FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

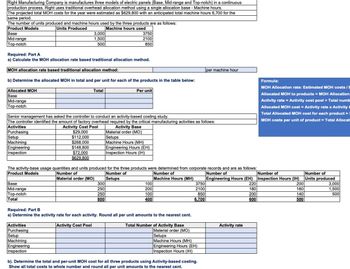

Transcribed Image Text:Right Manufacturing Company is manufactures three models of electric panels (Base, Mid-range and Top-notch) in a continuous

production process. Right uses traditional overhead allocation method using a single allocation base - Machine hours.

The projected total MOH costs for the year were estimated as $629,800 with an anticipated total machine hours 6,700 for the

same period.

The number of units produced and machine hours used by the three products are as follows:

Product Models

Base

Mid-range

Top-notch

Required: Part A

Units Produced

Machine hours used

3,000

3750

1,500

500

2100

850

a) Calculate the MOH allocation rate based traditional allocation method.

MOH allocation rate based traditional allocation method:

b) Determine the allocated MOH in total and per unit for each of the products in the table below:

per machine hour

Allocated MOH

Base

Mid-range

Top-notch

Total

Per unit

Senior management has asked the controller to conduct an activity-based costing study.

The controller identified the amount of factory overhead required by the critical manufacturing activities as follows:

Activities

Purchasing

Setup

Machining

Engineering

Inspection

Activity Cost Pool

$29,000

$112,000

$268,000

$148,800

$72,000

$629,800

Activity Base

Material order (MO)

Setups

Machine Hours (MH)

Engineering Hours (EH)

Inspection Hours (IH)

The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows:

Product Models

Formula:

MOH Allocation rate: Estimated MOH costs/E

Allocated MOH to products = MOH Allocation

Activity rate = Activity cost pool + Total numb

Allocated MOH cost = Activity rate x Activity

Total Allocated MOH cost for each product =

MOH costs per unit of product = Total Allocat

Base

Mid-range

Top-notch

Total

Required: Part B

Number of

Material order (MO)

Number of

Setups

300

250

250

800

Number of

Machine Hours (MH)

Number of

Number of

100

200

3750

2100

Engineering Hours (EH) Inspection Hours (IH)

220

Number of

Units produced

200

3,000

180

160

1,500

100

850

200

140

500

400

6,700

600

500

a) Determine the activity rate for each activity. Round all per unit amounts to the nearest cent.

Activities

Purchasing

Setup

Machining

Engineering

Inspection

Activity Cost Pool

Total Number of Activity Base

Material order (MO)

Setups

Machine Hours (MH)

Engineering Hours (EH)

Inspection Hours (IH)

b). Determine the total and per-unit MOH cost for all three products using Activity-based costing.

Show all total costs to whole number and round all per unit amounts to the nearest cent.

Activity rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Windows DESKTOP- Windows Number of setups Number of products Direct labor-hours Total overhead cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y FEB +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 240 40 1 1 8,800 3,200 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y an Product Z? (F your intermediate calculations to 2 decimal places. Round your answers to 2…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 231,000 11,000 MHs Machine setups Number of setups $ 180,000 300 setups Production design Number of products $ 94,000 2 products General factory Direct labor-hours $ 260,000 10,000 DLHs Activity Measure Product Y Product Z Machining 9,000 2,000 Number of setups 60 240 Number of products 1 1 Direct labor-hours 9,000 1,000 4. What is the activity rate for the Machine Setups activity cost pool?arrow_forwardBecton Labs, Incorporated, produces various chemical compounds for industrial use. One compound, called Fludex, is prepared using an elaborate distilling process. The company has developed standard costs for one unit of Fludex, as follows: Direct materials Direct labor Variable manufacturing overhead Total standard cost per unit Standard Quantity or 2.50 Hours ounces 0.90 hours Standard Price or Rate $ 22.00 per ounce $ 16.00 per hour 0.90 hours $ 2.00 per hour Standard Cost $ 55.00 14.40 1.80 $ 71.20 During November, the following activity was recorded related to the production of Fludex: a. Materials purchased, 14,000 ounces at a cost of $289,800. b. There was no beginning inventory of materials; however, at the end of the month, 4,050 ounces of material remained in ending inventory. c. The company employs 26 lab technicians to work on the production of Fludex. During November, they each worked an average of 150 hours at an average pay rate of $15.00 per hour. d. Variable…arrow_forward

- Hickory Company manufactures two products—13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $829,500 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 246,000 12,000 MHs Machine setups Number of setups $ 137,500 250 setups Product design Number of products $ 89,000 2 products General factory Direct labor-hours $ 357,000 14,400 DLHs Activity Measure Product Y Product Z Machine-hours 7,500 4,500 Number of setups 40 210 Number of products 1 1 Direct labor-hours 8,500 5,900 Foundational 7-12 (Algo) 12. Using the ABC system, what percentage of the Machining costs is assigned to Product…arrow_forwardGreenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining DESKTOP- Windows Number of setups Number of products Direct labor-hours General factory cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 40 240 1 1 8,800 3,200 % 15. Using the ABC system, what percentage of the General Factory cost is assigned to Product Y and Product Z? (Round your intermediate calculations and final answers to 2 decimal places.) Product Z (@ 2 0…arrow_forwardMickley Corporation produces two products, Alpha6s and Zeta7s, which pass through two operations, Sintering and Finishing. Each of the products uses two raw materials—X442 and Y661. The company uses a standard cost system, with the following standards for each product (on a per unit basis): Product Raw Material Standard Labor Time X442 Y661 Sintering Finishing Alpha6 1.8 kilos 2.0 liters 0.20 hours 0.80 hours Zeta7 3.0 kilos 4.5 liters 0.35 hours 0.90 hours Information relating to materials purchased and materials used in production during May follows: Material Purchases Purchase Cost Standard Price Used in Production X442 14,500 kilos $ 52,200 $ 3.50 per kilo 8,500 kilos Y661 15,500 liters $ 20,925 $ 1.40 per liter 13,000 liters The following additional information is available: The company recognizes price variances when materials are purchased. The standard labor rate is $19.80 per hour in Sintering and $19.20 per hour in Finishing. During…arrow_forward

- Tri-bikes manufactures two different levels of bicycles: the Standard and the Extreme. The total overhead of $300,000 has traditionally been allocated by direct labor hours, with 150,000 hours for the Standard and 50,000 hours for the Extreme. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $200,000 of overhead, with 4,000 hours used on the Standard product and 1,000 hours used on the Extreme product. It was also estimated that the setup cost pool would have $100,000 of overhead, with 1,000 hours for the Standard and 1,500 hours for the Extreme. Required: Calculate the amount of overhead assigned per product, under traditional and under ABC costing.arrow_forwardMickley Corporation produces two products, Alpha6s and Zeta7s, which pass through two operations, Sintering and Finishing. Each of the products uses two raw materials-X442 and Y661. The company uses a standard cost system, with the following standards for each product (on a per unit basis): Standard Labor Time Sintering Finishing 0.40 hours 0.80 hours 0.30 hours 0.90 hours Information relating to materials purchased and materials used in production during May follows: Material Standard Price $ 3.60 per kilo X442 Used in Production 8,600 kilos 13,100 liters Y661 $ 1.50 per liter Product Alpha6 Zeta7 Raw Material Y661 X442 1.5 kilos 3.5 kilos 4.4 liters 2.2 liters Purchases 14,100 kilos 15,100 liters Purchase Cost $ 53,580 $ 21,140 The following additional information is available: a. The company recognizes price variances when materials are purchased. b. The standard labor rate is $18.00 per hour in Sintering and $18.00 per hour in Finishing. c. During May, 1,250 direct labor-hours were…arrow_forwardDeoro Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity Setting up equipment Number of setups Ordering costs Number of orders Machine costs Receiving Direct materials Direct labor Deoro produces two models of dishwashers with the following expected prime costs and activity demands: Model A Units completed Direct labor hours Number of setups Number of orders $627,000 481,000 16,200 6,400 370 5,800 24,900 3,700 The company's normal activity is 7,900 direct labor hours. Machine hours Receiving hours Required: Model A Model B $482,510 372,000 864,000 410,000 Receiving hours Model A Machine hours $ del B Model B Unit Cost $836,000 497,000 8,500 1,500 240 1. Determine the unit cost for each model using direct labor hours to apply overhead. Round intermediate calculations and final answers to nearest cent. 12,800 18,300 6,300 610 18,600 43,200 10,000 2. Determine the unit cost for…arrow_forward

- Greenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 3. What is the activity rate for the Machining activity cost pool? (Round your answer to 2 decimal places.)arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y and…arrow_forwardTri-Bikes manufactures two different levels of bicycles - the Standard and the Extreme. The total overhead of $300,000 has traditionally been allocated by direct labor hours, with 150,000 hours for the Standard and 50,000 hours for the Extreme. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $180,000 of overhead, with 4,000 hours used on the Standard product and 1,000 hours used on the Extreme product. It was also estimated that the setup cost pool would have $120,000 of overhead, with 1,000 hours for the Standard and 1,500 hours for the Extreme. PLEASE NOTE: Predetermined overhead rates will be rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). The rates will include their proper label according to the textbook examples (no abbreviations). All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). What is the overhead cost per product,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education