FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

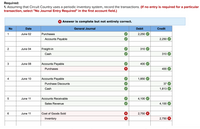

Transcribed Image Text:Required:

1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. (If no entry is required for a particular

transaction, select "No Journal Entry Required" in the first account field.)

X Answer is complete but not entirely correct.

No

Date

General Journal

Debit

Credit

1

June 02

Purchases

2,250

Accounts Payable

2,250

June 04

Freight-in

310

Cash

310

3

June 08

Accounts Payable

400

Purchases

400

4

June 10

Accounts Payable

1,850

Purchase Discounts

37

Cash

1,813

June 11

Accounts Receivable

4,100

Sales Revenue

4,100

June 11

Cost of Goods Sold

2,750

Inventory

2,750

![!

Required information

Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory

system (LO6-8)

[The following information applies to the questions displayed below.]

At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions occur during the

month of June.

2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45.

4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310.

8 Return defective radios to Radio World and receive credit, $400.

June

June

June

June 10 Pay Radio World in full.

June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750.

June 18 Receive payment on account from customers, $3,100.

June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30.

June 23 Selll radios to customers for cash, $4,850, that had a cost of $3,150.

June 26 Return damaged radios to Sound Unlimited and receive credit of $500.

June 28 Pay Sound Unlimited in full.

Problem 6-9B Part 1

Required:

1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. (If no entry is required for a particular

transaction, select "No Journal Entry Required" in the first account field.)

X Answer is complete but not entirely correct.](https://content.bartleby.com/qna-images/question/cc35bfef-1e1d-4e62-a745-481127990680/a6db0af3-ea98-49e4-ac25-583f01c539fd/j87vb0l_thumbnail.png)

Transcribed Image Text:!

Required information

Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory

system (LO6-8)

[The following information applies to the questions displayed below.]

At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions occur during the

month of June.

2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45.

4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310.

8 Return defective radios to Radio World and receive credit, $400.

June

June

June

June 10 Pay Radio World in full.

June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750.

June 18 Receive payment on account from customers, $3,100.

June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30.

June 23 Selll radios to customers for cash, $4,850, that had a cost of $3,150.

June 26 Return damaged radios to Sound Unlimited and receive credit of $500.

June 28 Pay Sound Unlimited in full.

Problem 6-9B Part 1

Required:

1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. (If no entry is required for a particular

transaction, select "No Journal Entry Required" in the first account field.)

X Answer is complete but not entirely correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- k t K nt ences Peterson Furniture Designs is preparing the annual financial statements dated December 31. Ending inventory information about the five major items stocked for regular sale follows: Required: 1-a. Complete the table column "Write-Down per Item" and then sum the final column. 1-b. Compute the amount of the total write-down when the LCM/NRV rule is applied to each item. 2. Prepare the journal entry Peterson Furniture Designs would record on December 31 to write down its inventory to LCM/NRV. Complete this question by entering your answers in the tabs below. h Req 1A Req 1B Item Alligator Armoires Bear Bureaus Cougar Credenzas Dingo Cribs Elephant Dressers Complete the table column "Write-Down per Item" and then sum the final column. NRV per Item Write-down per Item Req 2 Unit Cost (FIFO) $ 60 55 53 55 22 $ 56 55 59 55 14 Req 1A Quantity on Hand 50 30 80 70 50 Total Write- down Req 1B >arrow_forwardPurchase-Related Transactions Using Periodic Inventory System The following selected transactions were completed by Niles Co. during March of the current year: Mar. 1. Purchased merchandise from Haas Co., $43,250, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $650 was added to the invoice. 5. Purchased merchandise from Whitman Co., $19,175, terms FOB destination, n/30. 10. Paid Haas Co. for invoice of March 1. 13. Purchased merchandise from Jost Co., $15,550, terms FOB destination, 2/10, n/30. 14. Issued debit memo to Jost Co. for $3,750 of merchandise returned from purchase on March 13. 18. Purchased merchandise from Fairhurst Company, $13,560, terms FOB shipping point, n/eom. 18. Paid freight of $140 on March 18 purchase from Fairhurst Company. 19. Purchased merchandise from Bickle Co., $6,500, terms FOB destination, 2/10, n/30. 23. Paid Jost Co. for invoice of March 13 less debit memo of March 14. 29. Paid Bickle Co. for invoice of March 19. 31.…arrow_forwardProvide 7 entries in worksheetarrow_forward

- answer in text form please (without image)arrow_forwardCurrent Attempt in Progress Assume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory system. During September, these transactions occurred. Sept. Purchased calculators from Dragoo Co. at a total cost of $1,580, on account, terms n/30 FOB shipping point. 6. Paid freight of $49 on calculators purchased from Dragoo Co. Returned calculators to Dragoo Co. for $62 credit because they did not meet specifications. Sold calculators costing $480 for $680 to Fryer Book Store, on account, terms n/30. Granted credit of $46 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $36. 10 12 14 20 Sold calculators costing $560 for $800 to Heasley Card Shop, on account, terms n/30. Journalize the September transactions for Office Depot. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the…arrow_forwardJournal Entries-Periodic Inventory Paul Nasipak owns a business called Diamond Distributors. The following transactions took place during January of the current year. Jan. 5 Purchased merchandise on account from Prestigious Jewelers, $3,190. 8 Paid freight charge on merchandise purchased, $340. 12 Sold merchandise on account to Diamonds Unlimited, $4,380. 15 Received a credit memo from Prestigious Jewelers for merchandise returned, $660. 22 Issued a credit memo to Diamonds Unlimited for merchandise returned, $900. Journalize the transactions in a general journal using the periodic inventory method. Page: DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- 1. Jan. 5 2 3. 4 4 6. 7. 12 10 15 10 11 11 12 12 13 22 13 14 14 15 15 I II II 1I |arrow_forward

- Page 4 of 9 Keiler Motorcycle Shop completed the following transactions during the month of October. Keiler uses a perpetual inventory system. Any freight paid was paid with cash. Oct. 3 Purchased 20 bikes at a cost of $1,150 each from the Lyons Bike Company, under credit terms 1/30, n/45. FOB shipping point. 4 The correct company paid $150 cash freight for above shipment 6 Sold 10 bikes to Doug's Bicycle for $1,500 each, terms 1/15, n/30. Terms FOB destination. 7 Received credit from the Lyons Bike Company for the return of 2 defective bikes. 13 Issued a credit to Doug's Bicycle for the return of one bike from Oct 6 sale. 17 Purchased with cash Office Supplies from the Office Depot in the amount of $200. 20 Doug's Bicycle paid their account in full 24 Paid Lyons Bike Company. Required: Part A: Journalize the above transactions Part B: Calculate the balance of inventory at October 31, assuming the opening balance is $5,000 Part C: dentify one transaction that would be recorded…arrow_forwardProblem 6-3B (Algo) Record transactions and prepare a partial income statement using a perpetual inventory system (LO6-2, 6-5) At the beginning of June, Circuit Country has a balance in inventory of $2,100. The following transactions occur during the month of June. June 2 Purchase radios on account from Radio World for $1,800, terms 1/15, n/45. June 4 Pay cash for freight charges related to the June 2 purchase from Radio World, $220. June 8 Return defective radios to Radio World and receive credit, $200. June 10 Pay Radio World in full. June 11 Sell radios to customers on account, $3,200, that had a cost of $2,300. June 18 Receive payment on account from customers, $2,200. June 28 Purchase radios on account from Sound Unlimited for $2,900, terms 3/10, n/30. June 23 Sell radios to customers for cash, $4,400, that had a cost of $2,700. June 26 Return damaged radios to Sound Unlimited and receive credit of $400. June 28 Pay Sound Unlimited in full. Required: 1. Assuming that Circuit…arrow_forwardPlease dont provide solution image based thnxarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education