FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

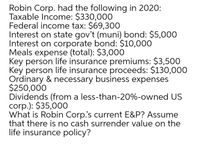

Transcribed Image Text:Robin Corp. had the following in 2020:

Taxable Income: $330,000

Federal income tax: $69,300

Interest on state gov't (muni) bond: $5,000

Interest on corporate bond: $10,000

Meals expense (total): $3,000

Key person life insurance premiums: $3,500

Key person life insurance proceeds: $130,000

Ordinary & necessary business expenses

$250,000

Dividends (from a less-than-20%-owned US

corp.): $35,000

What is Robin Corp's current E&P? Assume

that there is no cash surrender value on the

life insurance policy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Attleboro Corporation has the following on December 31, 2020. • Eligible Refundable Dividend Tax On Hand account balance of $52,500 ● Taxable income $830,000 • Part 1 taxes payable $350,000 Eligible dividends paid of $240,000 How much is Attleboro's dividend refund for 2020? ● Choose the correct answer. OA. $77,500 OB. $105,000 OC. $62,500 OD. $52,500arrow_forwardRobin Corp. had the following in 2020: Taxable Income: $330,000 Federal income tax: $69,300 Interest on state gov’t (muni) bond: $5,000 Interest on corporate bond: $10,000 Meals expense (total): $3,000 Key person life insurance premiums: $3,500 Key person life insurance proceeds: $130,000 Ordinary & necessary business expenses $250,000 Dividends (from a less-than-20%-owned US corp.): $35,000 What is Robin Corp.’s current E&P? Assume that there is no cash surrender value on the life insurance policy?arrow_forward100 Willobee Co. reported book income of $21,399,000 for 2023. This number included $1,284,000 of income from exempt municipal bonds. For tax purposes, the company reported $4,622,000 less in depreciation than that reported for GAAP purposes. The company also made tax payments of $3,210,000 during the year. If Willobee Co.'s 2023 tax rate was 30%, what will they report as deferred taxes on their 2023 balance sheet? ( 3) $1,386,600 deferred tax liability $1,771,800 deferred tax liability O $1,771,800 deferred tax asset $1,386,600 deferred tax assetarrow_forward

- Use the following information for Ingersoll, Incorporated. Assume the tax rate is 21 percent. 2020 2021 Sales $ 21,049 $ 19,038 Depreciation 2,466 2,574 Cost of goods sold 6,140 6,821 Other expenses 1,406 1,223 Interest 1,155 1,370 Cash 8,721 9,517 Accounts receivable 11,578 13,752 Short-term notes payable 1,764 1,731 Long-term debt 29,330 35,454 Net fixed assets 72,976 77,880 Accounts payable 6,323 6,910 Inventory 20,577 21,952 Dividends 2,429 2,404 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardExcelsior Corporation has the following headings on its December 31, 2019 Balance Sheet: Total Current Assets $200,000 Total Assets $500,000 Total Current Liabilities $169,000 Total Non Current Liabilities $300,000 On January 2020 Excelsior sells temporary investments to pay off $56,400 in long term debt Required 1: How much will working capital increase (decrease) by when comparing December 2019 with January 2020? Required 2: If no other transaction took place in January 2020, the current ratio at the end of January 2020 is: Required 3: If no other transaction took place in January 2020, the debt to equity ratio at the end of January 2020 is: Required 4: If no other transaction took place in January 2020, the financial leverage in January 2020 is (calculate the Equity Ratio and not the Equity Ratio percentage): Required 5: If last 12 month sales as of January 2020 amount to $480,000, the working capital turnover for the period ended January 31st 2020 is:arrow_forwardThe XYZ, Inc. reported $50 million of taxable income. Its federal tax rate was 21% (ignore any possible state corporation taxes). What is the company’s federal income tax bill for the year? Question 1 options: a) $11,500,000 b) $10,500,000 c) $12,100,000 d) $11,100,000arrow_forward

- Chocolate Pie Company's taxable income and other data for 2020 are presented below: Taxable Income $ 500,000 Interest received on municipal bonds 55,000 Estimated bad debt expense (not written off) 30,000 Cash expenditures for warranties 98,000 Product warranty expense for accounting purposes 152,000 Gross profit on installment sales for 2020 170,000 Gross profit recognized for tax purposes based on 2020 installment sales 150,000 Required: a. Calculate 2020 pretax financial income. b. For each item, explain why there is a difference if any exists, between how it is treated for tax purposes and pretax financial income.arrow_forwardRequired information [The following information applies to the questions displayed below.] Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $918 774 $144 $126 2025 $ 1,010 830 $ 180 $ 214 a. Expenses each year include $36 million from a two-year casualty insurance policy purchased in 2024 for $72 million. The cost is tax deductible in 2024. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $37 million and $53 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $31 million ($14 million collected in 2023 but not recognized as revenue until 2024) and $37 million, respectively. Hint. View this as two temporary differences-one reversing in…arrow_forwardIn 2020, Garner Grocers had taxable income of -$2,000,000. The corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision. In 2021, Garner has taxable income of $1,000,000. What is the amount of taxes the company paid in 2021? O a. $500,000 Ob. $750,000 O c. $1,500,000 O d. $0 O e. $250,000arrow_forward

- The Snella Company reports 2023 Pre-tax Net Income of $10,000. The following items exist: Municipal Bond Interest Revenue Fine paid to EPA Unearned Revenues $80 $200 $ 50 The tax rate is 20%. Indicate the amounts for 2023 Income Tax Expense and 12/31/23 Income Tax Payable, respectively. Select one: Oa. $2,064, $2,054 O b. $1,984, $1,954 O c. $1,984, $2,034 O d. $2,024, $2,014 Oe. $2,024, $2,034arrow_forward! Required information [The following information applies to the questions displayed below.] Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $ 940 796 $ 144 $ 104 2025 $ 1,032 a. Expenses each year include $58 million from a two-year casualty insurance policy purchased in 2024 for $116 million. The cost is tax deductible in 2024. 852 $ 180 $ 214 b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $59 million and $75 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $53 million ($36 million collected in 2023 but not recognized as revenue until 2024) and $59 million, respectively. Hint. View this as two temporary differences-one reversing…arrow_forward[Compatibility Mode] - Word (. FILE HOME INSERT DESIGN PAGE LAYOUT REFERENCES MAILINGS REVIEW VIEW Palatino Linotype - 10.5 - BIU abe X, x Paste 前。 A- ay A- Aa - A A Styles Editing Clipboard Font Paragraph 9. During 2002, the following transactions related to the capital stock of the Buffet-Line Corp. E Styles G occurred: Jan. 7 Declared a P.75 cash dividend on 150,000 shares of preferred stock. Paid dividends on preferred stock. Declared a P.50 cash dividend on 200,000 shares of common stock with a P20 par Feb. 7 March 4 value. Mar. 18 Paid dividends on common stock. June 30 Split common stock 4-for-1. Purchased 12,000 shares of Buffet-Line's own common stock at P32 per share%3; July 9 Sept. 10 Sept. 18 acquisition recorded at cost. Declared a cash dividend of P.40 per share on common stock outstanding. Paid dividends on common stock. PA 13 What total anmount is debited to retained earnings for the transactions above? c. 527,700 d. 614,700 a. 432,300 b. 498,700 PAGE 2 OF 4 859 WORDS…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education