FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

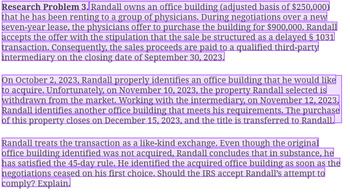

Transcribed Image Text:Research Problem 3. Randall owns an office building (adjusted basis of $250,000)

that he has been renting to a group of physicians. During negotiations over a new

seven-year lease, the physicians offer to purchase the building for $900,000. Randall

accepts the offer with the stipulation that the sale be structured as a delayed § 1031

transaction. Consequently, the sales proceeds are paid to a qualified third-party

intermediary on the closing date of September 30, 2023.

On October 2, 2023, Randall properly identifies an office building that he would like

to acquire. Unfortunately, on November 10, 2023, the property Randall selected is

withdrawn from the market. Working with the intermediary, on November 12, 2023,

Randall identifies another office building that meets his requirements. The purchase

of this property closes on December 15, 2023, and the title is transferred to Randall.

Randall treats the transaction as a like-kind exchange. Even though the original

office building identified was not acquired, Randall concludes that in substance, he

has satisfied the 45-day rule. He identified the acquired office building as soon as the

negotiations ceased on his first choice. Should the IRS accept Randall's attempt to

comply? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Show the solution in good accounting form Diamond's Pizza Inc. enters into a franchise agreement on December 31, 2019, giving Domino Corp. the right to operate as a franchisee of Diamond's Pizza for 5 years. Diamond charges Domino an initial franchisee fee of P475,000 for the right to operate as a franchisee. Of this amount, P190,000 is payable when Domino Corp. signs the agreement, and the balance is payable in five annual payments of P57,000 each on December 31. Consider the following for allocation of the transaction price at December 2019. Rights to the trade name, market area, technical and propriety know-how P190,000.00 Services - training, etc 94,591.50 Machinery and equipment etc. (costing, P95, 000) 133,000.00 Total Transaction price P417,591.50 The credit rating of Domino indicates that money can be borrowed at 8%. The present value of an ordinary annuity of five annual receipts of P57,000 each discounted at 8% is P227, 591.50. The discount of P57,408.50 represents…arrow_forwardPlease help mearrow_forward1. Debbie acquired a franchise to operate a donut shop from Dollar Donuts, Inc., for $100,000. She incurred anadditional $4,000 in legal costs to negotiate the terms with the franchiser. In five years, the franchise contract will berenegotiated. The current contract also states that there will be a $3, 000 annual fee plus a two percent charge basedon the store's annual revenue, which is expected to average 90,000 per year. What is the franchise cost that should becapitalized? a. $88,000 b. $92, 000 c. $100,000 d. $104,000arrow_forward

- Please do not give image formatarrow_forward11. Olabisi operates a lawn care service in southeastern Missouri. Olabisi incurs $63,000 of expenses determining the feasibility of expanding the business to southwestern Missouri. If Olabisi expands the business, the $63,000 is deductible in the current year. If Olabisi does not do so, then the $63,000 must be amortized over a 180-month period. True Falsearrow_forward4arrow_forward

- Exercise 6-31 (Algorithmic) (LO. 3) Stanford owns and operates two dry cleaning businesses. He travels to Boston to discuss acquiring a restaurant. Later in the month, he travels to New York to discuss acquiring a bakery. Stanford does not acquire the restaurant but does purchase the bakery on November 1, 2023. Stanford incurred the following expenses: Total investigation costs related to the restaurant Total investigation costs related to the bakery $42,000 53,200 If required, round any division to two decimal places and use in subsequent computation. Round your final answer to the nearest dollar. What is the maximum amount Stanford can deduct in 2023 for investigation expenses?arrow_forwardA buyer working with QRS Realty wants to make an offer on a property. To save time, the buyer makes a verbal offer of $210,000 and the seller agrees. The offer is: -invalid because it does not include a closing date-unenforceable because it is not in writing-voidable because the licensee did not review the offer-unilateral because the contract is not exclusivearrow_forwardExercise 6-31 (Algorithmic) (LO. 3) Stanford owns and operates two dry cleaning businesses. He travels to Boston to discuss acquiring a restaurant. Later in the month, he travels to New York to discuss acquiring a bakery. Stanford does not acquire the restaurant but does purchase the bakery on November 1, 2023. Stanford incurred the following expenses: Total investigation costs related to the restaurant Total investigation costs related to the bakery $31,750 51,600 If required, round any division to two decimal places and use in subsequent computation. Round your final answer to the nearest dollar. What is the maximum amount Stanford can deduct in 2023 for investigation expenses?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education