Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

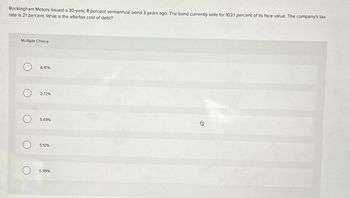

Transcribed Image Text:Rockingham Motors issued a 30-year, 8 percent semiannual bond 3 years ago. The bond currently sells for 103.1 percent of its face value. The company's tax

rate is 21 percent. What is the aftertax cost of debt?

Multiple Choice

O

6.10%

2.72%

О

О

О

5.69%

5.10%

5.99%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- jiminy's cricket farm issued a 30-year, 7 percent semiannual bond 3 years ago. the bond currently sells for 93 percent of its face value. the compnay's tax rate is 22 percent. what is the pretax cost of debt? what is the aftertax cost of debt Please use Excel Formulasarrow_forward4. Compute the annual cost for interest and redemption of these bondsarrow_forward(Cost of debt) Temple-Midland, Inc. is issuing a $1,000 par value bond that pays 7.7 percent annual interest and matures in 15 years. Investors are willing to pay $949 for the bond and Temple faces a tax rate of 21 percent. What is Temple's after-tax cost of debt on the bond? The after-tax cost of debt is%. (Round to two decimal places.)arrow_forward

- Lenovo issued 30-year, 7.7 percent semiannual bonds 6 years ago. The bonds sell presently at 101 percent of face value. What is the company's after-tax cost of debt if the tax rate is 35 percent?arrow_forwardCompany X pays interest to the amount of R1 500 a year on total liabilities of R10 000. It can also issue bonds with a YTM of 12%. What will the relevant before tax cost of debt be when calculating that WACC for the company? a. 18% b. 12% c. 15% d. 8%arrow_forwardYing Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table bel If the corporate tax rate is 22 percent, what is the aftertax cost of the company's debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Aftertax cost of debtarrow_forward

- 5 years ago, Barton Industries issued 25-year nuncallable, semiamual bonds with $1,000 face value and a 5%. coupan, semianual payment ($25 payment every months). The bonds currently sell for $894.87. If the firm's marginal tax rate is 25%, what is the firm's after-tax cost of debt? % ildes 1 the a AG ect thatarrow_forwardDengararrow_forwardThe existing 10 year, 6% bonds are trading in the market at $900. The corporate tax rate is 32% After-tax interest rate = YTM (1-T) 2a. Calculate the interest rate for the new bonds. 2b.What is the after-tax interest rate for the new bonds?arrow_forward

- KatyDid Clothes has a $110 million (face value) 25-year bond issue selling for 102 percent of par that carries a coupon rate of 8 percent. paid semiannually What would be Katydid's before-tax component cost of debt? Note: Round your answer to 2 decimal places. Cost of debt %arrow_forward(Cost of debt) Temple-Midland, Inc. is issuing a $1,000 par value bond that pays 8.2 percent annual interest and matures in 15 years. Investors are willing to pay $946 for the bond and Temple faces a tax rate of 35 percent. What is Temple's after-tax cost of debt on the bond? The after-tax cost of debt is%. (Round to two decimal places.)arrow_forward6. Ellesmere Corporation issues 1 million $1 par value bonds. The stated interest rate is 6% per year and the interest is paid twice a year. What is the real interest rate of the bond? ____ A. 6% B.3% C. 12% D. (1+6%/2)2-1 10.What is the present value of $10,000 per year perpetuity at an interest rate of 5%?____ A. $10,000 B. $100,000 C. $200,000 D. None of the above Please provide formula too.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education