FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

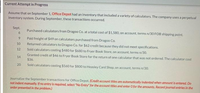

Transcribed Image Text:Current Attempt in Progress

Assume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual

inventory system. During September, these transactions occurred.

Sept.

Purchased calculators from Dragoo Co. at a total cost of $1,580, on account, terms n/30 FOB shipping point.

6.

Paid freight of $49 on calculators purchased from Dragoo Co.

Returned calculators to Dragoo Co. for $62 credit because they did not meet specifications.

Sold calculators costing $480 for $680 to Fryer Book Store, on account, terms n/30.

Granted credit of $46 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost

$36.

10

12

14

20

Sold calculators costing $560 for $800 to Heasley Card Shop, on account, terms n/30.

Journalize the September transactions for Office Depot. (Credit account titles are automatically Indented when amount is entered. Do

not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the

order presented in the problem.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- can you help me write journal entries for these transactions please... The following inventory transactions occurred at Zapata, Inc., which uses a perpetual inventory system: October 2 Purchased 50 units of inventory from a supplier on credit. The goods cost $30 each and the credit terms were 2/10, n/30. The shipping costs were $100 under the terms FOB destination and Zapata received the inventory on October 3rd. October 4 Returned 5 units of inventory from the October 2nd transaction to the supplier. October 6 Sold 15 of the units purchased on October 2nd for $50 each to customers for cash. October 7 October 10 Accepted a return of one unit of inventory from an October 6th customer for a cash refund. Established a petty cash fund for $300. October 11 October 15 October 28 Paid the supplier for one-half of the inventory purchased on October 2nd, net of any returns. Used $20 out of petty cash to pay for stamps (postage expense). Purchased 10 units…arrow_forward[The following information applies to the questions displayed below.] Autumn Company began the month of October with inventory of $30,000. The following inventory transactions occurred during the month: a. The company purchased inventory on account for $44,500 on October 12. Terms of the purchase were 2/10, n/30 Autumn uses the net method to record purchases. The inventory was shipped f.o.b. shipping point and freight charges of $650 were paid in cash. . b. On October 31, Autumn paid for the inventory purchased on October 12. c. During October inventory costing $20,250 was sold on account for $31,000. d. It was determined that inventory on hand at the end of October cost $54,010. Problem 8-1 (Algo) Part 1 Required: 1. Assuming Autumn Company uses a perpetual inventory system, prepare journal entries for the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardSales and Purchase-Related Transactions for Seller and Buyer Using Perpetual Inventory System The following selected transactions were completed during April between Swan Company and Bird Company. Both companies use the net method under a perpetual inventory system. Ap 2. Swan Company sold merchandise on account to Bird Company, $54,800, terms FOB shipping point, 2/10, n/30. Swan paid freight of $1,620, which was added to the invoice. The cost ef the goods sold was $33,180. 8. Swan Company sold merchandise on account to Bird Company, $48,300, terms FOB destination, 1/15, n/eom. The cost of the goods sold was $25,920. 8. Swan Company paid freight of $1,205 for delivery of merchandise sold to Bird Company on April 8. 12. Bird Company paid Swan Company for purchase of April 2. 23. Bird Company paid Swan Company for purchase of April 24. Swan Company sold merchandise on account to Bird Company, $66,060, terms FOB shipping point, n/eom. The cost of the goods sold was $37,140. 25. Swan…arrow_forward

- Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method. April 2 Purchased $3,900 of merchandise from Lyon Company with credit terms of 2/15, n/60, invoice dated April 2, and FOB shipping point. April 3 Paid $200 cash for shipping charges on the April 2 purchase. April 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $850. April 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. April 18 Purchased $7,100 of merchandise from Frist Corporation with credit terms of 1/10, n/30, invoice dated April 18, and FOB destination. April 21 After negotiations over scuffed merchandise, received from Frist a $400 allowance toward the $7,100 owed on the April 18 purchase. April 28 Sent check to Frist paying for the April 18 purchase, net of the allowance and the discounarrow_forwardAssume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory system. During September, these transactions occurred. Sept. 6 Purchased calculators from Oriole Co. at a total cost of $1,770, terms n/30. 9. Paid freight of S60 on calculators purchased from Oriole Co. Returned calculators to Oriole Co. for $69 credit because they did not meet specifications. Sold calculators costing $500 for $750 to Fryer Book Store, terms n/30. Granted credit of $45 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $30 Sold calculators costing $700 for $890 to Heasley Card Shop, terms n/30. 10 12 14 20 Journalize the September transactions. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the…arrow_forwardWildhorse Company commenced operations on July 1. Wildhorse Company uses a periodic inventory system. During July, Wildhorse Company was involved in the following transactions and events: July 2 Purchased $14,600 of merchandise from Suppliers Inc. on account, terms 2/10, n/30, FOB shipping point. 3 Returned $1,200 of merchandise to Suppliers inc. as it was damaged. Received a credit on account from Suppliers 4 Paid $590 of freight costs on July 2 shipment. 8 Sold merchandise for $3,000 cash. 11 Paid Suppliers Inc. the full amount owing 15 25 2 NG Sold merchandise for $6,400 on account, 1/10, n/30, FOB shipping point. Received full payment for the merchandise sold on July 25. 31 Wildhorse did a physical count and determined there was $10.100 of inventory on hand. Record the transactions in Wildhorse Company's books. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and…arrow_forward

- Record the journal entries for the following transactions of Beamer Co. if the company uses a) Perpetual Inventory System and b) Periodic Inventory System. a. February 11: Beamer Co. purchased merchandise from Alfa Co. for $8,200 under credit terms of 2/10, n/60. b. February 13: After negotiations with Alfa Co. concerning problems with the merchandise purchased on February 11, Beamer Co. received a credit memorandum granting a price reduction of $1,800. c. February 24: Beamer Co. paid Alfa Co. the balance due. Enter the transaction letter as the description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (i.e., January 15 would be 15/Jan). a) Perpetual Inventory System b) Periodic Inventory System Date +- +- +- General Journal Account/Explanation Page G3 PR Debit Credit Date General Journal Account/Explanation Page G9 PR Debit Credit + -arrow_forwardThe following merchandise transactions occurred in December. Both cormpanies use a perpetual inventory systerm.Dec.3.Wildhorse Company sold merchandise to Blossom Co. for $40,000, terms 2/10, n/30, FOB destination. This merchandisecost Wildhorse Company $18,000.4The correct company paid freight charges of $800.8Blossom Co. returned unwanted merchandise to Wildhorse. The returned merchandise had a sale price of $2,500 and acost of $990. It was restored to inventory.13Wildhorse Company received the balance due from Blossom Co. Assuming that Blossorm Co. had a balance in Merchandise Inventory on Decerber 1 of $6,000, determine the balance in theMerchandise Inventory account at the end of Decermber for Blossormn Co.arrow_forwardjournalize the April transactions using a perpetual inventory system.arrow_forward

- Please help mearrow_forwardCheese Factory uses a perpetual inventory system. The following activities occurred during May: • May 2 - Cheese Factory purchased $45,000 worth of inventory, on credit terms 3/10 n/30. . May 5 - Cheese Factory returned $5,000 worth of that inventory to the supplier. • May 9 - Cheese Factory paid for the inventory, taking advantage of all available discounts. Required: Prepare the journal entries to record the transactions above using the gross method. Use the MSWord link for the table to write your journal entries. After you have written the journal entries on the table in the MSWord document provided, put your name below the table on the document, save the document and then upload it to this problem in the upload space provided at the bottom of this box.arrow_forwardWhat did you guys get on this one?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education