Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

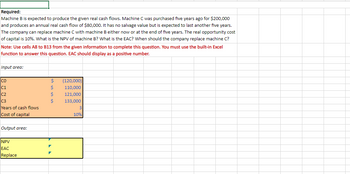

Transcribed Image Text:Required:

Machine B is expected to produce the given real cash flows. Machine C was purchased five years ago for $200,000

and produces an annual real cash flow of $80,000. It has no salvage value but is expected to last another five years.

The company can replace machine C with machine B either now or at the end of five years. The real opportunity cost

of capital is 10%. What is the NPV of machine B? What is the EAC? When should the company replace machine C?

Note: Use cells A8 to B13 from the given information to complete this question. You must use the built-in Excel

function to answer this question. EAC should display as a positive number.

Input area:

CO

C1

C2

C3

Years of cash flows

Cost of capital

Output area:

NPV

EAC

Replace

$

$

$

Ś

(120,000)

110,000

121,000

133,000

3

10%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your Company is interest in buying a new project that will last for 8 years. The projects internal rate of return is 5%. The project will generate annual operating cash inflows of $20,000. What is the most the company should pay for the equipment needed for this project? It will have no salvage value. Group of answer choices $128,000 $129,260 $13,540 $135,723 $122,797arrow_forwardBunnings Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186000 $195000 Future Cash Flow Year 1 86000 97000 Year 2 93000 84000 Year 3 83000 86000 Year 4 75000 75000 Year 5 55000 63000 Required:a) Identify which option of equipment should the company accept based on Profitability Index? b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 2 years?arrow_forward3. Schultz Company is considering purchasing a machine that would cost $478,800 and have a useful life of 5 years. The machine would reduce cash operating costs by $114,000 per year. The machine would have a salvage value of $6,200. Schultz Company prefers a payback period of 3.5 years or less.Required: a. Compute the payback period for the machine. What does this mean? b. Compute the return on average investment (ROI)arrow_forward

- A project that costs $2,300 to install will provide annual cash flows of $730 for each of the next 5 years. a. Calculate the NPV if the opportunity cost of capital is 12%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV b. Is this project worth pursuing? Yes O No c. What is the project's internal rate of return IRR? (Do not round intermediate calculations. Round your answer to 2 decimal places.) %24arrow_forwardSuppose Acme Manufacturing Corporation's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years. Year Year 1 Year 2 Year 3 Year 4 Cash Flow $350,000 $500,000 $450,000 $475,000 If the project's weighted average cost of capital (WACC) is 7%, what is its NPV? O $334,825 $418,531 O $355,751 $397,604arrow_forwardBrunette Company is contemplating investing in a new piece of manufacturing machinery. The amount to be invested is $180,000. The present value of the future cash flows generated by the project is $163,000. Should they invest in this project? Oa. yes, because the rate of return on the project is equal to the desired rate of return used to calculate the present value of the future cash flows Ob. no, because net present value is +$17,000 Oc. no, because the rate of return on the project is less than the desired rate of return used to calculate the present value of the future cash flows Od. yes, because the rate of return on the project exceeds the desired rate of return used to calculate the present value of the future cash flowsarrow_forward

- Vishanoarrow_forwardGiant Machinery Ltd is considering to invest in one of the two following Projects to buy a new equipment. Each project will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9%. The cash flows of the projects are provided below. Project 1Cost $175,000 Project 2 Cost $185,000 Future Cash Flows For Project 1 Year 1 Year 2 Year 3 Year 4 Year 5 is 76,000 83,000 67,000 65,000 55,000 respectively. For Project 2 it is 87,000 78,000 69,000 65,000 57,000 for Year 1 Year 2 Year 3 Year 4 Year 5 resp. Required: a) Identify which project should the company accept based on NPV method. (Note: Please round up the result of each calculation of PV to 2 decimal places only for simplification) b) Identify which project should the company accept based on simple pay back method if the payback criteria is maximum 2 years. c) Which project Giant Machinery should choose if two methods are in conflictarrow_forwardA company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $ -810,000 Equipment replacement cost in year 2, $ -300,000 Annual operating cost, $/year Salvage value, $ Life, years -860,000 250.000 4 an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors. e equivalent annual cost of the project is $-820000arrow_forward

- howell petroleum, incorporatred, is trying to evaluate a generation project with the following cash flows: year 0 -39,300,000 year 1 63,300,000 year 2 -12,300,000 What is the NPV for the project if hte company requires a return of 12 percent? this project has two irr what are theyarrow_forwardWhat information does the payback period provide? Suppose Omni Consumer Products's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years. Year Year 1 Cash Flow $375,000 Year 2 $450,000 Year 3 $400,000 Year 4 $400,000 If the project's weighted average cost of capital (WACC) is 10%, what is its NPV? $261,541 $313,849 $287,695 $222,310 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply. ㅁㅁ The discounted payback period is calculated using net income instead of cash flows. The discounted payback period does not take the project's entire life into account. The discounted payback period does not take the time value of money into account.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education