Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

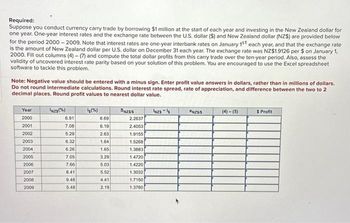

Transcribed Image Text:Required:

Suppose you conduct currency carry trade by borrowing $1 million at the start of each year and investing in the New Zealand dollar for

one year. One-year interest rates and the exchange rate between the U.S. dollar ($) and New Zealand dollar (NZ$) are provided below

for the period 2000-2009. Note that interest rates are one-year interbank rates on January 1st each year, and that the exchange rate

is the amount of New Zealand dollar per U.S. dollar on December 31 each year. The exchange rate was NZ$1.9126 per $ on January 1,

2000. Fill out columns (4)-(7) and compute the total dollar profits from this carry trade over the ten-year period. Also, assess the

validity of uncovered interest rate parity based on your solution of this problem. You are encouraged to use the Excel spreadsheet

software to tackle this problem.

Note: Negative value should be entered with a minus sign. Enter profit value answers in dollars, rather than in millions of dollars.

Do not round intermediate calculations. Round interest rate spread, rate of appreciation, and difference between the two to 2

decimal places. Round profit values to nearest dollar value.

Year

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

INZ8(%)

6.91

7.08

5.29

6.32

6.26

7.05

7.66

8.41

9.48

5.48

1g (%)

6.69

6.19

2.63

1.64

1.65

3.29

5.03

5.52

4.41

2.19

SNZS/S

2.2637

2.4053

1.9155

1.5268

1.3883

1.4720

1.4220

1.3032

1.7150

1.3780

INZS-13

ONZS/S

(4)-(5)

$ Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardOn July 1, 2020, Mifflin Company borrowed 200,000 euros from a foreign lender evidenced by an interest-bearing note due on July 1, 2021. The note is denominated in euros. The U.S. dollar equivalent of the note principal is as follows: LO 9-2 LO 9-2 LO 9-2 LO 9-2, 9-3 Problems 1. Which of the following combinations correctly describes the relationship between foreign currency transactions, exchange rate changes, and foreign exchange gains and losses? LO 9-1 Type of Transaction Foreign Currency Foreign Exchange Gain or Loss a. Export sale Appreciates Loss b. Import purchase Appreciates Gain c. Import purchase Depreciates Gain d. Export sale Depreciates Gain Date Amount July 1, 2020 (date borrowed). . . . . . . . . . . . . . . . . . . . . . . . . $225,000 December 31, 2020 (Mifflin’s year-end). . . . . . . . . . . . . . . . 220,000 July 1, 2021 (date repaid). . . . . . . . . . . . . . . . . . . . . . . . . . . . 210,000 In its 2021 income statement, what amount should Mifflin include as a…arrow_forwardSuppose that the U.S. firm Halliburton buys construction equipment from the Japanese firm Komatsu at a price of ¥250 million The equipment is to be delivered to the United States and paid for in one year. The current exchange rate is ¥96 = $1. The current interest rate on one-year U.S. Treasury bills is 6%, and on one-year Japanese government bonds the interest rate is 4%. a. If Halliburton exchanges dollars for yen today and invests the yen in Japan for one year, it will need to exchange today in order to have ¥250 million in one year. (Round your response to the nearest dollar)arrow_forward

- A British bank issues a $130 million, three-year Eurodollar CD at a fixed annual rate of 8 percent. The proceeds of the CD are lent to a British company for three years at a fixed rate of 10 percent. The spot exchange rate of pounds for U.S. dollars is £1.50/US$. a-1. Is this expected to be a profitable transaction ex ante? Yes No a-2. What are the cash flows if exchange rates are unchanged over the next three years? (Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places. (e.g., 32.16)) Eurodollar CD British Loan t Cash Outflow (U.S.$) (£) Cash Inflow (£) Spread (£) 1 million million million million 2 million million million million 3 million million million million b. If the U.S. dollar is expected to appreciate against the pound to £1.65/$1, £1.815/$1, and £2.00/$1 over the next three years, respectively, what will be the cash flows on this transaction? (Negative amount should be indicated by a minus sign. Do not round intermediate…arrow_forwardThe GBPUSD exchange rate was $1.4500 per pound on June 10, 2021. The GBPUSD exchange rate today is $1.2500 per pound. In the past 12 months, has the value of the British pound (relative to the U.S. dollar) increased in value, decreased in value, or remained the same?arrow_forwardSuppose the annual rate of inflation in Taiwan is 6.66%, and the annual rate of inflation in Mexico is 5.99%. If the Mexican peso depreciates relative to the Taiwan dollar by 4% in real terms, then which of the following would be correct? a, Nominal exchange rate appreciation by 4.825%. b. Nominal exchange rate depreciation by 3.393%. c. Nominal exchange rate appreciation by 3.512%. d. Nominal exchange rate depreciation by 4.603%. e. There is no change in the nominal exchange rate.arrow_forward

- The following is information on interest-rates and exchange rates for Australia and the U.K. being quoted by ANZ bank (assume there are no bid-ask spreads, for simplicity). The spot exchange rate for the number of AUD (Australian dollars) per GBP (British pound) is 1.8005. The annualized 6 month interest-rate in Australia (respectively, the U.K.) is 10% (respectively, 8%). Using the formula given in class, what is the 6 month forward exchange rate (consistent with no arbitrage) expressed as the number of AUD per GBP? Assume 6 months is exactly 0.5 years. Give your answer to 4 decimal places (because Canvas only accepts 4 decimal places).arrow_forwardsuppose you purchased a 10 million one-year Australian dollar loan that pays 7 percent interest annually. The spot rate of U.S. dollars for Australian dollars (AUD/USD) is $0.820/A$1. What is par value of the loan in U.S. dollars?arrow_forwardSuppose that Boeing Corporation exported a Boeing 747 to Lufthansa and billed €10 million payable in one year. The money market interest rates and foreign exchange rates are given as follows: The U.S. one-year interest rate: 6.10% per annum; The euro zone one-year interest rate: 9.00% per annum; The spot exchange rate: $1.50/€; and The one-year forward exchange rate: $1.46/€. Assume that Boeing sells a currency forward contract of €10 million for delivery in one year, in exchange for a predetermined amount of U.S.dollars. Which of the following is/are true? On the maturity date of the contract Boeing will (0) have to deliver €10 million to the bank (the counter party of the forward contract). (ii) take delivery of $14.6 million (iii) have a zero net euro exposure (iv) have a profit, or a loss, depending on the future changes in the exchange rate, from this sale. Oi) and (iv) O (0) and (iv) O (i), (ii), and (iv) (0.0) and (iii)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education