FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

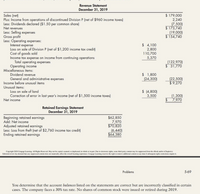

Rox Corporation’s multiple-step income statement and

1. Review both statements and indicate where each incorrectly classified item should be classified. 2. Prepare a correct multiple-step income statement for 2019. 3. Determine the correct beginning balance in retained earnings, and then prepare a correct 2019 retained earnings statement.

Transcribed Image Text:Revenue Statement

December 31, 2019

Sales (net

Plus: Income from operations of discontinued Division P (net of $960 income taxes)

Less: Dividends declared ($1.50 per common share)

Net revenues

Less: Selling expenses

Gross profit

Less: Operating expenses:

Interest expense

Loss on sale of Division P (net of $1,200 income tax credit)

Cost of goods sold

Income tax expense on income from continuing operations

$ 179,000

2,240

(7,500)

$ 173,740

(19,000)

$ 154,740

$ 4,100

2,800

110,700

5,370

Total operating expenses

(122,970)

$ 31,770

Operating income

Miscellaneous items:

Dividend revenue

General and administrative expenses

Income before unusual items

Unusual items:

Loss on sale of land

Correction of error in last year's income (net of $1,500 income taxes)

Net income

$ 1,800

(24,300)

(22,500)

$9,270

$ (4,800)

3,500

(1,300)

$ 7,970

Retained Earnings Statement

December 31, 2019

Beginning retained earnings

Add: Net income

Adjusted retained earnings

Less: Loss from theft (net of $2,760 income tax credit)

Ending retained earnings

$62,850

7,970

$70,820

(6,440)

$64,380

Coprige 30 Cimpuge Laming A Righn Roeral. Mag se coglod. samet. er duplicandia sker ia part Due to dedseik sgte tet pary co ay be ngproned trethe ak ndir schupri

biialvien hes demel eet omte d mey llet be orenl king npeiener. Cempupe Leenin erves terigemnt al omietny tie sene rig m me

Problems

5-69

You determine that the account &alances listed on the statements are correct but are incorrectly classified in certain

cases. The company faces a 30% tax rate. No shares of common stock were issued or retired during 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is taken from the records of Erie Corp.(in thousands) for the year ended on December 31: 2019 2018 Sales $1,397 $1,122 Cost of Goods Sold 935 814 Selling Expenses 154 121 General Expenses 88 77 Other Revenue 4 7 Interest Expense 2 9 Income Taxes 134 66 After preparing a vertical analysis of this income statement data, what were the favorable and unfavoralbe changes?arrow_forwardUse the following information for Ingersoll, Incorporated. Assume the tax rate is 24 percent. 2020 2021 Sales Depreciation $ 17,573 $16,536 1,781 1,856 Cost of goods sold 4,579 4,827 Other expenses 1,006 884 Interest 855 986 Cash 6,247 6,826 Accounts receivable 8,160 9,787 Short-term notes payable 1,290 1,267 Long-term debt 20,680 24,936 Net fixed assets 51,152 54,633 Accounts payable 4,576 5,004 Inventory 14,487 15,408 1,550 1,738 Dividends Prepare a balance sheet for this company for 2020 and 2021 (Do not round intermediate calculations) Current assets Assets INGERSOLL, INCORPORATED Balance Sheet as of December 31 2020 2021 Total assets $ 86,654 Liabilities & Equity Current liabilities Total liabilities & owners' equity $ 6,271arrow_forwardUsing the attached financial statements attached, ratios need to be calculated for all boxes that are greyed out. Please provide details of how these ratios are calculated.arrow_forward

- Need help please. Thank youarrow_forwardJoseph Bright lists the following transactions for the period ended 30 September 2017. Classify EACH item as follows: i. Write either capital or revenue in the expenditure type column to indicate the type of expenditure involved or EACH item. ii. Insert a-check mark (√) in the appropriate column to indicate whether the item is reported-in the Statement of profit or loss or in the Statement of financial position. The first one is done as an example. Description CLASSIFICATION OF EXPENDITURE Expenditure Type Statement where item should be reported Statement of Profit Statement of Example Wages of the computer operators 1 Cost of customizing software for use in business 2 Installing thief detection equipment 3 Cost of paper used for printing receipts during the year 4 Cost of toner used by the computer printer 5 Cost of adding extra memory to the compute or loss Revenue financial positionarrow_forwardQuestion: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 Below is the list of nominal ledger balances of Tonson Plc at 31 December 2021. Tonson’s financial year end is at 31 December. Nominal ledger closing balances at 31 December 2021 The following information is relevant. 1. Closing inventory at 31 December 2021 is £45,000 On further investigation of the suspense account in the trial balance above, it was discovered that: An expense of £8,250 for legal services had been posted to the suspense account and a cash receipt of £15,750 had been posted to the suspense account. This represented the disposal proceeds from selling equipment, which had been purchased on 1 March 2017 at a cost of £48,000. Tonson depreciates non-current assets as follows: buildings at 1 per cent on a straight-line basis plant and equipment at 10 per cent on a straight-line basis motor vehicles at 20 per cent on a reducing balance basis.…arrow_forward

- What is the adjusting journal entry on December 31, 2019? Debit Unrealized Holding Gain/Loss (P&L), P200,000; Credit Retained Earnings, P200,000 Debit Financial Asset FVPL, P500,000; Credit Retained Earnings, P500,000 Debit Retained Earnings, P100,000; Credit Financial Asset FVPL, P100,000 Debit Retained Earnings, P300,000; Credit Unrealized Gain (P&L), P300,000 Debit Retained Earnings, P200,000; Credit Unrealized Holding Gain/Loss (P&L), P200,000 None of the choicesarrow_forwardGamma Corporation has been in business for 6 years as of 2021. Management presents 2-year comparative financial statements. In 2021, Gamma decides to change from FIFO to LIFO for inventory costing. Which of the following statements are true with respect to how Gamma must report this change on its financial statements? I. Re-state both the 2021 and 2020 Income statements. II. Report the change on the 2021 Income Statement only. III. Report the cumulative change in Retained Earnings for 2016-2020 as an adjustment to beginning Retained Earnings on the 2021 Statement of Retained Earnings. IV. Report the cumulative change in Retained Earnings for 2016-2019 as an adjustment to beginning Retained Earnings on the 2020 re-stated Statement of Retained Earnings. V. Adjust the carrying amount of Inventory on the 2021 Balance Sheet. I and IV O II, III, and V OI, IV, and V OI and IIIarrow_forwardI need help with these please. A. Record transfer of net loss to retained earnings. B. Record transfer of net income to retained earnings. C. Record repurchase of shares for retirement. D. Record declaration of cash dividend. E. Record payment of cash dividend.arrow_forward

- Perform the Reperformance or Recalculation procedures to check the mathematical accuracy ofthe Income Statement. What issue did you find? What is the next step? Create a Correctedversion of the Income Statement. Income Statement For the Year Ended For the Year Ended Revenue 3/31/2021 3/31/2022 Sales Revenue: Corporate Accounts $ 353,739.57 $ 343,050.56 Sales Revenues: Storefront $ 80,649.00 $ 91,411.50 Total Sales Revenue $ 434,388.57 $ 434,462.06 Cost of Goods Sold: Ingredients $ 69,736.39 $ 64,645.64 Cost of Goods Sold: Boxes and Cupcake Cups $ 3,875.55 $ 3,755.55 Cost of Goods Sold: Beverages $ 5,466.50 $ 5,681.50 Total COGS $ 76,078.44 $ 74,082.69 Gross Profit $ 358,310.13 $ 360,379.37 Interest Revenue $…arrow_forwardA revenue was earned in 2019 but payment is not received until 2020. Using the accrual basis of accounting, the revenue should appear on: A. the 2020 income statement B. the 2019 income statement C. both the 2019 and 2020 income statements D. neither the 2019 nor 2020 income statementarrow_forwardOn the attached page prepare a well-formatted multi-section income statement for the Fiona Company for the fiscal year ending December 31, 2020 from the data below. Use the entire figures as shown on your income statement.Note: For items in section 2 (Other Items) and section 4 (Below-the-line Items) use brackets if an item will have a negative impact on earnings. In section 1 individual items are not generally shown in brackets except for calculated margins or totals if negative. Cost of Goods Sold amounted to $20,000. Sale of equipment that had a historical cost of $1,400 had accumulated depreciation of $910 and was sold for $890. The tax rate related to such a transaction is 25%. Non-taxable interest income on municipal bonds of $300 Sales revenue totaled $35,000. Interest expense totaled $500 for the period. Selling and Administrative Expenses amounted to $6,000 The company discontinued operations during the year that will result in total losses before taxes of $2,000. This…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education