Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

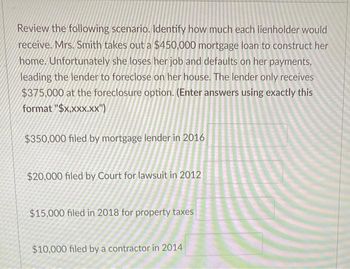

Transcribed Image Text:Review the following scenario. Identify how much each lienholder would

receive. Mrs. Smith takes out a $450,000 mortgage loan to construct her

home. Unfortunately she loses her job and defaults on her payments,

leading the lender to foreclose on her house. The lender only receives

$375,000 at the foreclosure option. (Enter answers using exactly this

format "$x,xxx.xx")

$350,000 filed by mortgage lender in 2016

$20,000 filed by Court for lawsuit in 2012

$15,000 filed in 2018 for property taxes

$10,000 filed by a contractor in 2014

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- . Points (OBJ. 4) Years ago, the Devons took out a 30-year mortgage on their vacation home. When they originally took out the loan, they paid the lender $24,000 in points. On September 1 of the current year, the Devons refinanced their $650,000 balance of the mortgage with another 30-year mortgage. To get a lower interest rate, the Devons paid the lender points totaling $13,000. At the time of the refinancing, the Devons had unamortized points from the first loan of $18,000. How much can the Devons deduct as points on their tax return for the current year?arrow_forwardThe Nicols are buying a house selling for $245,000. They pay a down payment of $45,000 from the sale of their current house. To obtain a 20-year mortgage at a 6.5% interest rate, the Nicols must pay 3.5 points at the time of closing. a) What is the amount of the mortgage? b) What is the cost of the 3.5 points? a) The amount of the mortgage is $ b) The cost of the 3.5 points on the mortgage is $arrow_forward9. Jason bought a home in Arlington, Texas, for $127,000. He put down 25% and obtained a mortgage for 30 years at 6%. a. What is Jason’s monthly payment? (Do not round intermediate calculations. Round your answer to the nearest cent.) Monthly payment $ b. What is the total interest cost of the loan? (Use the amortization worksheet on the financial calculator.) Total interest cost $arrow_forward

- Your cousin and her partner have a combined gross income of $10,111 and monthly expenses totaling $3,205. They plan to buy a house with a mortgage whose monthly PITI will be $2,000. (a) What is your cousin and her partner's combined housing expense ratio? (b) What is their total obligations ratio? (c) For what kind of mortgage can they qualify, if any? (d) If they do not qualify for an FHA mortgage, by how much should they reduce their monthly expenses in order to be eligible? (Set up an equation and solve it.)arrow_forwardRequired information [The following information applies to the questions displayed below.] On January 1 of year 1, Arthur and Aretha Franklin purchased a home for $2.59 million by paying $290,000 down and borrowing the remaining $2.30 million with a 8 percent loan secured by the home. The Franklins paid interest only on the loan for year 1, year 2, and year 3 (unless stated otherwise). Note: Enter your answers in dollars and not in millions of dollars. Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. b. What is the amount of interest expense the Franklins may deduct in year 2 assuming year 1 is 2022? Deductible interest expensearrow_forwardJasmine purchased a home in San Francisco near her best friend Sallie. The purchase price of the home was $ 2,000,000. However, Jasmine only financed 80% of the home value as she was able to secure the $400,000 down payment to help lower her monthly payments. What is her monthly payment if she financed at today's rate of 7.55% for a 15-year mortgage?arrow_forward

- Mike Jones bought a new split-level home for$150,000 with 20% down. He decided to use Victory Bank for his mortgage. They were offering 13 3/4% for 25-year mortgages (11.85%). Provide Mike with an amortization schedule for two periods. 1. Portion to-- interest: ?? principle:??, Balance of loan outstanding: ?? 2. Portion to-- interest: ?? principle:??, Balance of loan outstanding: ??arrow_forwardRonald and Samantha Brady recently had their condominium in Port Isaac appraised for $324,800. The balance on their existing first mortgage is $154,720. If their bank is willing to loan up to 75% of the appraised value, what is the amount (in $) of credit available to the Bradys on a home equity line of credit? $arrow_forward1. Alex owns a home with a replacement value of $320,000. The homeowners policy has an 80% coinsurance clause and a face value of $240,000. Damage caused by a fire costs $125,280 to repair. What compensation will the insurance company pay? 2. Using Table 19-5 and 19-6, find the annual premium for an automobile insurance policy for Sandra who has a good credit rating. She lives in Territory 1 and buys 50/100/50 coverage for her liability protection. Sandra's vehicle is Model Class 2 and is five years old. In addition to the liability coverage, she purchased comprehensive and collision insurance with a $250 deductible on comprehensive and a $500 deductible on collision. TABLE 19-5 Annual Automobile Liability Insurance Premiums Territory 1 Territory 2 Liability Limits BAD GOOD ОСС GOOD ОСС BAD 50/100/50 385 600 846 354 552 778 100/300/100 425 682 961 391 627 884 250/500/250 460 750 1036 423 690 953 500/1000/500 530 843 1208 488 776 1111 GOOD = good credit; OCC = occasional payments past…arrow_forward

- 2. Simple versus compound interest Financial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Heather deposited $1,700 at her local credit union in a savings account at the rate of 9.8% paid as simple interest. She will earn interest once a year for the next 13 years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Heather in 13 years? O $3,865.80 O $5,731.65 O $1,882.93 O $266.60 Now, assume that Heather's credit union pays a compound interest rate of 9.8% compounded annually. All other things being equal, how much will Heather have in her account after 13 years? O $5,731.65 O $561.70 $1,866.60 O $3,865.80arrow_forwardGive me correct answer and explanation. Don't upload any image please.jarrow_forwardK Bill and Kim Johnson are purchasing a house for $309,000. Their bank requires them to pay a 10% down payment. The current mortgage rate is 8%, and they are required to pay one point at the time of closing. Determine the total amount Bill and Kim will pay for their house, including principal, interest, down payment, and points (do not include taxes and homeowners' insurance) for the following lengths of their mortgage. a) 10 years b) 20 years c) 30 years CATarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education