FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.

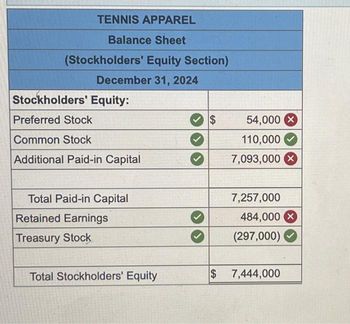

Transcribed Image Text:TENNIS APPAREL

Balance Sheet

(Stockholders' Equity Section)

December 31, 2024

Stockholders' Equity:

Preferred Stock

Common Stock

Additional Paid-in Capital

Total Paid-in Capital

Retained Earnings

Treasury Stock

Total Stockholders' Equity

$

54,000 X

110,000

7,093,000 X

7,257,000

484,000 X

(297,000)

$ 7,444,000

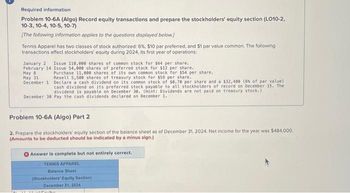

Transcribed Image Text:Required information

Problem 10-6A (Algo) Record equity transactions and prepare the stockholders' equity section (LO10-2,

10-3, 10-4, 10-5, 10-7)

[The following information applies to the questions displayed below.)

Tennis Apparel has two classes of stock authorized: 6%, $10 par preferred, and $1 par value common. The following

transactions affect stockholders' equity during 2024, its first year of operations:

January 2 Issue 110,000 shares of common stock for $64 per share..

February 14 Issue 54,000 shares of preferred stock for $12 per share..

May 8

Purchase 11,000 shares of its own common stock for $54 per share..

May 31

Resell 5,500 shares of treasury stock for $59 per share.

December 1 Declare a cash dividend on its common stock of $0.70 per share and a $32,400 (6% of par value)

cash dividend on its preferred stock payable to all stockholders of record on December 15. The

dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.)

December 30 Pay the cash dividends declared on December 1.

Problem 10-6A (Algo) Part 2

2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2024. Net income for the year was $484,000.

(Amounts to be deducted should be indicated by a minus sign.)

Answer is complete but not entirely correct.

TENNIS APPAREL

Balance Sheet

(Stockholders' Equity Section)

December 31, 2024

****

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forwardis there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education