FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Required:

Smoot discovers that Jensen has designed the sculpture using the highest-grade wood available, rather than the standard grade of wood that Wood Creations normally uses.

Replacing the grade of wood will lower the cost of direct materials by 50%. However, the redesign will require an additional $1,100 of design cost, and the sculptures will be sold for $2,300 each. Will this design change allow the sculpture to meet its target

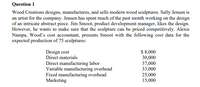

Transcribed Image Text:Question 1

Wood Creations designs, manufactures, and sells modern wood sculptures. Sally Jensen is

an artist for the company. Jensen has spent much of the past month working on the design

of an intricate abstract piece. Jim Smoot, product development manager, likes the design.

However, he wants to make sure that the sculpture can be priced competitively. Alexis

Nampa, Wood's cost accountant, presents Smoot with the following cost data for the

expected production of 75 sculptures:

$ 8,000

30,000

37,000

33,000

25,000

15,000

Design cost

Direct materials

Direct manufacturing labor

Variable manufacturing overhead

Fixed manufacturing overhead

Marketing

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Whispering Winds Company manufactures automobile components for the worldwide market. The company has three large production facilities in Virginia, New Jersey, and California, which have been operating for many years. Brett Harker, vice president of production, believes it is time to upgrade operations by implementing computer-integrated manufacturing (CIM) at one of the plants. Brett has asked corporate controller Connie Carson to gather information about the costs and benefits of implementing CIM. Carson has gathered the following data: Initial equipment cost $ 6,174,000 Working capital required at start-up $ 600,000 Salvage value of existing equipment 76,350 Annual operating cost savings 855,120 Salvage value of new equipment at end of its useful life 203,600 Working capital released at end of its useful life 600,000 Useful life of equipment 10 years Whispering Winds Company uses a 12% discount rate. Click here to view the factor table $ $ $ $arrow_forwardAttached is questions diagram, USE EXCEL AS ITS REQUIRED Question 10. Using the replacement chain method (machine B can be replaced with an identical machine at the end of year 3), determine which project should be adopted after tax. Pick the correct answer. Machine A Machine B Either machine Neither machinearrow_forwardCalculate the NPV based upon the following facts: Bob has just completed the development of a better face shield for health workers. The new product is expected to produce annual revenues of $230,000. Bob requires an investment in an advanced 3D Printer costing $30,000. The project has an expected life of 5 years. The 3D printer will have a $20,000 salvage value at the end of 5 years. Working capital is expected to increase by $80,000 which Bob will recover at the end of the products life cycle. Annual operating expenses are estimated at $200,000. The required rate of return is 4%.arrow_forward

- Arnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $3 million and which it currently rents out for $137,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.4 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $440,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.7 million in the first year and to stay constant for eight…arrow_forwardThe Mowbot plant must replace an existing HVAC unit (doing nothing is not an option). You are evaluating two pieces of equipment. Each unit offers a saving in annual energy cost over the existing equipment. Alternative Unit A Unit B Unit C Up front cost $44,000 $65,000 $84,000 Operating cost/year $1.900 $1.400 $900 Energy savings / year $14,000 $16,500 $17,500 Salvage Value $2,000 $4,000 $5,000 Economic life, years 7. 7. Mowbot's MARR is 12%. Based on annual worth analysis (not incremental), which unit should you recommend? HTML Editora BI 工E三 E三xi x ミ = ECE 12pt Paragrapharrow_forwardYour company is developing a new textbook for FIN 301 and you paid your current FIN 301 instructor $700,000 for his input about the feasibility of such a product. The project would involve initial capital investment of $1,200,000 and installation costs related to the capital expenditures of $600,000. The project would also necessitate an increase in net working capital of $200,000 at the beginning of the project. You can straight line depreciate any depreciable expenses to zero over the three-year life of the project, and you don't expect the capital investment to be sold at the end of the project. Each year, you estimate you will receive $3,000,000 in sales revenue from your awesome textbook. Variable product and selling costs associated with these sales are expected to be 40% of revenue in each of those years. The fixed costs in each of the three years of the project will be $500,000. The corporate tax rate is 40%. Calculate the total year 0 cash flows associated with the project. $…arrow_forward

- The CFO of The Fun Factory is investigating the possibility of investing in a three-dimensional printer that would cost $16,500. The printer would eliminate the need to have prototypes of new toys be produced by a third party. The cost of having the prototypes manufactured by the third party is about $7,161 per year. The printer would have a useful life of five years with no salvage value with expected annual operating costs of $3,300 per year. Required: Compute the simple rate of return on the printer. (Round your answer to 1 decimal place.) Simple rate of return %arrow_forwardCan some one please help me to answer each question correctly? please and thank you.arrow_forwardVishunuarrow_forward

- Citco Company is considering investing up to $512,000 in a sustainability-enhancing project. Its managers have narrowed their choices to three potential projects. • Project A would redesign the production process to recycle raw materials waste back into the production cycle, saving on direct materials costs and reducing the amount of waste sent to the landfill. Project B would remodel an office building, utilizing solar panels and natural materials to create a more energy-efficient and healthy work environment. Project C would build a new training facility in an underserved community, providing jobs and economic security for the local community. Required: 1. Assuming the cost of capital is 12%, complete the table below by computing the payback period, NPV, profitability index, and internal rate of return. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) 2. Based strictly on the economic analysis, in which project should they invest?…arrow_forwardA proposed building may be roofed in either composition roofing (C) or galvanized steel sheet (S). The composition roof costs $56,000 and is replaced every 5 years (assume at the same cost). The steel roof costs $68,000 but the useful life is very long. Neither roof has any salvage value, nor is maintenance needed. If the MARR is 10%, what minimum life must the steel roof have to make it the better alternative? (Report to the nearest whole year; don't bother interpolating.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education