Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

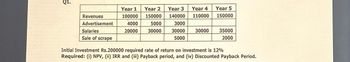

Transcribed Image Text:Q1.

Revenues

Advertisement

Salaries

Sale of scrape

Year 1

100000

4000

20000

Year 2

150000

5000

30000

Year 3

140000

3000

30000

5000

Year 4

110000

30000

Year 5

150000

35000

2000

Initial Investment Rs.200000 required rate of return on investment is 12%

Required: (i) NPV, (ii) IRR and (iii) Payback period, and (iv) Discounted Payback Period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the payback period for an investment of $10000 with net revenues as follows: year 1: $5000, Year 2: $3000, Year 3: $2000, Year 4: $5000, Year 5: $3000. A. 2 years B. 3 years C. 4 years D. 5 yearsarrow_forwardPlease do not give solution in image format thankuarrow_forwardProblem 07.037 - MIRR calculation For the net cash flow series, find the external rate of return (EROR) using the MIRR method with an investment rate of 20% per year and a borrowing rate of 10% per year. Year Net Cash Flow, $ The external rate of return is 1 4,000 2 -3,000 3 -7,000 4 12,000 5 -700arrow_forward

- Suppose the MARR is 12%. Use the following table to answer the question--The IRR on the CMS Investment is CMS FMS Initial Investment Annual Revenue Useful Life (Years) A. 17.0% - 18.0% B. 20.0% - 21.0% C. 15.0% - 16.0% D. 0.5% -1.0% E. 11.0% - 12.0% $20,000 6,688 15 $29,000 9,102 in 5arrow_forwardProject A has the following estimated cash flows and present values:Year Cash flow $ Discount factor@ 12% Present value $0 Cost (95 000) 1.0 (95 000) 1–5 Contributionper annum 50 000 3.605 180 250 1–5 Fixed costsper annum (25 000) 3.605 (90 125) 5 Residual value 20 000 0.567 11 340 The benefit of using sensitivity analysis in an investment appraisal would be:arrow_forwardTyped plz and asap please provide a quality solution take care of plagiarismarrow_forward

- Payback period and discounted payback period (Using 5% Rate of Return) Initial investment is 600,000arrow_forwardDetermine the modified B/C ratio for the following information at 8% interest per year. Cost Component Initial Investment M & O cost Benefits Disbenefits 0.55 1.15 1.80 4.65 Estimated cost $16,000 $1,000 years 1-5 $1,500 years 6-10 $8,000 per year $2,500 per yeararrow_forwardCalculate the Payback period (PBP) and Profitability Index (PI) of the investment and state the Pro’s and Cons of this method The annual incremental profits/ (losses) relating to the investment are estimated as follows: Years CF’s (000) Year 0 -175,000 Year 1 K11,000 Year 2 K3,000 Year 3 K34,000 Year 4 K47,000 Year 5 K8,000 Investment at the start of the project would be K175, 000,000.the investment sum assuming nil disposal value after five years, would be written off using the equal instalment method. The depreciation has been included in the profit estimates above, which should be assumed to arise at each year end. Assume the cost of Capital is 12% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 D.f 1.00 0.893 0.797 0.712 0.636 0.567arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education