FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

![mework Assignment i

es

C

CON

Required information

Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

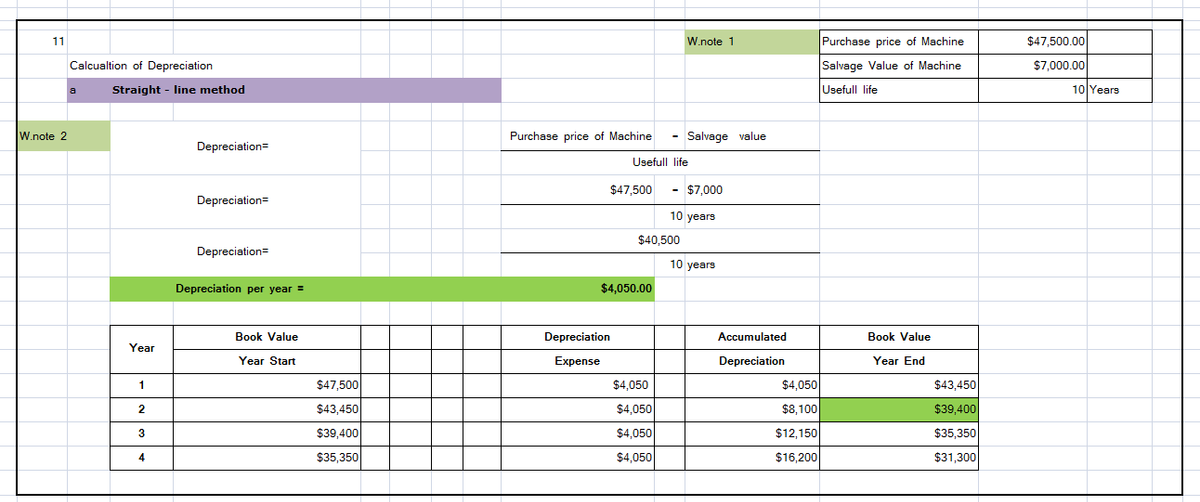

Exercise 8-4 Straight-line depreciation LO P1

Esc

Straight-Line Depreciation

Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of

$47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value.

During its second year, the machine produces 34,500 units of product.

Determine the machine's second-year depreciation and year end book value under the straight-line method.

Choose Numerator: /

Cost minus salvage

$

Year 2 Depreciation

Year end book value (Year 2)

F1

F2

40,500/

Estimated useful life (years)

$

✔

F3

Choose Denominator:

#

Dashboard

F4J

10

4,050

Prev.

F5

%

=

=

E

Paraphrasing Tool ....

Annual Depreciation

Expense

1

Depreciation expense

$

Saved

S

2 3

F6 G

A

C

logitech

4,050

of 9

F7

&

Excelsior Career De... Nationw

7

Score.answer >

F8

*

8

F9

(

9

F10

C](https://content.bartleby.com/qna-images/question/75b9eb0a-6c09-4640-9bd0-d00c787ecce6/cc76ba80-a5dc-4c77-b1c4-41842ad55b8d/u40lw5q_thumbnail.jpeg)

Transcribed Image Text:mework Assignment i

es

C

CON

Required information

Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

Exercise 8-4 Straight-line depreciation LO P1

Esc

Straight-Line Depreciation

Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of

$47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value.

During its second year, the machine produces 34,500 units of product.

Determine the machine's second-year depreciation and year end book value under the straight-line method.

Choose Numerator: /

Cost minus salvage

$

Year 2 Depreciation

Year end book value (Year 2)

F1

F2

40,500/

Estimated useful life (years)

$

✔

F3

Choose Denominator:

#

Dashboard

F4J

10

4,050

Prev.

F5

%

=

=

E

Paraphrasing Tool ....

Annual Depreciation

Expense

1

Depreciation expense

$

Saved

S

2 3

F6 G

A

C

logitech

4,050

of 9

F7

&

Excelsior Career De... Nationw

7

Score.answer >

F8

*

8

F9

(

9

F10

C

Expert Solution

arrow_forward

Step 1

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Skip to question [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $49,100. The machine's useful life is estimated at 10 years, or 401,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,100 units of product. Determine the machine’s second-year depreciation and year end book value under the straight-line method.arrow_forwardRequired information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,900. The machine's useful life is estimated at 10 years, or 399,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 33,900 units of product. Exercise 8-4 Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method. Straight-Line Depreciation. Choose Numerator: / Year 2 Depreciation Year end book value (Year 2) Choose Denominator: = Annual Depreciation Expense Depreciation expense 0arrow_forwardA machine costing $215,200 with a four-year life and an estimated $18,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 493,000 units of product during its life. It actually produces the following units: 123,000 in Year 1, 122,500 in Year 2, 119,800 in Year 3, 137,700 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Straight Line Units of Production Compute depreciation for each year (and total depreciation of all years combined) for the machine…arrow_forward

- A machine costing $210,200 with a four-year life and an estimated $19,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 478,000 units of product during its life. It actually produces the following units: 121,800 in Year 1, 122,400 in Year 2, 119,600 in Year 3, 124,200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) ompute depreciation for each year (and total depreciation of all years combined) for the machine under the Double-declining-balance. DDB Depreciation for the…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $49,100. The machine's useful life is estimated at 10 years, or 401,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,100 units of product. Determine the machine’s second-year depreciation using the units-of-production method.arrow_forward! Required information [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,900. The machine's useful life is estimated at 10 years, or 389,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 32,900 units of product. Determine the machine's second-year depreciation and year end book value under the straight-line method. Straight-Line Depreciation Annual Depreciation Expense Choose Numerator: / Choose Denominator: Depreciation expense %D Year 2 Depreciation Year end book value (Year 2) IIarrow_forward

- A machine costing $208,800 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 482,000 units of product during its life. It actually produces the following units: 122,900 in Year 1, 123,900 in Year 2, 120,100 in Year 3, 125,100 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Straight Line Units of Production Double declining balance Compute depreciation for each year (and total depreciation of all years…arrow_forwardRequired information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company Installs a computerized manufacturing machine In Its factory at the beginning of the year at a cost of $86,800. The machine's useful life is estimated at 20 years, or 404,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 34,400 units of product. Exercise 8-5 Units-of-production depreciation LO P1 Determine the machine's second-year depreciation using the units-of-production method. X Answer is not complete. Unite-of-produotion Depreciation Choose Denominator: Annual Depraciati on Expensu Depreciation expense per unit Choose Numerator: Cost minus salvage Estimated Useful life (years) Annual Production (units) Year Depreclation Expense 6,880arrow_forwardShalles Corporation, an 80%-owned subsidiary of Pani Corporation, sold inventory items to its parent at a $48,000 profit in 2014. Pani resold one-third of this inventory to outside entities. Shalles reported net income of $200,000 for 2014. Noncontrolling interest share of consolidated net income that will appear in the income statement for 2014 is A. $32,000. B. $33,600. C. $40,000. D. $30,400.arrow_forward

- ramirez company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $49,100. The machine's useful life is estimated at 10 years, or 401,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,100 units of product. Determine the machine's second-year depreciation using the units-of-production methodarrow_forwardA machine costing $213,600 with a four-year life and an estimated $16,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 494,000 units of product during its life. It actually produces the following units: 121,600 in Year 1, 123,700 in Year 2, 119,700 in Year 3, 139,000 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Straight Line Units of Production Compute depreciation for each year (and total depreciation of all years combined) for the machine…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education