FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

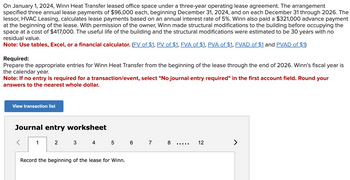

Transcribed Image Text:On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement

specified three annual lease payments of $96,000 each, beginning December 31, 2024, and on each December 31 through 2026. The

lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 5%. Winn also paid a $321,000 advance payment

at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the

space at a cost of $417,000. The useful life of the building and the structural modifications were estimated to be 30 years with no

residual value.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is

the calendar year.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your

vers to the nearest whole dollar.

View transaction list

Journal entry worksheet

1

2

3

4 5 6 7

Record the beginning of the lease for Winn.

8

12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2021, Wetick Optometrists leased diagnostic equipment from Southern Corp., which had purchased the equipment at a cost of $1,643,565. The lease agreement specifies six annual payments of $350,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 thereafter through 2025. The six-year lease term ending December 31, 2026 (a year after the final payment), is equal to the estimated useful life of the equipment. The contract specifies that lease payments for each year will increase on the basis of the increase in the Consumer Price Index for the year just ended. Thus, the first payment will be $350,000, and the second and subsequent payments might be different. The CPI at the beginning of the lease is 140. Southern routinely acquires diagnostic equipment for lease to other firms. The interest rate in these financing arrangements is 11%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables…arrow_forwardGive me correct answer with explanation.harrow_forwardLee Company entered into a lease of warehouse on January 1, 2020. The lease contract provided the following information: Lease term 5 years Estimated useful life of the leased asset 15 years Annual rental payable at the end of each year 600,000 Interest rate implicit in the lease 12% Included in the lease agreement an option for the lessee to extend the lease term for another 5 years. At the commencement date, the exercise of the extension option is not reasonably certain. At the December 31, 2022, the lessee decided to extend the lease for further 5 years. The agreement was finalized on January 1, 2023 with following arrangement on the extension option: New annual rental payable at the end of each year 700,000 New interest rate implicit in the lease 10% REQUIRED: Prepare table of amortization and journal entries for the entire lease term.arrow_forward

- can u help me with the journal entries with working ?arrow_forwardThornhill Equipment (lessor) leased a construction crane to Vanier Construction (lessee) on January 1, 2023. The following information relates to the leased asset and the lease agreement. (Click the icon to view the data.) Both companies use the straight-line depreciation method for cranes, and they both have December 31 year-end dates. Required Requirement a. Evaluate how the lessor (Thornhill Equipment) should account for the lease transaction. Start by determining the present value of the lease payments (PVLP). Then calculate the percentage of the PVLP compared to the fair value of the leased asset. (Use a financial calculator for all present value computations. Enter all currency values as positive amounts rounded to the nearest whole dollar. Round the percentage to the nearest whole percent.) PVLP Fair value of asset PVLP as % of fair value % Leased asset and lease agreement - Cost of crane to lessor 100,000 Thornhill's normal selling price for crane $ 146,913 Useful life…arrow_forwardFederated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. . The lease agreement specified annual payments of $34,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. . The company had the option to purchase the machine on December 30, 2026, for $43,000 when its fair value was expected to be $58,000, a sufficient difference that exercise seems reasonably certain. . The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 12%. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease llability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare…arrow_forward

- Three different lease transactions are presented below for Pharoah Enterprises. Assume that all lease transactions start on January 1, 2024. Pharoah does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of the leases is paid at the beginning of each year. Pharoah Enterprises prepares its financial statements using ASPE. Lease term Estimated economic life Yearly rental payment Fair market value of leased asset Present value of lease rental payments Interest rate Manufacturing Equipment 5 years 15 years $16,800 $117,600 $75,852 3.5% Office Equipment 6 years 3 years 7 years 6 years $18,000 $4,680 $102,000 $21,000 $94,356 $12,060 Vehicles 4% 8% Assume that Pharoah Enterprises has purchased the vehicle for $102,000 instead of leasing it and that the amount borrowed was $102,000 at 8% interest, with interest payable at the end of each year. Prepare the entries for 2024. (List all debit entries before credit entries. Credit…arrow_forwardPLEASE, PROVIDE CORRECT RESPONSE AND I WILL LIKE YOUR ANSWER. Problem 21-16 (Part Level Submission) Bramble Corporation entered into a lease agreement on January 1, 2020, to provide Cullumber Company with a piece of machinery. The terms of the lease agreement were as follows. 1. The lease is to be for 3 years with rental payments of $13,768 to be made at the beginning of each year. 2. The machinery has a fair value of $60,000, a book value of $40,000, and an economic life of 8 years. 3. At the end of the lease term, both parties expect the machinery to have a residual value of $25,000, none of which is guaranteed. 4. The lease does not transfer ownership at the end of the lease term, does not have a bargain purchase option, and the asset is not of a specialized nature. 5. The implicit rate is 6%, which is known by Dawkins. 6. Collectibility of the payments is probable.arrow_forwardCat Emporium Corp. (CEC) reports its financial results in accordance with IFRS. On January 1, 2020, CEC entered into an agreement to lease equipment for five years. Details of the lease follow: The lease is payable annually in five equal instalments of $10,000. The first payment is due on January 1, 2020, the commencement date of the The lease includes an option to purchase the equipment at the end of the lease term for $20,000. The useful life of the equipment is nine At the inception of the lease, the estimated fair market value of the equipment at the end of the lease term was $30,000; the estimated residual value at the end of its useful life was $0. CEC uses the straight-line method to depreciate all its right-of-use (ROU) CEC’s incremental borrowing rate for transactions of this type is 6%. The implicit rate in the lease is not readily determinable by CEC exercised its option to purchase on January 1, CEC’s year end is December Required: Prepare a lease liability…arrow_forward

- On January 1, 2021, the lessee company signed an operating lease to lease a building from the lessor. Lease payments are $57,000 per year and are made at the beginning of the year. Assume the following is the partial Lease Amortization Schedule (with only two rows and three columns shown) prepared by the lessee company: Date Annual Payment Interest on Liability 1/1/2022 57,000 44,000 1/1/2023 57,000 38,000 In the journal entry made on December 31, 2022, the lessee company should debit/credit Right-of-Use Asset by $___________. (Just enter the amount. Do not put a plus or minus sign in front of the amount.)arrow_forwardNeal Company entered into a nine-year lease on a warehouse on Dec. 31, 2019. Lease payments of 520,000 which included executory cost of 20,000 is due annually, beginning on Dec. 31, 2020 and every Dec. 31 thereafter. The cost of restoring the underlying asset to its original condition as required by the contract is estimated at the present value of 200,000. The interest rate implicit in the lease is 9%. The PV of an ordinary annuity of 1 for nine years at 9% is 5.60. 1. What amount should be reported as lease liability on December 31,2020? a. ₱ 4,500,000 b. ₱ 2,912,000 c. ₱ 4,680,000 d. ₱ 2,800,000 2. What is the initial recognition of the right of use asset? a. ₱ 3,112,000 b. ₱ 2,800,000 c. ₱ 3,000,000 d. ₱ 4,700,000 3. What is the carrying value of the right of use asset on December 31, 2021? a. ₱ 2,520,000 b. ₱ 2,488,889 c. ₱ 2,750,000 d. ₱ 2,666,667arrow_forwardPrepare the journal entries Leasing AG would make in 2020 related to the lease arrangement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education