Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

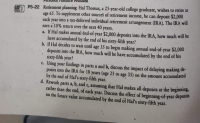

Transcribed Image Text:Retirement planning Hal Thomas, a 25-year-old college graduate, wishes to retire at

age 65. To supplement other sources of retirement income, he can deposit $2,000

each year into a tax-deferred individual retirement arrangement (IRA). The IRA will

earn a 10% return over the next 40 years.

a. If Hal makes annual ênd-of-year $2,000 deposits into the IRA, how much will be

have accumulated by the end of his sixty-fifth year?

b. If Hal decides to wait until age 35 to begin making annual end-of-year $2,000

deposits into the IRA, how much will he have accumulated by the end of his

sixty-fifth year?

c. Using your findings in parts a and b, discuss the impact of delaying making de-

posits into the IRA for 10 years (age 25 to age 35) on the amount accumulated

by the end of Hal's sixty-fifth year.

d. Rework parts a, b, and c, assuming that Hal makes all deposits at the beginning,

rather than the end, of each year. Discuss the effect of beginning-of-year deposits

on the future value accumulated by the end of Hal's sixty-fifth year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Jane wants to retire with $2,000,000 in her retirement account exactly 35 years from today. If she thinks she can earn an interest rate of 10. percent compounded monthly, how much must she deposit each month to fund her retirement? $432.83 O $493,32 O $526.78 $582.32arrow_forwardTo prepare for an early retirement, a self-employed businessman makes deposits of $6200 at the begin of each half-year for 6 years, starting on his 40 birthday. When he is 53, he wishes to make 30 equal day withdrawals. What is the size of each withdrawal if interest is 7.21% compounded daily?arrow_forwardA couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 22.00 years and pool the money into a savings account that pays 4.00% APR. They plan on living for 27.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal? Yearly Contribution Account Fidelity Mutual Fund Vanguard Mutual Fund Employer 401k Balance $24,316.00 $184,560.00 $304,945.00 $1,000.00 $10,000.00 $15,000.00 APR 6.00% 8.00% 6.00%arrow_forward

- Irene plans to retire on December 31st, 2019. She has been preparing to retire by making annual deposits, starting on December 31st, 1979, of $2450 into an account that pays an effective rate of interest of 9.1%. She has continued this practice every year through December 31st, 2000. Her goal is to have $1.5 million saved up at the time of her retirement. How large should her annual deposits be (from December 31st, 2001 until December 31st, 2019) so that she can reach her goal? Payment = $68573.5arrow_forwardYou have just made your first $4,500 contribution to your individual retirement account. Assume you earn an annual return of 11.3 percent and make no additional contributions. What will your account be worth when you retire in 39 years?arrow_forwardA self employed person deposit $1,250 annually in a retirement account that earns 5.5 percent. What will be the account balance at age 62 if the savings program starts when the individual is age 50? How much additional money will be in the account if the saver defers retirement until age 66 and continue the annual contribution until then? How much additional money will be in the account if the saver discontinues the contributions at age 62, but let's it build up until retirement at age 66?arrow_forward

- Noah invests $600 at the end of each quarter for 30 years in an account paying 5.64% interest compounded quarterly and then he retires. Suppose that he was in the 15% bracket when the deposits were made and interest was earned. Suppose his tax bracket is now 33% in retirement. Find the current after-tax value of Noah's account if it was set-up as (i) a Traditional Individual Retirement Account (IRA): $ (ii)a Roth Individual Retirement Account (Roth-IRA): $arrow_forwardIn 2012 the maximum Social Security deposit by an individual was $8,386.75. Suppose you are 27 and make a deposit of this amount into an account at the end of each year. How much would you have (to the nearest dollar) when you retire if the account pays 2% compounded annually and you retire at age 65?_____$arrow_forwardHailey starts an IRA (Individual Retirement Account) at the age of 22 to save for retirement. Shedeposits $450 each month. The IRA has an average annual interest rate of 8% compounded monthly.How much money will she have saved when she retires at the age of 65? Round your answer to thenearest cent, if necessary.arrow_forward

- Darnell Johnson wants to know if he can retire in 35 years at age 60, when he plans to do a lot of fishing. Assume the deposit into his retirement account averages $3800 at the end of each year and that the funds earn 6% per year. find amount of annuity and the interest earned.arrow_forwardIra Roth opens up a Roth IRA and places $4,500 in his retirement account at the beginning of each year for 20 years. He believes the account will earn 8 percent interest per year, compounded quarterly. How much will he have in his retirement account in 20 years?arrow_forwardRaghubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education