Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

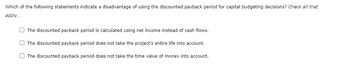

Transcribed Image Text:Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that

apply.

The discounted payback period is calculated using net income instead of cash flows.

The discounted payback period does not take the project's entire life into account.

The discounted payback period does not take the time value of money into account.

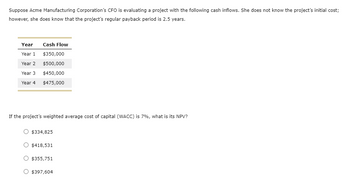

Transcribed Image Text:Suppose Acme Manufacturing Corporation's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost;

however, she does know that the project's regular payback period is 2.5 years.

Year

Year 1

Year 2

Year 3

Year 4

Cash Flow

$350,000

$500,000

$450,000

$475,000

If the project's weighted average cost of capital (WACC) is 7%, what is its NPV?

O $334,825

$418,531

O $355,751

$397,604

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Total project value ($) Debt Option Loan-to-value Rate (%) Interest only period (years) Amortization (years) $35,000,000.00 A 65% 3.25% 3 20 B 70% 3.25% 3 30 C 70% 3.00% 0 30 D 50% 4.25% 0 30arrow_forwardThe internal rate of return is the: discount rate that makes present value of cash inflows equal to present value of cash outflows. discount rate that causes a project's after-tax income to equal zero. discount rate that results in a zero net accounting return. rate of return required by the project's investors.arrow_forwardWhich of the following statements is FALSE? A. When evaluating a capital budgeting decision, we generally include interest expense. B. Only include as incremental expenses in your capital budgeting analysis the additional overhead expenses that arise because of the decision to take on the project. C. Many projects use a resource that the company already owns. O D. As a practical matter, to derive the forecasted cash flows of a project, financial managers often begin by forecasting earnings.arrow_forward

- In capital budgeting decisions, are there reasons a company might choose to take a project that was NPV negative? Explain.arrow_forwardNonearrow_forwardQUESTION #1: Which of the following is a disadvantage of using the IRR method of capital budgeting over other types: A- IRR does not consider the time and value of money. B- IRR assumes reinvestment of project cash flows at the same rate as the IRR C- IRR ignores the prudent simplicity of paybacks D- None of the above QUESTION #2: The net present value (NPV) of an investment is___________. A- The present value of all benefits (cash inflows) B- The present value of all costs (cash outflows) of the project C- The present value of all benefits (cash inflows) minus the present value of all costs (cash outflows) of the project D- The present value of all benefits (cash outflows) minus the present value of all costs (cash inflows) of the projectarrow_forward

- NPV and IRR are two of the most important decision criteria in capital budgeting. Will NPV and IRR methods always yield the same accept/reject decision? Please elaborate and list one potential cause of ranking conflicts between NPV and IRR.arrow_forwardHow can I explain these?arrow_forwardIn a few sentences, answer the following question as completely as you can. Compare discounted cash flow (DCF) and non-discounted cash flow capital budgeting techniques. If you were to evaluate a project, which one of these techniques would you use?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education