FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

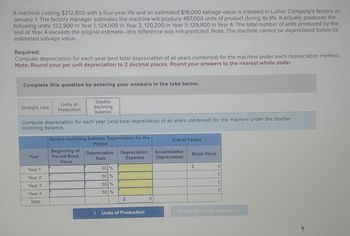

Transcribed Image Text:A machine costing $212,800 with a four-year life and an estimated $18,000 salvage value is installed in Luther Company's factory on

January 1. The factory manager estimates the machine will produce 487,000 units of product during its life. It actually produces the

following units: 122,900 in Year 1, 124,000 in Year 2, 120,200 in Year 3, 129,900 in Year 4. The total number of units produced by the

end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its

estimated salvage value.

Required:

Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method.

Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.

Complete this question by entering your answers in the tabs below.

Straight Line

Units of

Production

Double

declining

balance

Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Double-

declining-balance.

Double-declining-balance Depreciation for the

End of Period

Year

Beginning of

Period Book

Period

Depreciation

Rate

Depreciation

Expense

Accumulated

Book Value

Depreciation

Value

Year 1

50 %

$

0

Year 2

50%

0

Year 3

50 %

0

Year 4

Total

50 %

0

$

0

<

Units of Production

Double declining balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (2). A machine costing $207,800 with a four-year life and an estimated $17,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 477,000 units of product during its life. It actually produces the following units: 122,900 in Year 1, 122,900 in Year 2, 121,100 in Year 3, 120,100 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.arrow_forward7arrow_forwardYour answerarrow_forward

- xact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printer is expected to have a four-year useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: Year 1 390,000 Year 2 410,000 Year 3 420,000 Year 4 300,000 Total 1,520,000 The printer was sold at the end of Year 4 for $1,650. Requireda. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation.arrow_forwardA machine costing $211,400 with a four-year life and an estimated $19,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 481,000 units of product during its life. It actually produces the following units: 123,200 in Year 1, 123,600 in Year 2, 121,400 in Year 3, 122,800 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Straight Line Units of Production Year Year 1 Year 2 Year 3 Year 4 Total Compute depreciation for each year (and total depreciation…arrow_forwardA machine costing $217,200 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 493,000 units of product during its life. It actually produces the following units: 122,200 in Year 1, 124,100 in Year 2, 121,500 in Year 3, 135,200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) A machine costing $217,200 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce…arrow_forward

- Okl Company pays $283,000 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. 1. Paid $14,150 cash for a new component that increased the equipment's productivity. 2. Paid $3,538 cash for minor repairs necessary to keep the equipment working well. 3. Paid $7,100 cash for significant repairs to increase the useful life of the equipment from four View transaction list Journal entry worksheet seven years. Journal entry worksheet Journal entry worksheetarrow_forwardQuick Producers acquired factory equipment on March 1 of Year 1 costing $39,000 . In view of pending technological developments, it is estimated that the equipment will have an $8,000 resale value upon disposal in four years and that disposal costs will be $500. Data relating to the equipment follow. Estimated Service Life Years 4 Service hours 20,000 Calendar Year Actual Service Hours Year 1 4,700 Year 2 5,000 Year 3 4,800 Year 4 4,400 Year 5 1,000 Required Compute depreciation expense each year for the life of the asset assuming (1) units-of-production, (2) straight-line, (3) sum-of-the-years’-digits, and (4) double-declining-balance depreciation.●Note: Round depreciation expense to the nearest whole dollar 1. Units-of-Production●Note: Do not use negative signs with any of your answers. Numerator Denominator Result Depreciation per Unit Answer ÷ Answer = ●Note: Use the result EXACTLY as displayed above in the calculations…arrow_forwardA machine costing $217,600 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 494,000 units of product during its life. It actually produces the following units: 122,200 in Year 1, 124,300 in Year 2, 120,000 in Year 3, 137,500 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Straight Line Units of Production Double declining balance Compute depreciation for each year (and total depreciation of all years…arrow_forwardOki Company pays $283,500 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. 1. Paid $20,250 cash for a new component that increased the equipment's productivity. 2. Paid $5,063 cash for minor repairs necessary to keep the equipment working well. 3. Paid $13,200 cash for significant repairs to increase the useful life of the equipment from four to seven years. View transaction list Journal entry worksheet > Record the betterment cost of $20,250 paid in cash. Note: Enter debits before credits. Debit Credit Transaction General Journal 1 MacBook Airarrow_forwardRequlred Information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $85,400. The machine's useful life is estimated at 20 years, or 402,000 units of product, with a $5.000 salvage value. During its second year, the machine produces 34,200 units of product. Exerclse 8-4 Stralght-Illne depreclation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method. Straight-Line Depreciation Annual Depreciation Expense Choose Numerator: Choose Denominator: Depreciation expense Year 2 Depreciation Year end book value (Year 2)arrow_forwardExact Photo Service purchased a new color printer at the beginning of Year 1 for $39,000. The printer is expected to have a four-year useful life and a $3,900 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: Year 1 551,300 483,700 384,700 389,600 Year 2 Year 3 Year 4 Total 1,809,300 The printer was sold at the end of Year 4 for $4.300. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods.arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education