FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

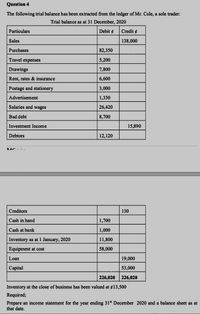

Transcribed Image Text:Question 4

The following trial balance has been extracted from the ledger of Mr. Cole, a sole trader:

Trial balance as at 31 December, 2020

Particulars

Debit ¢

Credit ¢

Sales

138,000

Purchases

82,350

Travel expenses

5,200

Drawings

7,800

Rent, rates & insurance

6,600

Postage and stationery

3,000

Advertisement

1,330

Salaries and wages

26,420

Bad debt

8,700

Investment Income

15,890

Debtors

12,120

Creditors

130

Cash in hand

1,700

Cash at bank

1,000

Inventory as at 1 January, 2020

11,800

Equipment at cost

58,000

Loan

19,000

Сapital

53,000

226,020

226,020

Inventory at the close of business has been valued at ¢13,500

Required;

Prepare an income statement for the year ending 31s December 2020 and a balance sheet as at

that date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate Wiper's debt ratio and debt/equity ratio at December 31, 2020 and 2019.arrow_forwardByrd Company had the following transactions during 2019 and 2020: 1. Prepare the journal entries for Byrd for both 2019 and 2020. Assume that the net price method is used to account for the credit terms. 2. Show how the preceding items would be reported in the current liabilities section of Byrd’s December 31, 2019, balance sheet. 3. Next Level Assuming Byrd’s current assets were $1,200,000 and its current ratio was 2.4 at the end of 2018, compute the current ratio at the end of 2019 (based solely on the effects of the preceding transactions).arrow_forwardWHY DOESNT THE NET INCOME AND RETAIN EARNING HAVE A 2020 AND 2021 COLUMN AS LIKE THE ASSET COLUMNarrow_forward

- how to determine net income for december 2019 if i am given cash dividends of 2000. stock issuence of 1400. liabillties of 26,500. assets of 40000. the decmber 2018 assets 34000. liabilities of 21,500 are also given.arrow_forwardLuxAll Inc., includes the following selected accounts in its general ledger at December 31, attached in ss below thanks ng wparrow_forwardA revenue was earned in 2019 but payment is not received until 2020. Using the accrual basis of accounting, the revenue should appear on: A. the 2020 income statement B. the 2019 income statement C. both the 2019 and 2020 income statements D. neither the 2019 nor 2020 income statementarrow_forward

- Multi-Step Income Statement Question: Based on the Multi-step Income Statement you prepared on your scratch paper, what is the amount of "Net Income After-Taxes" on the Multi-step Income Statement for the period ending 12/31/xx? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 W ASUS f4 f5 f6 f7 f9 f10 f11 团 %24 4 & 7. 9. Y U I G H JK 因 6 图 近 图arrow_forward1.32. Creating Balance Sheets and Income Statements. Using the information in the below table, prepare a classified balance sheet for Erie Company as of December 31, 2019 and December 31, 2020, along with multi-step income statements for the years then endedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education