FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

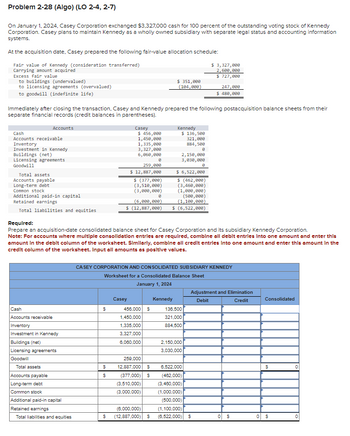

Transcribed Image Text:Problem 2-28 (Algo) (LO 2-4, 2-7)

On January 1, 2024, Casey Corporation exchanged $3,327,000 cash for 100 percent of the outstanding voting stock of Kennedy

Corporation. Casey plans to maintain Kennedy as a wholly owned subsidiary with separate legal status and accounting information

systems.

At the acquisition date, Casey prepared the following fair-value allocation schedule:

Fair value of Kennedy (consideration transferred)

Carrying amount acquired

Excess fair value

to buildings (undervalued)

to licensing agreements (overvalued)

to goodwill (indefinite life)

Cash

Accounts receivable

Inventory

Investment in Kennedy

Buildings (net)

Licensing agreements

Goodwill

Total assets

Accounts payable

Long-term debt

Common stock

Immediately after closing the transaction, Casey and Kennedy prepared the following postacquisition balance sheets from their

separate financial records (credit balances in parentheses).

Accounts

Additional paid-in capital

Retained earnings

Total liabilities and equities

Cash

Accounts receivable

Inventory

Investment in Kennedy

Buildings (net)

Licensing agreements

Goodwill

Total assets

Accounts payable

Long-term debt

Common stock

Additional paid-in capital

Retained earnings

Total liabilities and equities

$

Casey

$

$

$ 456,000

1,450,000

1,335,000

3,327,000

6,060,000

Casey

259,000

$ 12,887,000

$ (377,000)

(3,510,000)

(3,000,000)

Required:

Prepare an acquisition-date consolidated balance sheet for Casey Corporation and its subsidiary Kennedy Corporation.

Note: For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this

amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the

credit column of the worksheet. Input all amounts as positive values.

456,000 $

8

$ 6,522,000

$ (462,000)

(3,460,000)

(1,000,000)

(500,000)

(6,000,000)

(1,100,000)

$ (12,887,000) $ (6,522,000)

1,450,000

1,335,000

3,327,000

6,060,000

259,000

12,887,000 $

(377,000) S

(3,510,000)

(3,000,000)

$ 351,000

(104,000)

8

CASEY CORPORATION AND CONSOLIDATED SUBSIDIARY KENNEDY

Worksheet for a Consolidated Balance Sheet

January 1, 2024

(6,000,000)

$ (12,887,000)

Kennedy

$ 136,500

321,000

884,500

Kennedy

2,150,000

3,030,000

$ 3,327,000

2,600,000

$ 727,000

136,500

321,000

884,500

247,000

$ 480,000

2,150,000

3,030,000

6,522,000

(462,000)

(3,460,000)

(1,000,000)

(500,000)

.100,000)

$ (6.522,000) $

Adjustment and Elimination

Credit

Debit

0 $

Consolidated

$

0 $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please correct answer and don't use hend raitingarrow_forward(a) The following ratios have been extracted from an analysis of the accounts of three companies – North, South and East: Required: Comment on the respective performance of each of the three companies. (b) ‘The consolidation of financial statements hides rather than provides information.’ Discuss.arrow_forwardsolve within 30 mins.arrow_forward

- Please Do not Give image formatarrow_forwardPlease provide short answers or by saying YES / NO to the following questions: a) All inter-company sales, purchases, AR, AP and profits are eliminated upon consolidation. b) The entity which has control need to consolidate the financials c) To have control over other business, 49% of the voting rights in the other business are sufficient d) What are the three sections under which cash flow statements are analyzed e) Goodwill can be categorized as a liability.arrow_forwardCompute Measures for DuPont Disaggregation Analysis Use the information below for 2018 for 3M Company to answer the requirements. ($ millions) Sales Net income, consolidated Net income attributable to 3M shareholders Pretax interest expense Assets Total equity Equity attributable to 3M shareholders Net income consolidated S a. Compute return on equity (ROE) from the perspective of a 3M shareholder. Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE Numerator Denominator E Net income consolidated (adjusted) 2018 2017 $32,765 5,363 5,349 S 207 36,500 $37,987 9,848 11,622 9,796 11,563 S + Average total equity 5,349 $ b. Compute the DuPont model component measures for profit margin, asset turnover, and financial leverage. (Perform these computations from a consolidated perspective). Profit Margin (PM) Note: 1. Select the appropriate numerator and denominator used to…arrow_forward

- Please don't give image formatarrow_forwardProblem Company owns 90 percent of Solution Dairy's stock. The balance sheets of the two companies immediately after the Solution acquisition showed the following amounts: Assets Cash & Receivables. Inventory Land Buildings & Equipment (net) Investment in Solution Dairy Total Assets Liabilities & Stockholders' Equity Current Payables Long-Term Liabilities Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Problem Company $ 149,000 217,000 77,000 396,000 273,600 $ 1,112,600 Solution Dairy $ 76,000 266,600 390,000 380,000 $ 71,000 91,000 60,000 238,000 $ 460,000 $ 28,000 158,000 62,000 212,000 $ 1,112,600 $ 460,000 The fair value of the noncontrolling interest at the date of acquisition was determined to be $30,400. The full amount of the increase over book value is assigned to land held by Solution. At the date of acquisition, Solution owed Problem $13,000 plus $1,500 accrued interest. Solution had recorded the accrued interest, but Problem had not.arrow_forward(b) Assuming that the exchange of Assets A and B lacks commercial substance, record the exchange for both Tamarisk, Inc. and Vaughn, Inc. in accordance with generally accepted accounting principles. (Do not round intermediate calculations. Round final answer to O decimal places e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Tamarisk, Inc.'s Books Debit Credit Vaughn, Inc.'s Books eTextbook and Mediaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education