FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:9

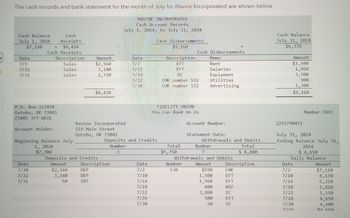

The cash records and bank statement for the month of July for Ravine Incorporated are shown below.

Cash Balance

July 1, 2024

$7,110

Date

7/9

7/21

7/31

Cash

Receipts

$8,420

Cash Receipts

Description

Sales

P.O. Box 123878

Gotebo, OK 73041

(580) 377-OKIE

Account Holder:

Date

7/10

7/22

7/31

Sales

Sales

Beginning Balance July

1, 2024

$7,700

Amount

$2,560

3,140

2,720

$8,420

Ravine Incorporated

519 Main Street

Gotebo, OK 73041

Deposits and Credits

Amount

$2,560

3,140

50

DEP

DEP

INT

RAVINE INCORPORATED

Cash Account Records

July 1, 2024, to July 31, 2024

Description

Date

7/7

7/12

7/19

7/22

7/30

Cash Disbursements

$9,160

Deposits and Credits

Number

3

Date

7/2

7/10

7/14

7/18

7/22

7/26

7/30

Description

EFT

EFT

DC

CHK number 531

CHK number 532

FIDELITY UNION

You Can Bank On Us

Total

$5,750

Cash Disbursements

Number

530

Memo

Rent

Salaries

Equipment

Utilities

Advertising

Account Number:

Statement Date:

Number

7

Withdrawals and Debits

Amount

$590

1,500

1,960

400

3,800

500

50

=

Withdrawals and Debits

Total

$ 8,800

Description

CHK

EFT

EFT

NSF

DC

EFT

SF

Cash Balance

July 31, 2024

$6,370

Amount

$1,500

1,960

3,500

900

1,300

$9,160

2252790471

July 31, 2024

Ending Balance July 31,

2024

$ 4,650

Daily Balance

Date

7/2

7/10

7/14

7/18

7/22

7/26

Member FDIC

7/30

7/31

Amount

$7,110

8,170

6,210

5,810

5,150

4,650

4,600

$4 65A

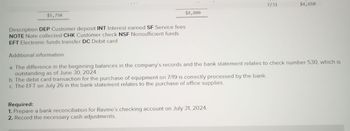

Transcribed Image Text:$5,750

$8,800

Description DEP Customer deposit INT Interest earned SF Service fees

NOTE Note collected CHK Customer check NSF Nonsufficient funds

EFT Electronic funds transfer DC Debit card

Additional information:

7/31

a. The difference in the beginning balances in the company's records and the bank statement relates to check number 530, which is

outstanding as of June 30, 2024.

b. The debit card transaction for the purchase of equipment on 7/19 is correctly processed by the bank.

c. The EFT on July 26 in the bank statement relates to the purchase of office supplies.

Required:

1. Prepare a bank reconciliation for Ravine's checking account on July 31, 2024.

2. Record the necessary cash adjustments.

$4,650

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The bank reconciliation shows the following adjustments: Deposits in transit: $852 Notes receivable collected by bank: $1,000; interest: $20 Outstanding checks: $569 Error by bank: $300 Bank charges: $30 Using the following accounts: Bank Errors Bank Service Charges Cash Deposits in Transit Interest Expense Interest Income Notes Receivable Outstanding Checks prepare the two correcting journal entries: DR [ Select ] ["Cash", "Bank Service Charges", "Interest Income", "Bank Errors", "Interest Expense"] [ Select ] ["$300", "$852", "$30", "$569", "$1,020"] CR [ Select ] ["Bank Errors", "Interest Income", "Bank Service Charges", "Interest Expense", "Cash"] [ Select ] ["$30", "$852", "$569", "$300", "$1,030"] and DR…arrow_forwardneed answer pleasearrow_forwardBased on the following information, what amount would be subtracted from the bank statement side of the bank reconciliation? ATM withdrawal $31; Outstanding checks $135; Interest $4; Deposit in-transit $87.Multiple Choice $139 $166 $87 $135 $31arrow_forward

- A -1 Prepared by Reviewed by William, Inc. Bank Confirmation - General Account December 31, 2022 Balance per Bank at December 31, 2022 $20,200.22 * Deposit in Transit - per A-1-2 2,000.00 # Outstanding Checks - per A-1-3 (5,200.00) Other - Note Collected by Bank (10,000.00) ^ Bank Service Charge (9.50) Balance per Books at December 31, 2022 $8,990.72 * f f Column footed. ^ Amount agrees to amount recorded as a deposit on the bank statement and description agrees with receipt enclosed with 12/31/22 bank statement. This note is the Kristopher note receivable that was recorded as a receipt by the client in the cash receipts journal on January 3, 2023. The receivable was appropriately credited and properly reflected in the January cash receipts journal. No adjustment needed as bank and books simply record this in different periods. #Agreed to December 31,…arrow_forwardBalance, December 31, 2018 $3,340 ADD: Deposit in transit 100 3,440 LESS: Outstanding checks $400 400 Adjusted bank balance, December 31, 2018 $3,040 Book: Balance, December 31, 2018 $2,540 ADD: Bank collection $510 Interest revenue 20 530 3,070 LESS: Service charge $30 30 Adjusted book balance, December 31, 2018 $3,040arrow_forwardThe bank reconciliation shows the following adjustments: Deposits in transit: $852 Notes receivable collected by bank: $1,000; interest: $20 Outstanding checks: $569 Error by bank: $300 Bank charges: $30 Using the following accounts: Bank Errors Bank Service Charges Cash Deposits in Transit Interest Expense Interest Income Notes Receivable Outstanding Checks prepare the two correcting journal entries: DR [ Select ] ["Bank Service Charges", "Interest Expense", "Interest Income", "Bank Errors", "Cash"] [ Select ] ["$569", "$30", "$300", "$1,020", "$852"] CR [ Select ] ["Interest Expense", "Cash", "Bank Service Charges", "Interest Income", "Bank Errors"] [ Select ] ["$852", "$300", "$569", "$1,030", "$30"] and DR…arrow_forward

- Do not provide answer in image formatarrow_forwardCurrent Attempt in Progress Identify whether each of the following items would be (a) added to the book balance, or (b) deducted from the book balance in a bank reconciliation. 1. 2 3. 4. 5. EFT transfer to a supplier. Bank service charge. Check printing charge. Error recording check # 214 which was written for $260 but recorded for $620. Collection of note and interest by the bank on the company's behalf.arrow_forwardnta 22 Coronado has the following assets at December 31, 2019. Cash in bank-savings account 134,000 Certificates of deposit (270-day) 226,000 sponder a como Cash on hand 1,600 Postdated checks 6,000 Cash refund due from State Taxing Authority 32,100 Checking account balance 12,000 What amount should be reported as cash? arcar nta O a. 135,600 O b. 134,000 O c. 179,700 O d. 147,600 pe here to searcharrow_forward

- Prepare adjusting journal entries to reconcile the book and bank balancesarrow_forwardBank reconcjliation Instructions Chart of Accounts First Question Journal Instructions The following data were gathered to use in reconciling the bank account of Reddan Company: Balance per bank $17,350 Balance pir company records 10,035 Bank service charges 35 Deposit in transit 3,350 Note collected by bank with $190 interest 4,600 Outstanding checks 6,100 Instructions a. What is the adjusted balance on the bank reconciliation? b. Journalize any necessary entries for Reddan Company based on the bank reconciliation. Refer to the Chart of Accounts for exact wordina of Check My Workarrow_forwardBank Reconciliation The following data were gathered to use in reconciling the bank account of Bradford Company: Balance per bank $ 17,400 Balance per company records 8,195 Bank service charges Deposit in transit Note collected by bank with $130 interest Outstanding checks a. What is the adjusted balance on the bank reconciliation? 45 3,100 4,900 7,450 b. Journalize any necessary entries for Bradford Company based on the bank reconciliation. If an amount box does not require an entry, leave it blank.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education