FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:on list

ion 1

tion 2

tion 3

tion 4

stion 5

stion 6

stion 7

me solve thie

K

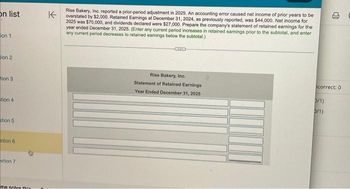

Rise Bakery, Inc. reported a prior-period adjustment in 2025. An accounting error caused net income of prior years to be

overstated by $2,000. Retained Earnings at December 31, 2024, as previously reported, was $44,000. Net income for

2025 was $70,000, and dividends declared were $27,000. Prepare the company's statement of retained earnings for the

year ended December 31, 2025. (Enter any current period increases in retained earnings prior to the subtotal, and enter

any current period decreases to retained earnings below the subtotal.)

GIL

Rise Bakery, Inc.

Statement of Retained Earnings

Year Ended December 31, 2025

correct: 0

D/1)

3/1)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ocean Ltd recorded an accounting profit before tax of $50,000 for the year ended 30 June 2020. Included in the accounting profit were the following income and expenses: Rent revenue Interest revenue Bad debts expense An extract of the Statement of Financial Position for 30 June 2020 revealed the following: Accounts receivable Allowance for doubtful debts Interest receivable Rent Revenue in Advance $46,000 $28,000 $34,000 The company tax rate is 30%. 2020 $96,000 ($44,000) $40,000 $22,000 2019 $56,000 ($18,000) $24,000 $38,000 Required: Calculate taxable income (loss) and record the necessary journal entry for current income tax expense for the year ended 30 June 2020.arrow_forwardSandhill, Inc., changed from the LIFO cost flow assumption to the FIFO cost flow assumption in 2020. The increase in the prior year's income before taxes is $1,127,000. The tax rate is 20%. Prepare Sandhill's 2020 journal entry to record the change in accounting principle. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardjohnson company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectable accounts had a credit balance of $12000 at the begining of 2024. no previously written off accounts recievable were reinstated during 2024. at 12/31/2024, gross accounts recievable totaled $200,100, and prior to recording the adjusting entry to recognize bad debt expenses for 2024, the allowance for uncollectable accounts had a debit balance of $22000. required 1. what was the balance in gross accounts recievable as of 12/31/2023? 2. what journal entry should johnson record to recognize bad debt expense for 2024? 3. assume johnson made no other adjustments of the allowance for uncollectable accounts during 2024. Determine the amount of accounts recievable written off during 2024. 4. if johnson instead used the direct write off method, what would bad debt expense be for 2024?arrow_forward

- In 2021, Winslow International, Inc.’s controller discovered that ending inventories for 2019 and 2020 were overstated by $220,000 and $520,000, respectively.Determine the effect of the errors on retained earnings at January 1, 2021. (Ignore income taxes.)arrow_forwarda) Prepare all journal entries to record the activity for the items above for 2020 b) Prepare any journal entries required at December 31, 2020 to record bad debt expense for the yeararrow_forward12/31/2020: During 2020, $10,000 in accounts receivable were written off. At the end of the second year of operations, Yolandi Company had $1,000,000 in sales and accounts receivable of $400,000. XYZ’s management has estimated that $17,000 in accounts receivable would be uncollectible. For the end of 2020, after the adjusting entry for bad debts was journalized, what is the balance in the following accounts: Bad debt expense: Allowance for doubtful accounts: For the end of 2020, what is the company's net realizable value?arrow_forward

- Sagararrow_forwardOn January 31, 2020, Allison company wrote off and uncollectible accounts of $8500. The company uses the allowance method for bad debts. The write off would cause total current assets to be? A decreased by $8,500, Increased by $8500 increase by $17,000 or will it remain the same amount?arrow_forwardPharoah Ltd. prepared an aging of its accounts receivable at December 31, 2023 and determined that the net realizable value of the receivables was $324800. Additional information for calendar 2023 follows: Allowance for expected credit losses, beginning $38080 Uncollectible account written off during year 25760 Accounts receivable, ending 358400 Uncollectible accounts recovered during year 5600 For the year ended December 31, 2023, Pharoah's loss on impairment should be $20000. $15680. ○ $17920. $25760.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education