FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

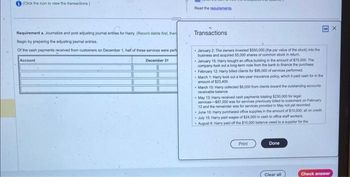

Transcribed Image Text:(Click the icon to view the transactions.)

COTT

Requirement a. Journalize and post adjusting journal entries for Harry. (Record debits first, then

Begin by preparing the adjusting journal entries.

of the cash payments received from customers on December 1, half of these services were perf

Account

December 31

Read the requirements

Transactions

January 2: The owners invested $550,000 (the par value of the stock) into the

business and acquired 55,000 shares of common stock in return

January 15: Harry bought an office building in the amount of $75,000. The

company took out a long-term note from the bank to finance the purchase

February 12: Harry billed clients for $95,000 of services performed.

March 1: Hamry took out a two-year insurance policy, which it paid cash for in the

amount of $23,400.

- March 10: Harry collected $8,000 from clients toward the outstanding accounts

receivable balance.

May 13: Harry received cash payments totaling $230,000 for legal

services $87,000 was for services previously billed to customers on February

12 and the remainder was for services provided in May not yet recorded

June 10: Harry purchased office supplies in the amount of $10,000, all on credit

July 15: Harry paid wages of $24,000 in cash to office staff workers

August 8: Harry paid off the $10,000 balance owed to a supplier for the

Print

Done

Clear all

Check answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- July Transactions Date Transaction Description July 1 Began business by making a deposit in a company bank account of $40,000, in exchange for 4,000 shares of $10 par value common stock. July 1 Paid the premium on a 1-year insurance policy, $4,800. July 1 Paid the current month's store rent expense, $3,600. July 6 Purchased repair equipment from Paul's Pool Equipment Company, $7,800. Paid $600 down and the balance was placed on account. July 8 Purchased repair supplies from Mary's Repair Company on credit, $450. July 10 Paid telephone bill, $300. July 11 Cash pool service revenue for the first third of July, $2,650. July 18 Made payment to Mary's Repair Company, $300. July 20 Cash pool service revenue for the second third of July, $4,000. July 31 Cash pool service revenue for the last third of July, $2,250. July 31 Paid the current month's electric bill, $500. July 31 Declared and paid cash dividend of $1,100.…arrow_forwardJournal entries 1. Your company purchased six months worth of supplies on January 1. This is a credit purchase. The purchase price was $25,000. 2. Assume the facts in problem 1. On March 31, an inventory of supplies was taken and $18,000 worth of supplies was remaining in inventory. 3. A one-year insurance policy was purchased on January 1, for $19,000. Cash was paid when the policy was delivered. 4. Assume the facts in problem 3. Record the appropriate adjusting journal entry for the month of February. 5. On March 1, 2016 conference room furniture for was purchased on credit for $12,000. 6. Assume the facts in problem 5. The furniture has a 12 year life. Record the appropriate adjusting entry. 7. On May 16, an architect was given $1,500 to draft house plans. The plans will be drawn up some time in July. Prepare the appropriate journal entry for May.arrow_forwardRecord The Following Transactions North and several others invested $650,000 cash in the business in exchange for 10,000 shares of capital stock. On May 27, A $400 invoice was received for several radio advertisements aired in May. The entire amount is due on June 5. Received a $100 payment on the $300 account receivable Declared a $2,000 dividend payable on July 15. Provided surveying services to client for $2,830. The entire amount was collected on this date Identify the Accruals (Unpaid expenses, Prepaid Expenses, uncollected revenue, unearned revenue) On November 1, Able Corporation purchased a six-month insurance policy expense from The Baylor Agency for $3,000. Salaries earned but not received by Milford’s employees from January 1 through January 31, 2012, totaled $180,000. Consulting services valued at $2,850 were provided during December to clients who had made payment in advance.arrow_forward

- July 1 July 1 July 3 July 5 July 12 July 18 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Common Stock Retained Earnings Maintenance and Repairs Expense Supplies Expense Depreciation Expense 14,400 5520 1080 2160 9600 350 2400 6480 744C 1440Carrow_forwardPrepare journal entries to record the following transactions: Dec. 1 - Mr. John Miller deposited $100,000 as initial investment to his newly open business, Miller Repair Shop DEC. 1:arrow_forwardThe Dog & Cat Hospital, owned by Kate Miller, a veterinarian, opened for business on December 1 of the current year. Using the horizontal worksheet below, record the following December transactions. Total the columns to show that assets equal liabilities plus stockholders' equity as of December 31. 1. Miller opened a checking account on December 1 at Biltmore Bank in the name of The Dog & Cat Hospital and deposited $12,500 Miller received common stock for her investment. 2. Paid rent for December, $750. 3. Purchased office equipment on account, $1,450. 4. Purchased supplies for cash, $950. 5. Billed clients for services rendered, $3,650. 6. Paid secretary's salary, $975. 7. Paid $750 on account for the equipment purchased on December 3. 8. Collected $2,900 from clients previously billed for services. 9. The firm paid stockholders $1,500 cash as a dividend. Note: Use negative signs with answers, when appropriate. Assets Liabilities Stockholders' Equity = Accounts Office Accounts Common…arrow_forward

- with this entries July 1 Began business by making a deposit in a company bank account of $40,000, in exchange for 4,000 shares of $10 par value common stock. July 1 Paid the premium on a 1-year insurance policy, $4,800. July 1 Paid the current month's store rent expense, $3,600. July 6 Purchased repair equipment from Paul's Pool Equipment Company, $7,800. Paid $600 down and the balance was placed on account. July 8 Purchased repair supplies from Mary's Repair Company on credit, $450. July 10 Paid telephone bill, $300. July 11 Cash pool service revenue for the first third of July, $2,650. July 18 Made payment to Mary's Repair Company, $300. July 20 Cash pool service revenue for the second third of July, $4,000. July 31 Cash pool service revenue for the last third of July, $2,250. July 31 Paid the current month's electric bill, $500. July 31 Declared and paid cash dividend of $1,100. i have to Prepare adjusting entries using the following information in…arrow_forwardJim commenced business as a sole trader under the name of ‘JimTag’, and he has provided the following accounts and their closing balances for the year ended 31st December 2020: Jim Tag Unadjusted Trial Balance as at 31 December 2020 Accounts $ $ Capital: JimTag as at 1 January, 2020 98,900 Drawings 21,700 Sales 260,700 PAYG Withheld 23,200 Cost of Goods Sold 128,700 Cash at Bank 22,400 Accounts Receivable 14,150 GST Collected 25,500 Sales commissions expense 6,560 Staff salaries expense 64,500 Accounting fees 2,300 Advertising expense 7,970 Inventory as at 31 December, 2020 40,250 Computer Equipment at cost 36,000 Shop Fittings at cost 70,000 Accumulated Depreciation: Computer Equipment 5,400 Accumulated Depreciation: Shop Fittings 18,000 Accounts Payable 18,900 Long-term Bank…arrow_forwardComprehensive review of the entire accounting cycle, Chapters 1-5 0 (175 min) Check Figure Net Income $5,388.44 P5-2C. From the following transactions as well as additional data, please complete the entire accounting cycle for Mike's Plumbing of Prince Albert. (Use a chart of accounts similar to the one in Problem P5-1A on page 228.) 2022 May 1 To open the business, Mike Quinlan invested $10,000 cash and $7,400 worth of plumbing equipment. 1 Paid rent for four months in advance, $1,980. 3 Purchased office equipment on account from MacKenzie Co., $3,800. 7 Bought plumbing supplies, $1,645. 8 Collected $3,600 for plumbing services provided. 9 Mike paid his home utility bill with a company cheque, $122. Billed Western Construction Co. for plumbing fees earned but not to be received until later, $9,600. 10 14 21 28 Advertising bill was received from ABCD Radio Co. but is not to be paid until next month, $420. Received cheque from Western Construction Co. in partial payment of transaction…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education