FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

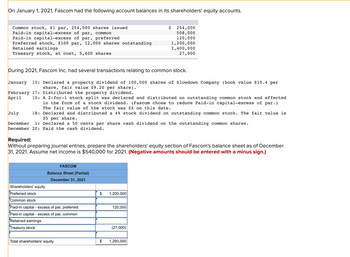

Transcribed Image Text:On January 1, 2021, Fascom had the following account balances in its shareholders' equity accounts.

Common stock, $1 par, 254,000 shares issued

Paid-in capital-excess of par, common

Paid-in capital-excess of par, preferred

Preferred stock, $100 par, 12,000 shares outstanding

Retained earnings

Treasury stock, at cost, 5,400 shares

During 2021, Fascom Inc. had several transactions relating to common stock.

January 15: Declared a property dividend of 100,000 shares of Slowdown Company (book value $10.4 per

share, fair value $9.20 per share).

February 17: Distributed the property dividend.

April

10:

A 2-for-1 stock split was declared and distributed on outstanding common stock and effected

in the form of a stock dividend. (Fascom chose to reduce Paid-in capital-excess par. )

The fair value of the stock was $4 on this date.

18: Declared and distributed a 4% stock dividend on outstanding common stock. The fair value is

$5 per share.

July

December 1: Declared a 50 cents per share cash dividend on the outstanding common shares.

December 20: Paid the cash dividend.

FASCOM

Balance Sheet (Partial)

December 31, 2021

Required:

Without preparing journal entries, prepare the shareholders' equity section of Fascom's balance sheet as of December

31, 2021. Assume net income is $540,000 for 2021. (Negative amounts should be entered with a minus sign.)

Shareholders' equity

Preferred stock

Common stock

Paid-in capital - excess of par, preferred

Paid-in capital - excess of par, common

Retained earnings

Treasury stock

Total shareholders' equity

$ 1,200,000

$ 254,000

508,000

120,000

120,000

1,200,000

2,400,000

27,000

(27,000)

$ 1,293,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit December 31, 2020arrow_forwardPrepare a classified balance sheet for Sandpiper Corporation as ofDecember 31, 2019 using columns 2 and 3 of the accounting paper supplied.Parenthetically show common shares authorized, issued, and outstanding. Use pencilonly, place the units, tens, hundreds, thousands, etc. in the proper mini column, andleave the pennies blank. No commas are necessary when you use the accounting paperproperly. Dollars signs used at the top of the column and after a total line. Use columns2 for detail and column 3 for netting, totals, and grand totals. Leave column 1 and 4blank. This balance sheet balances with these numbers. Bracketed notes are for thepreparer and parathetical notes are for the reader of the financials. You are thepreparerarrow_forwardYou are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company's interest expense for the year ended December 31, 2024. Your accounting group provided you the following Information on the company's debt Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. On July 1, 2024, Moonlight Bay Issued bonds with a face amount of $2,700,000. The bonds mature in 15 years and Interest of 11% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield Investors 12%. Moonlight Bay records Interest at the effective rate. 2. At December 31, 2023, Moonlight Bay had a 10% Installment note payable to Third Mercantile Bank with a balance of $700,000. The annual payment is $160,000, payable each June 30. 3. On January 1, 2024, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $85,000 beginning January 1, 2024.…arrow_forward

- Waterway Company has the following stockholders' equity accounts at December 31, 2020. Common Stock ($100 par value, authorized 8,700 shares) $502,800 Retained Earnings 277,400arrow_forwardYou’ve been hired to perform an audit of Hubbard Company for the year ended December 31, 2019. You find the following account balances related to shareholders’ equity: Preferred stock, $100 par $ 33,000 Common stock, $10 par 68,000 Capital surplus (15,100) Retained earnings 172,000 Because of the antiquated terminology and negative balance, you examine the Capital Surplus account and find the following entries: Credit (Debit) Additional paid-in capital on common stock $ 27,700 Capital from donated land 16,900 Treasury stock (400 common shares at cost) (5,600) Additional paid-in capital on preferred stock 2,000 Stock dividend (50%) (20,000) Prior period adjustment (net of income taxes) (10,100) Loss from fire (uninsured), 2018 (18,100) Property dividend declared (5,600) Cash dividends declared (23,300) Balance $ (36,100) Your examination of the Preferred Stock and Common Stock accounts reveals that the amounts shown correctly state the…arrow_forward(a) Prepare a statement of profit or loss for the year ended 31 December 2019. Notes to the accounts are not required.arrow_forward

- Teal Company is presently testing a number of new agricultural seed planters that it has recently developed. To stimulate interest, it has decided to grant to five of its largest customers the unconditional right of return to these products if not fully satisfied. The right of return extends for 4 months. Teal estimates returns of 20%. Teal sells these planters on account for $1,500,000 (cost $825,000) on January 2, 2020. Customers are required to pay the full amount due by March 15, 2020. (a) Your answer is correct. Prepare the journal entry for Teal at January 2, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 2, Accounts Receivable 1,500,000 2020 Sales Revenue 1,500,000 (To recognize revenue.) Cost of Goods Sold 825000 Inventory 825000 (To record cost of goods sold.) eTextbook and…arrow_forwardAllianze Ltd has the following data information as of 30 June 2022: Current assets of $ 6,970 Net fixed assets of $18,700 Current liabilities of $4,570 Long term debts of $9,490. Required: Calculate shareholders’ equity and prepare a balance sheet for the company for the period.arrow_forwardYou are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company's interest expense for the year ended December 31, 2024. Your accounting group provided you the following information on the company's debt:Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)1. On July 1, 2024, Moonlight Bay issued bonds with a face amount of $ 1,000,000. The bonds mature in 20 years and interest of 7% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield investors 8% Moonlight Bay records interest at the effective rate.2. At December 31, 2023, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance of $580,000. The annual payment is $100, 000, payable each June 30.3. On January 1, 2024, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $65,000beginning January 1, 2024.…arrow_forward

- How would this be recorded on an Income Statement. During 2019, Natural State's CFO noticed that bad debt expense in the 2018 income statement was $50,000 too low as a result of an accounting error made by a Natural State employee in the prior yeararrow_forwardplease help mearrow_forwardVaughn, Inc. had net sales in 2025 of $1,470,100. At December 31, 2025, before adjusting entries, the balances in selected accounts were Accounts Receivable $313,900 debit, and Allowance for Doubtful Accounts $1,814 debit. Assume that 11% of accounts receivable will prove to be uncollectible. Prepare the entry to record bad debt expense. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.) Date Account Titles and Explanation Dec. 31, 2025 Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education