FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

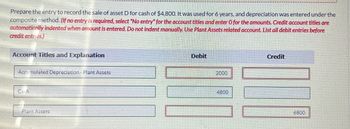

Transcribed Image Text:Prepare the entry to record the sale of asset D for cash of $4,800. It was used for 6 years, and depreciation was entered under the

composite method. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are

automatically indented when amount is entered. Do not indent manually. Use Plant Assets related account. List all debit entries before

credit entries.)

Account Titles and Explanation

Accumulated Depreciation - Plant Assets

Debit

2000

Credit

Cash

Plant Assets

4800

6800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 1arrow_forwardThe following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to theuse of delivery equipment. The double-declining-balance method of depreciation is used. Journalize the transactions and the adjusting entries. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardDo not give image formatarrow_forward

- a. What was the annual amount of depreciation for the Years 1-3 using the straight-line method of depreciation? b. What was the book value of the equipment on January 1 of Year 4? c. Assuming that the equipment was sold on January 3 of Year 4 for $379,920, journalize the entry to record the sale. Refer to the Chart of Accounts for exact wording of account titles. d. Assuming that the equipment had been sold on January 3 of Year 4 for $410,485 instead of $379,920, journalize the entry to record the sale. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardOn July 1, delivery equipment was purchased for $4,320. The delivery equipment has an estimated useful life of three years (36 months) and no salvage value. Required: Using the straight-line depreciation method, analyze the necessary adjusting entry as of July 31 (one month) using T accounts, and then formally enter this adjustment in thearrow_forwardOn July 1, 2020, Bridgeport Corporation purchased Johnson Company by paying $189,700 cash and issuing a $64,500 note payable to Steve Johnson. At July 1, 2020, the balance sheet of Johnson Company was as follows. Cash $38,100 Accounts payable $160,000 Accounts Receivable 67,500 Stockholders' equity 165,800 Inventory 75,800 $325,800 Land 29,400 Buildings (net) 55,200 Equipment (net) 52,200 Copyrights 7,600 $325,800 The recorded amounts all approximate current fair values except for land (worth $45,400), inventory (worth $94,900), and copyrights (worth $11,300).arrow_forward

- Only need help with part Barrow_forwardCompute the following: a. Carder & Company purchased equipment for $24,000 with a useful life of eight years and no expected salvage value. Prepare the adjusting entry for the first year using the straightline depreciation method. Omit explanations. If an amount box does not require, leave it blank. Page: 1 DATE DESCRIPTION POST.REF. DEBIT CREDIT 1 a. fill in the blank a56629fe4031fb0_2 fill in the blank a56629fe4031fb0_3 1 2 fill in the blank a56629fe4031fb0_5 fill in the blank a56629fe4031fb0_6 2 a. Carder & Company purchased equipment for $24,000 with a useful life of eight years and no expected salvage value. Compute the book value at the end of the second year of the equipment's life. Book Value $fill in the blank bd8c2300bf8af95_1 b. DAC Company pays its employees every Friday. On January 2, 20--, the Company paid $6,000 for the 5 days beginning the previous December 29. Prepare the adjusting entry on December 31. Omit…arrow_forwardThis section of the balance sheet represents asset subaccounts that typically can be liquidated within a 1-year period from the statement date. Current liabilities Current assets Net assets O Non-current assetsarrow_forward

- On December 1, delivery equipment was purchased for $8,928. The delivery equipment has an estimated useful life of four years (48 months) and no salvage value. Question Content Area Using the straight-line depreciation method, analyze the necessary adjusting entry as of December 31 (one month) using T accounts, and then formally enter this adjustment in the general journal. DATE ACCOUNT TITLE DOC.NO. POST.REF. DEBIT CREDIT 1 20-- Dec. 31 Depr. Expense - Delivery Equipment 2 Accum. Depr. - Delivery Equipmentarrow_forwardImpact of Improvements and Replacements on the Calculation of Depreciation 1. Using the straight-line method, prepare general journal entries for depreciation on December 31, 20-1, for Simulators A and B. If an amount box does not require an entry, leave it blank. 2. Enter the transactions for January 20-2 in a general journal. If an amount box does not require an entry, leave it blank. 3. Assuming no other additions, improvements, or replacements, calculate the depreciation expense for each simulator for 20-2 through 20-8. If required, round your answers to the nearest cent. On January 1, 20-1, two flight simulators were purchased by a space camp for $77,000 each with a salvage value of $5,000 each and estimated useful lives of eight years. On January 1, 20-2, the hydraulic system for Simulator A was replaced for $6,000 cash and an updated computer for more advanced students was installed in Simulator B for $9,000 cash. The hydraulic system is expected to extend the life of…arrow_forwardWolfpack Corp. has determined it should record depreciation expense of $40,000 for the year ending 12/31/X7. Required: In the general journal below, complete the year-end entry to record depreciation. Debit Credit Dec 31 ? 40,000 ? 40,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education