FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

![**Required Information**

*[The following information applies to the questions displayed below]*

On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,580 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts:

| Item | Amount ($) |

|----------------------------|------------|

| Cash | 9,390 |

| Accounts receivable | 16,020 |

| Office supplies | 3,830 |

| Office equipment | 18,550 |

| Land | 45,980 |

| Accounts payable | 9,060 |

| Common stock | 84,580 |

| Cash dividends | 2,650 |

| Consulting revenue | 16,020 |

| Rent expense | 4,190 |

| Salaries expense | 7,570 |

| Telephone expense | 830 |

| Miscellaneous expenses | 650 |

*Explanation*:

This table lists the financial items and corresponding amounts recorded by Ernst Consulting company as of December 31, after its establishment and owner contribution in early December. It includes assets such as cash, accounts receivable, office supplies, office equipment, and land. It also details liabilities like accounts payable, and equity items like common stock and cash dividends. Revenue and expenses such as consulting revenue, rent expense, salaries expense, telephone expense, and miscellaneous expenses are also documented. These records represent the company's financial status at the end of the month.](https://content.bartleby.com/qna-images/question/6836d12e-b54d-4227-8311-78839a65ba8f/84be1f06-4926-4239-9bc9-784f3639d7ee/bs2iwo_thumbnail.jpeg)

Transcribed Image Text:**Required Information**

*[The following information applies to the questions displayed below]*

On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,580 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts:

| Item | Amount ($) |

|----------------------------|------------|

| Cash | 9,390 |

| Accounts receivable | 16,020 |

| Office supplies | 3,830 |

| Office equipment | 18,550 |

| Land | 45,980 |

| Accounts payable | 9,060 |

| Common stock | 84,580 |

| Cash dividends | 2,650 |

| Consulting revenue | 16,020 |

| Rent expense | 4,190 |

| Salaries expense | 7,570 |

| Telephone expense | 830 |

| Miscellaneous expenses | 650 |

*Explanation*:

This table lists the financial items and corresponding amounts recorded by Ernst Consulting company as of December 31, after its establishment and owner contribution in early December. It includes assets such as cash, accounts receivable, office supplies, office equipment, and land. It also details liabilities like accounts payable, and equity items like common stock and cash dividends. Revenue and expenses such as consulting revenue, rent expense, salaries expense, telephone expense, and miscellaneous expenses are also documented. These records represent the company's financial status at the end of the month.

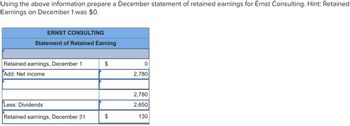

Transcribed Image Text:### Ernst Consulting: December Statement of Retained Earnings

To understand how retained earnings for Ernst Consulting have changed over the month of December, the following statement of retained earnings has been prepared. This follows the initial note that retained earnings on December 1st were $0.

**Ernst Consulting**

**Statement of Retained Earning**

| Description | $ |

|----------------------------------|-----------|

| **Retained earnings, December 1**| 0 |

| Add: Net income | 2,780 |

| | **2,780** |

| Less: Dividends | 2,650 |

| **Retained earnings, December 31**| **130** |

### Explanation of the Statement Components:

1. **Retained earnings, December 1:** It starts with $0 as there were no retained earnings at the beginning of the month.

2. **Add: Net income:** The company earned a net income of $2,780 over the month.

3. **Total before dividends:** Summing the initial retained earnings and the net income gives a total of $2,780.

4. **Less: Dividends:** The company distributed $2,650 in dividends to the shareholders during the month.

5. **Retained earnings, December 31:** After paying out the dividends, the remaining retained earnings amount to $130.

This statement provides a clear view of how the retained earnings for the company are calculated and adjusted by accounting for the net income earned and the dividends paid out during the month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $83,540 in assets to launch the business. On October 31, the company's records show the following items and amounts. Cash $12,650 Cash withdrawals by owner $ 1,570 13,520 13,520 Accounts receivable Office supplies Land Consulting revenue Rent expense 2,850 3,110 45,940 Salaries expense 17,530 Telephone expense Office equipment Accounts payable 6,490 850 660 8,110 Miscellaneous expenses Owner investments 83,540 Using the above information prepare an October statement of owner's equity for Ernst Consulting. ERNST CONSULTING Statement of Owner's Equity 0arrow_forwardnces [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,920 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable office supplies Land office equipment Accounts payable. Owner Investments Assets $ 8,450 Cash withdrawals by owner Consulting revenue 16,950 4,080 Rent expense 46,020 Salaries expense 18,860 Telephone expense 9,280 Miscellaneous expenses 84,920 Exercise 1-18 (Algo) Preparing an income statement LO P2 Using the above information prepare a December income statement for the business. Liabilities Equity Revenues $ 2,930 16,950 4,420 7,900 860 680 ERNST CONSULTING Income Statementarrow_forward[The following information applies to the questions displayed below.] Deliberate Speed Corporation (DSC) was incorporated as a private company. The company's accounts included the following at June 30: Accounts Payable Buildings $ 27,800 156,000 58, 250 155,000 Cash Common Stock Equipment 138,000 Land 262,000 3,250 Notes Payable (long-term) Retained Earnings. 440, 100 Supplies 11, 900 During the month of July, the company had the following activities: a. Issued 5,500 shares of common stock for $550,000 cash. b. Borrowed $135,000 cash from a local bank, payable in two years. c. Bought a building for $233,000; paid $90,000 in cash and signed a three-year note for the balance. d. Paid cash for equipment that cost $225,000. e. Purchased supplies for $54,250 on account. 4. Prepare a trial balance at July 31. Answer is not complete. Cash Supplies Equipment Buildings Accounts Payable Notes Payable (long-term) Common Stock Totals DELIBERATE SPEED CORPORATION Trial Balance At July 31 Debit $…arrow_forward

- Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,360 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Cash $ 7,010 Accounts receivable Office supplies 18,350 4,480 Office equipment 19,360 Land 46,040 Accounts payable 9,740 Common stock 85,360 Cash dividends Consulting revenue Rent expense Salaries expense Telephone expense Miscellaneous expenses $ 3,390 18,350 4,820 8,370 910 720 Also assume the following: a. The owner's initial investment consists of $39,320 cash and $46,040 in land in exchange for its common stock. b. The company's $19,360 equipment purchase is paid in cash. c. Cash paid to employees is $3,110. The accounts payable balance of $9,740 consists of the $4,480 office supplies purchase and $5,260 in employee salaries yet to be paid. d. The…arrow_forwardmework i Baird Company began operations on January 1, Year 1, by issuing common stock for $34,000 cash. During Year 1, Baird received $53,100 cash from revenue and incurred costs that required $38,100 of cash payments. Problem 10-26A (Algo) Part b Prepare a GAAP-based income statement and balance sheet for Baird Company for Year 1, under the following independent scenario: b. Baird is in the car rental business. The $38,100 was paid to purchase automobiles. The automobiles were purchased on January 1, Year 1, and have three-year useful lives, with no expected salvage value. Baird uses straight-line depreciation. The revenue was generated by leasing the automobiles. Complete this question by entering your answer in the tabs below. Income Statement 2 Prepare an Income Statement. W Balance Sheet S BAIRD COMPANY Income Statement for Year 1 7 3 E D 4 $ $ R D F 0 0 % 5 * 8 J 1 ( 9 K O 0 L P Help >arrow_forwardThe information on the following page was obtained from the records of Breanna Inc.: Accounts receivable $ 10,700 Accumulated depreciation 50,700 Cost of goods sold 121,000 Income tax expense 8,500 Cash 62,000 Net sales 203,000 Equipment 127,000 Selling, general, and administrative expenses 36,000 Common stock (8,000 shares) 94,000 Accounts payable 13,900 Retained earnings, 1/1/19 28,800 Interest expense 5,900 Merchandise inventory 38,500 Long-term debt 35,000 Dividends declared and paid during 2019 15,800 Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in paid-in capital during the year.Required: Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a…arrow_forward

- On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,050 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Office equipment Land Accounts payable Common stock $ 7,950 Cash dividends Consulting revenue Rent expense 17,450 4,200 19,060 Salaries expense 46,010 Telephone expense 9,430 Miscellaneous expenses 85,050 Exercise 1-20 (Algo) Preparing a balance sheet LO P2 Use the above information to prepare a December 31 balance sheet for Ernst Consulting. ERNST CONSULTING Balance Sheet < Prev 10 of 10 Next $ 3,070 17,450 0 4,530 8,090 880 690arrow_forwardP.nilesharrow_forwardRahularrow_forward

- Dogarrow_forwardOn December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,460 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Land office equipment Accounts payable Owner investments $ 6,650 Cash withdrawals by owner 18,650 Consulting revenue 4,640 Rent expense 46,000 Salaries expense 19,560 Telephone expense 9,890 Miscellaneous expenses 85,460 ERNST CONSULTING Income Statement $ 3,490 18,650 4,920 8.500 890 700 Using the above information prepare a December income statement for the business.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education