FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

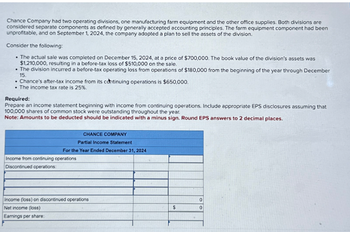

Transcribed Image Text:Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are

considered separate components as defined by generally accepted accounting principles. The farm equipment component had been

unprofitable, and on September 1, 2024, the company adopted a plan to sell the assets of the division.

Consider the following:

• The actual sale was completed on December 15, 2024, at a price of $700,000. The book value of the division's assets was

$1,210,000, resulting in a before-tax loss of $510,000 on the sale.

• The division incurred a before-tax operating loss from operations of $180,000 from the beginning of the year through December

15.

• Chance's after-tax income from its continuing operations is $650,000.

• The income tax rate is 25%.

Required:

Prepare an income statement beginning with income from continuing operations. Include appropriate EPS disclosures assuming that

100,000 shares of common stock were outstanding throughout the year.

Note: Amounts to be deducted should be indicated with a minus sign. Round EPS answers to 2 decimal places.

CHANCE COMPANY

Partial Income Statement

For the Year Ended December 31, 2024

Income from continuing operations

Discontinued operations:

Income (loss) on discontinued operations

Net income (loss)

Earnings per share:

$

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject:- accountingarrow_forwardPresented below is information related to a company at the beginning of the year: Common Stock, $10 par $6,700 Retained Earnings 4,700 During the year, 10 shares were reacquired at $11 per share. How much is the total stockholders' equity after the treasury stock transaction, assuming the company accounts for treasury stock under the cost method?arrow_forwardPlease help with all answersarrow_forward

- Blossom Company has these accounts at December 31: Common Stock, $9 par, 4,800 shares issued, $43,200; Paid-in Capital in Excess of Par $34,900; Retained Earnings $47,000; and Treasury Stock, 500 shares, $11,500. Prepare the stockholders' equity section of the balance sheet. (Enter the account name only and do not provide the descriptive information provided in the question.) Blossom Company Balance Sheet (Partial) December 31 $ $arrow_forwardOn its Form 10-K for the year ended December 31, 2016, Ameri Bank Corp. reported information related to basic earnings per share.Fill in the missing information. Rounding instruction: Round answer a. to two decimal places.Round answer b., c., & d. to the nearest million.Round answer e. to three decimal places. $ millions, except per share amounts 2015 2014 2013 Net income $17,287 $4,833 d. Answer Preferred stock dividends $1,483 b. Answer $1,349 Net income applicable to common shareholders $15,804 c. Answer $9,993 Average common shares outstanding 10,462.282 10,527.818 e. Answer Basic earnings per share a. Answer $0.34 $0.94arrow_forward31. Closed the credit balance of the income summary account, $269,400. 2. Journalize the entries to record the transactions, and post to the eight selected Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. listed. Also prepare T accounts for the following: Paid-In Capital from Sale cf July 1. Declared a 4% stock dividend on common stock, to be capitalized at the 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts FROBLEM 12-4B Btries for selected oporate transactions Objectives 4, 5, 7, 8 Shoshone Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Shoshone Enterprises Inc., with balances on January 1, 2006, are as follows: Common Stock, $20 stated value (100,000 shares authorized, 75,000 shares issued) Paid-In Capital in Excess of Stated Value Retained Earnings.. Treasury Stock (5,000 shares, at cost) $1,500,000 180,000 725,000 140,000 ADNET ASS The following selected transactions occurred…arrow_forward

- please answer do not image formatarrow_forwardPlease help mearrow_forwardDémó Consulting End-of-Period Spreadsheet For the Year Ended August 31, 20Y9 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 10,250 10,250 Accounts Receivable 24,400 24,400 Supplies 2,590 2,170 420 Land 20,980 20,980 Office Equipment 19,760 19,760 Accumulated Depreciation 2,710 1,290 4,000 Accounts Payable 6,590 6,590 Salaries Payable 320 320 Common Stock 8,200 8,200 Retained Earnings 16,690 16,690 Dividends 3,170 3,170 Fees Earned 66,970 66,970 Salary Expense 18,060 320 18,380 Supplies Expense 2,170 2,170 Depreciation Expense 1,290 1,290 Miscellaneous Expense 1,950 1,950 101,160 101,160 3,780 3,780 102,770 102,770arrow_forward

- On its Form 10-K for the year ended December 31, 2018, Bank of America Corp. reported information related to basic earnings per share.Fill in the missing information. Rounding instruction: Round answer a. to two decimal places.Round answer b., c., & d. to the nearest million.Round answer e. to one decimal place. $ millions, except per share amounts 2018 2017 2016 Net income $28,147 $18,232 d. Answer Preferred stock dividends 1,451 b. Answer $1,682 Net income applicable to common shareholders 26,696 c. Answer $16,140 Average common shares outstanding 10,096.5 10,195.6 e. Answer Basic earnings per share a. Answer $1.63 $1.57arrow_forwardThe declaration, record, and payment dates in connection with a cash dividend of $97,000 on a corporation's common stock are October 1, November 7, and December 15. Journalize the entries required on each date. If no entry is required, choose "No Entry Required" and leave the amount boxes blank.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education