FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

![Required information

Use the following information to answer questions. (Algo)

[The following information applies to the questions displayed below]

The following information is available for ADT Company, which produces special-order security products and uses a job

order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost.

Inventaries

Raw materials

Mork in process

Finished goods

Beginning of

period

$ 35,000

9,200

53,000

Cost incurred for the period

Raw materials purchases

Factory payroll

Factory overhead (actual)

Indirect materials used

Indirect labor used

Other overhead costs

End of Period

$ 37,900

18,100

33,200

$ 197,000

150,000

14,000

34,500

91,500](https://content.bartleby.com/qna-images/question/c1cea8e8-0bc7-480d-90a7-aeda8243d222/c3b4dde1-e4ef-46f0-8b12-b3903b0122ed/05rfzs_thumbnail.png)

Transcribed Image Text:Required information

Use the following information to answer questions. (Algo)

[The following information applies to the questions displayed below]

The following information is available for ADT Company, which produces special-order security products and uses a job

order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost.

Inventaries

Raw materials

Mork in process

Finished goods

Beginning of

period

$ 35,000

9,200

53,000

Cost incurred for the period

Raw materials purchases

Factory payroll

Factory overhead (actual)

Indirect materials used

Indirect labor used

Other overhead costs

End of Period

$ 37,900

18,100

33,200

$ 197,000

150,000

14,000

34,500

91,500

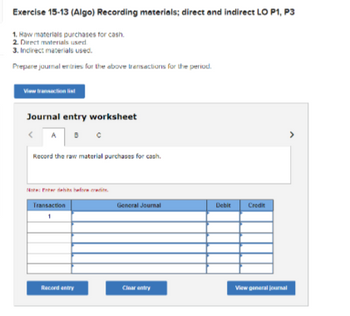

Transcribed Image Text:Exercise 15-13 (Algo) Recording materials; direct and indirect LO P1, P3

1. Raw materials purchases for cash.

2. Direct materials used

3. Indirect materials used.

Prepere journal entries for the above transactions for the period.

View transaction list

Journal entry worksheet

A B

Record the raw material purchases for cash.

Note: Freits before radi

Transaction

1

Racord entry

General Journal

Clear entry

Debit Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A job cost sheet of Wildhorse Company is given below. Job Cost Sheet JORNO White Lion C Date Requested 42 FOR Told Company Date Completed Date Direct Materials Direct Manufacturing Labor Overhead 7/10 200 600 730 400 480 1700 1520 31 500 600 Cost of completed job Direct materials Direct labor Manufacturing overhead Total cost Unit cost (a) Your answer is correct Answer the following questiona. (1) What are the source documents for direct maten als direct labor, and manufacturing overhead costs assigned to this job? Source Documents Direct material Direct labar Manufacturing (2) Overhead is applied on the basis of direct tabar cost. What is the predetermined manufacturing overhead rate! termined manufacturing overhead cate 120 31 What are the total cost and the unit cost of the completed job Round unitat o 2 decimal places, eg 125 Total cost of the completed job 120 Unit cost of the completed job S 14006 Textbook and Media List of Accounts Prepare the salty to record the soniction…arrow_forwardPlease do not give solution in image format thankuarrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forward

- Required information [The following information applies to the questions displayed below.] The following information is available for ADT Company, which produces special-order security products and uses a job order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost. Inventories Raw materials Work in process Finished goods Beginning of period $ 41,000 9,800 54,000 Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual) Indirect materials used. Indirect labor used Other overhead costs End of Period $ 37,000 19,700 35,000 $ 197,000 100,000 10,000 23,000 109,000arrow_forwardPredetermined Factory Overhead Rate Exotic Engine Shop uses a job order cost system to determine the cost of performing engine repair work. Estimated costs and expenses for the coming period are as follows: Engine parts Shop direct labor Shop and repair equipment depreciation Shop supervisor salaries Shop property taxes Shop supplies $953,500 696,000 31,700 88,000 16,000 12,200 Advertising expense 19,100 Administrative office salaries 82,000 Administrative office depreciation expense 10,500 Total costs and expenses $1,909,000 The average shop direct labor rate is $24.00 per hour. Determine the predetermined shop overhead rate per direct labor hour. Round the answer to nearest whole cent. $ per direct labor hourarrow_forwardPlease I want to learn how to make these problems with a good explanation. One of those there is the possible answer. I need only question 16 Thank youarrow_forward

- ! Required information Use the following information to answer questions. (Algo) [The following information applies to the questions displayed below.] The following information is available for ADT Company, which produces special-order security products and uses a job order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost. Beginning of period $ 45,000 9,600 68,000 End of Period Inventories Raw materials Work in process Finished goods $ 45,000 19,000 33,500 Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual) Indirect materials used Indirect labor used Other overhead costs $ 178,000 250,000 9,000 57,500 115,500 Exercise 15-13 (Algo) Recording materials; direct and indirect LO P1, P3 1. Raw materials purchases for cash. 2. Direct materials used. 3. Indirect materials used. Prepare journal entries for the above transactions for the period. X Answer is not complete. No Transaction General Journal…arrow_forwardPlease explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forwardanswer in text form please (without image), answer both the partsarrow_forward

- Predetermined Factory Overhead Rate Road Runner Engine Shop uses a job order cost system to determine the cost of performing engine repair work. Estimated costs and expenses for the coming period are as follows: Engine parts Shop direct labor Shop and repair equipment depreciation Shop supervisor salaries Shop property taxes Shop supplies Advertising expense Administrative office salaries Administrative office depreciation expense Total costs and expenses The average shop direct labor rate is $22 per hour. $1,054,900 770,000 39,700 110,400 20,000 15,400 21,100 90,700 11,600 $2,133,800 Determine the predetermined shop overhead rate per direct labor hour. Round the answer to nearest whole cent. per direct labor hourarrow_forwardPlease do not give solution in image format thankuarrow_forwardplease answer in excel with formula explanation with steps so that i can understand provide narrations alsoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education