Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

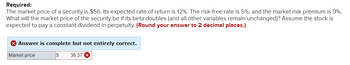

Transcribed Image Text:Required:

The market price of a security is $56. Its expected rate of return is 12%. The risk-free rate is 5%, and the market risk premium is 9%.

What will the market price of the security be if its beta doubles (and all other variables remain unchanged)? Assume the stock is

expected to pay a constant dividend in perpetuity. (Round your answer to 2 decimal places.)

> Answer is complete but not entirely correct.

Market price

$ 36.37 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you observe the following situation: Security Beta Expected Return Pete Corp. 1.70 0.180 Repete Co. 1.39 0.153 What is the risk - free rate? (Do not round intermediate calculations. Round the final answer to 3 decimal places.) Risk - free rate % Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Expected Return on Market Pete Corp. % Repete Co. %arrow_forwardData: S0 = 102; X = 115; 1 + r = 1.1. The two possibilities for ST are 146 and 84. Required: The range of S is 62 while that of P is 31 across the two states. What is the hedge ratio of the put? Form a portfolio of one share of stock and two puts. What is the (nonrandom) payoff to this portfolio? What is the present value of the portfolio? Given that the stock currently is selling at 102, calculate the put value.arrow_forwardWhich of the following statements is CORRECT? (Assume that the risk-free rate is a constant.) a. The effect of a change in the market risk premium depends on the slope of the yield curve. b. If the market risk premium increases by 1%, then the required return on all stocks will rise by 1%. c. If the market risk premium increases by 1%, then the required return will increase by 1% for a stock that has a beta of 1.0. d. The effect of a change in the market risk premium depends on the level of the risk-free rate. e. If the market risk premium increases by 1%, then the required return will increase for stocks that have a beta greater than 1.0, but it will decrease for stocks that have a beta less than 1.0.arrow_forward

- Hi, How do i solve this problem using a formula or financial calculator? Two securities, A and B, are available for trading. Prices (at t=0) and future payoffs (at t=1) in bothstates are given in the following table. Assume that both states are equally likely (50% chance of each). There is another security, call it C, whose payoff at t=1 is equal to $300 in the weak state and$600 in the strong state. Find the no-arbitrage price (at t=0) of security C What is the risk-free rate of return in this economy?arrow_forwardIf the risk free rate is 4.4%, the expected return on the market portfolio (i.e., Rm)( is 11.6%, and the beta of Stock B is 0.9 , what is the required rate of return for Stock B according to the Capital Asset Pricing Model (CAPM)? (Round your answer rounded to one decimal place and record without a percent sign). Your Answer: If the risk free rate is 1.2%, the market risk premium (i.e., Rm - Rf) is 13.5%, and the beta of Stock B is 1.9 , what is the required rate of return for Stock B according to the Capital Asset Pricing Model (CAPM)? (Round your answer rounded to one decimal place and record without a percent sign). Your Answer:arrow_forwardAssume that if M launches a new e-trading platform, its price will go up to $261. Else, M price will go down to $62. You are aware that M shares are being traded at $162. You also know that the risk-free rate is 5%.What is the probability that M price will go down?***Please round your answer to the nearest three decimals (i.e. 0.512)arrow_forward

- Assume that the risk-free rate is 2.5% and the market risk premium is 8%. What is the required return for the overall stock market? Round your answer to one decimal place. ? % What is the required rate of return on a stock with a beta of 0.5? Round your answer to one decimal place. ? % The above is a two part question, therefore the second answer is determined based off the first answer provided. Please, please, please do provide both answers.arrow_forwardrisk-free rate have to be if they are correctly priced? (See Problems 19 and 20.) 11.4 CAPM Suppose the risk-free rate is 8 percent. The expected return on the market is 14 percent. If a particular stock has a beta of .60, what is its expected return based on the CAPM? If another stock has an expected return of 20 percent, what must its beta be? (See Problem 13.)arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education