FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:!

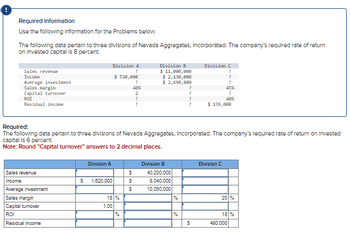

Required Information

Use the following information for the Problems below.

The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return

on Invested capital is 8 percent.

Sales revenue

Income

Average investment

Sales margin

Capital turnover

ROI

Residual income

Sales revenue

Income

Average investment

Sales margin

Capital turnover

ROI

Residual income

S

Division A

Division A

2

$ 530,000

?

400%

2

?

?

1,620,000

Required:

The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested

capital is 6 percent.

Note: Round "Capital turnover" answers to 2 decimal places.

18 %

1.00

Division B

$ 11,000,000

$ 2,130,000

$ 2,690,000

$

$

$

Division B

40,200,000

8,040,000

10,050,000

%

?

%

?

Division C

?

?

?

45%

?

48%%

$

$ 139,000

Division C

20%

18 %

480,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A. Compute the divisional ROI for the Campus Division. B. Compute the divisional RI for the Campus Division.arrow_forwardWhat is EVA for Division Y?arrow_forwardConner Manufacturing has two major divisions. Management wants to compare their relative performance. Information related to the two divisions is as follows: Division 1: Sales: Expenses: Asset investment: $200,000 $150,000 $1,000,000 Division 2: Sales: $45,000 Expenses: $35,000 Asset investment: $200,000 Conner currently requires investments to meet a rate of return on asset investment of 5%. Which division has the greatest level of "residual income"? Select one: O a. Division 1 O b. Division 2 O c. Both divisions have the same return on investment ratioarrow_forward

- Memanarrow_forwardThe operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating income Invested Assets Retail Division $103,400 $470,000 Commercial Division 105,000 420,000 Internet Division 130,000 500,000 Assume that management has established a 10% minimum acceptable return for invested assets. a. Determine the residual income for each division. Retail Division Commercial Division Internet Division Operating income $103,400 $105,000 $130,000 Minimum acceptable operating income as a percent of invested assets Residual income $ $ $ b. Which division has the most residual income?arrow_forwardSelected sales and operating data for three divisions of different structural engineering firms are given as follows: Sales Average operating assets Net operating income Minimum required rate of return Division A $6,300,000 $1,260,000 $ 340,200 20.00% Division B $10,300,000 $ 5,150,000 $ 968,200 18.80% Division C $9,400,000 $1,880,000 $ 249,100 17.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. I Margin Turnover ROI Division A 5.40 % times % Division B % 2.00 times :% Division C % times % 2. Compute the residual income (loss) for each division. (Loss amounts should be indicated by a minus sign. Roui Division A Division B Division C Average operating assets Required rate of return % % % Required operating income Actual operating income Required operating income (above) Residual income (loss) 3. Assume that each division is presented with an investment opportunity that would y a. If performance is being…arrow_forward

- Selected sales and operating data for three divisions of different structural engineering firms are given below: Division C $ 25,450,000 $ 5,090,000 $636,250 12.50% Sales Average operating assets Net operating income Minimum required rate of return Division A $ 12,360,000 $ 3,090,000 $ 494,400 7.00% Required: 1. Compute each division's margin, turnover, and return on investment (ROI). 2. Compute each division's residual income (loss). 3. Assume each division is presented with an investment opportunity yielding a 8% rate of return. a. If performance is being measured by ROI, which division or divisions will accept the opportunity? b. If performance is being measured by residual income, which division or divisions will accept the opportunity? Division B $ 28,360,000 $ 7,090,000 $ 453,760 7.50% Complete this question by entering your answers in the tabs below. Division A Division B Division C Required 1 Required 2 Required 3A Required 3B Assume each division is presented with an…arrow_forward(J) Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Division ADivision BDivision CSales$ 12,120,000$ 28,120,000$ 20,120,000Average operating assets$ 3,030,000$ 7,030,000$ 5,030,000Net operating income$ 496,920$ 449,920$ 503,000Minimum required rate of return7.00%7.50%10.00%Required: 1. Compute the margin, turnover, and return on investment (ROI) for each division. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 8% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept the opportunityarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education