60% of sales Invest in operating $1,000,000.00 Contribution margin $4,000,000.00 $4,800,000.00 Fixed expenses $640,000.00 Fixed expenses $3,200,000.00 $ 640,000.00 $3,840,000.00 Net Operating Income Net operating income $800,000.00 $960,000.00 Divisional operating assets $4,000,000.00 $ 1,000,000.00 $5,000,000.00 Margin…arrow_forwardAccounting - ROIarrow_forward24arrow_forward

- 1. If Department B is able to reduce its operating assets by $100,000, Department B's new ROI would be 2. If Department A is able to increase its controllable margin by $60,000 as a result of reducing variable costs, Department A's new ROI would bearrow_forwardAssume that a company plans to introduce a new product to the market at a target selling price of $20 per unit. It is investing $4,000,000 to purchase the equipment needed to produce and sell 250,000 units per year. Assuming the company’s required rate of return on all investments is 16.50%, what is the new product’s target cost per unit? Multiple Choice $21.84 $22.84 $18.36 $17.36arrow_forwardOnly do 5 and 6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education