FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

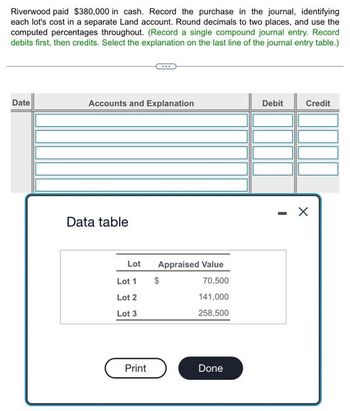

Transcribed Image Text:Riverwood paid $380,000 in cash. Record the purchase in the journal, identifying

each lot's cost in a separate Land account. Round decimals to two places, and use the

computed percentages throughout. (Record a single compound journal entry. Record

debits first, then credits. Select the explanation on the last line of the journal entry table.)

Date

Accounts and Explanation

Data table

Lot

Lot 1

Lot 2

Lot 3

Print

Appraised Value

70,500

141,000

258,500

$

Done

Debit

Credit

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information (The following information applies to the questions displayed below.) Rodriguez Company pays $335,000 for real estate plus $17,755 in closing costs. The real estate consists of land appraised at $196,000; land improvements appraised at $68,600; and a building appraised at $225,400. Prepare the journal entry to record the purchase. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet Record the costs of lump-sum purchase.arrow_forwardQuestion: Prepare the journal entry to replenish the fund. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 2 decimal places, eg. 52.75. List all debit entries before credit entries.) VIEW POLIES Show Attempt History Current Attempt in Progress Sunland Airline needs to send one of its employees to Nunavut for three weeks to perform some repairs on some aircraft it owns. Some of the payments to be made for the supplies needed on the assignment will be paid from a petty cash fund. Sunland issued a cheque in the amount of $800.00 to establish the fund. After a few days at the assignment, the nployee returned the following receipts along with a report that the fund had $69.20 left in cash. Receipt Amount Description 1 $26.85 Taxi ride from airport to job site 43.50 FedEx charges for delivering plane parts 35.60 4 74.05 5 355.30…arrow_forwardYour staff person has provided you with the following journal entry for January 20x1 depreciation. The monthly deprecation is supposed to be $100.00. What is wrong with this entry?arrow_forward

- 2.16) Find the average daily balance (new purchases included) Dates Payment End of Day Balance 4/1-4/5 4/6 4/7-4/22 4/23 4/24-4/30 Average $380.00 Purchase $110.00 Po X $300.00 x $410.00 x $410.00 X $30.00 X $30.00 x Total Number of Days v 5 1 16 1 7 30 Sum of Balances $1,500.00 $410.00 $6,560.00 $30.00 $210.00arrow_forwardPrepare the entry to record the sale of asset D for cash of $4,800. It was used for 6 years, and depreciation was entered under the composite method. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Use Plant Assets related account. List all debit entries before credit entries.) Account Titles and Explanation Accumulated Depreciation - Plant Assets Debit 2000 Credit Cash Plant Assets 4800 6800arrow_forwardDeadwood paid $265,000 in cash. Record the purchase in the journal, identifying each lot's cost in a separate Land account. Round decimals to two places, and use the computed percentages throughout. (Re iournal entny table)arrow_forward

- Following are descriptions of land purchases in four separate cases. Requireda. Determine the cost used for recording the land acquired in each case.b. Record the journal entry for each case on the date of the land’s acquisition. Note: Round your answers to the nearest whole dollar. Case One 1. At the midpoint of the current year, a $32,000 check is given for land, and the buyer assumes the liability for unpaid taxes in arrears of $800 at the end of last year and those assessed for the current year of $720. a. Determine the cost used for recording the land acquired.Cost of land $Answer b. Record the journal entry on the date of the Account NameDr.Cr. Answer Answer Answer To record land acquisition.arrow_forwardPrisha received an invoice for $5,000 that had payment terms of 3/5 n/30. She made a partial payment of $2,000 during the discount period. a. Calculate the amount credited. Round to the nearest cent b. Calculate the balance on the invoice after the partial payment was made.arrow_forwardAccountingarrow_forward

- Tony's favorite memories of his childhood were the times he spent with his dad at camp. Tony was daydreaming of those days a bit as he and Suzie jogged along a nature trail and came across a wonderful piece of property for sale. He turned to Suzie and said, "I've always wanted to start a camp where families could get away and spend some quality time together. If we just had the money, I know this would be the perfect place." On November 1, 2025, Great Adventures purchased the land by issuing a $580,000, 6%, 8-year installment note to the seller. Payments of $7,622 are required at the end of each month over the life of the 8-year loan. Each monthly payment of $7,622 includes both interest expense and principal payments (i.e., reduction of the loan amount). Late that night, Tony exclaimed, "We now have land for our new camp; this has to be the best news ever!" Suzie said, "There's something else I need to tell you. I'm expecting!" Required: 1. Complete the first three rows of an…arrow_forward(c) Compute the amount of depreciation for each of Years 1 through 3 using the depreciation rate to 2 decimal places, e.g. 15.84% and final answers to 0 decimal places, e.g. 45,892.) Depreciation for Year 1 Depreciation for Year 2 Depreciation for Year 3 eTextbook and Media LA $ $ LA double-declining-balance method. (Round $ Assistance Usarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education