FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

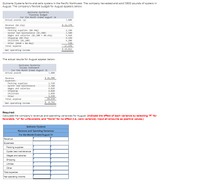

Transcribed Image Text:Quilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold 7,800 pounds of oysters in

August. The company's flexible budget for August appears below:

Quilcene Oysteria

Flexible Budget

For the Month Ended August 31

Actual pounds (g)

7,800

$ 32,370

Revenue ($4.159)

Expenses:

Packing supplies ($0.30g)

Oyster bed maintenance ($3, 500)

Wages and salaries ($2,109 + $0.45g)

Shipping ($8.55q)

Utilities ($1,280)

Other ($460 + $e.019)

Total expense

2,340

3, 5ee

5,610

4,290

1, 280

538

17,558

$ 14,812

Net operating income

The actual results for August appear below:

Quilcene Oysteria

Income Statement

For the Month Ended August 31

Actual pounds

7,800

Revenue

$ 26,900

Expenses:

Packing supplies

Oyster bed maintenance

Wages and salaries

Shipping

Utilities

2,510

3, 36е

6,020

4, 020

1,e90

1,158

18,158

Other

Total expense

Net operating income

$ 8,742

Requlred:

Calculate the company's revenue and spending variances for August. (Indicate the effect of each varlance by selecting "F" for

favorable, "U" for unfavorable, and "None" for no effect (1.e., zero varlance). Input all amounts as positive values.)

Quilcene Oysteria

Revenue and Spending Variances

For the Month Ended August 31

Revenue

Expenses:

Packing supplies

Oyster bed maintenance

Wages and salaries

Shipping

Utilities

Other

Total expense

Net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The May 2024 revenue and cost information for Boise Outfitters, Inc. follows: 1(Click the icon to view the revenue and cost information.) Prepare a standard cost income statement for management through gross profit. Report all standard cost variances for management's use. Has management done a good or poor job of controlling costs? Explain. (Use a minus sign or parentheses to enter any contra expenses. Enter all other amounts as positive numbers.) Boise Outfitters, Inc. Standard Cost Income Statement For the Month Ended May 31, 2024 (1) Sales Revenue $540,000 (2) Cost of Goods Sold at standard $344,000 (3) Manufacturing Cost Variances: (4) Direct Materials Cost Variance (5) Direct Materials Efficiency Variance (6) Direct Labor Cost Variance 4,800 (7) Direct Labor Efficiency Variance (8) Variable…arrow_forwardRequired: Calculate all variances and prepare an operating statement for the month endedJune 2015 by using the following table format. Sales variances £ Favourable (F)/Adverse (A) Sales price variance: Sales volume variance: Total sales variance Direct material variances £ Favourable (F)/Adverse (A) Material price variance: Material usage variance: Total direct material variance Direct labour variances £ Favourable (F)/ Adverse (A) Labour rate variance: Labour efficiency variance: Total direct labour variance Variable overhead variances £ Favourable (F)/ Adverse (A) Variable…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Jake's Roof Repair has provided the following data concerning its costs Cost per Repair Hour $15.00 $ 7.70 $0.50 $ 3.50 $ 0.60 Wages and salaries Parts and supplies Equipeent depreciation Truck operating expenses Rent Administrative expenses Fixed Cost per Month $ 21,000 $2,730 $ 5,709 $ 4,020 $3,050 For example, wages and salaries should be $21,000 plus $15.00 per repair-hour. The company expected to work 2.900 repair-hours in May, but actually worked 2.800 repair-hours. The company expects its sales to be $52.00 per repair-hour Required: Compute the company's activity variances for May (Indicate the effect of each variance by selecting "F" for favorable. "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)arrow_forwardCorrect answer please Do not give solution in image formatarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education