FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:4.

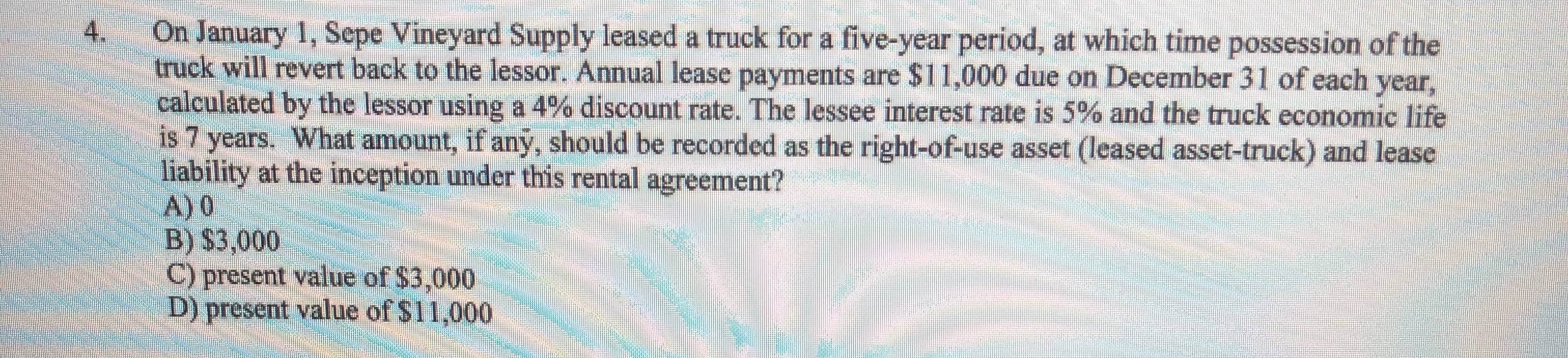

On January 1, Sepe Vineyard Supply leased a truck for a five-year period, at which time possession of the

truck will revert back to the lessor. Annual lease payments are $11,000 due on December 31 of each year,

calculated by the lessor using a 4% discount rate. The lessee interest rate is 5% and the truck economic life

is 7 years. What amount, if any, should be recorded as the right-of-use asset (leased asset-truck) and lease

liability at the inception under this rental agreement?

A) 0

B) $3,000

C) present value of $3,000

D) present value of $11,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Metlock Company leases a building and land. The lease term is 8 years and the annual fixed payments are $840,000. The lease arrangement gives Metlock the right to purchase the building and land for $13,550,000 at the end of the lease. Based on an economic analysis of the lease at the commencement date, Metlock is reasonably certain that the fair value of the leased assets at the end of lease term will be much higher than $13,550,000. What are the total lease payments in this lease arrangement? Total lease payments Click if you would like to Show Work for this question: Open Show Workarrow_forwardKingbird Company leases a building and land. The lease term is 7 years and the annual fixed payments are $720,000. The lease arrangement gives Kingbird the right to purchase the building and land for $13,000,000 at the end of the lease. Based on an economic analysis of the lease at the commencement date, Kingbird is reasonably certain that the fair value of the leased assets at the end of lease term will be much higher than $13,000,000. What are the total lease payments in this lease arrangement? Total lease payments :____________arrow_forwardLessee enters into a three year lease of equipment and agrees to make the following annual payments at the end of each year 10,000 in year one, 12,000 in year two and 14,000 in year three. Discount rate is approx. 4, 235% and right of use asset is depreciated on a straight line basis over the lease term. What is the value of the lease liability at the end of years 2 & 3?arrow_forward

- Can you help me with this problem with step by step explanation, please?arrow_forwardKing Company leased equipment from Mann Industries. The lease agreement qualifies as a finance lease and requires annual lease payments of $52,538 over a six-year lease term (also the asset’s useful life), with the first payment at January 1, the beginning of the lease. The interest rate is 5%. The asset being leased cost Mann $230,000 to produce. Required:1. Determine the price at which the lessor is “selling” the asset (present value of the lease payments).2. What would be the amounts related to the lease that the lessor would report in its income statement for the year ended December 31 (ignore taxes)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education